You’ll want to keep an eye on this Starbucks competitor as it continues its rapid expansion.

Starbucks (NASDAQ: SBUX) has a hot upstart on its heels.

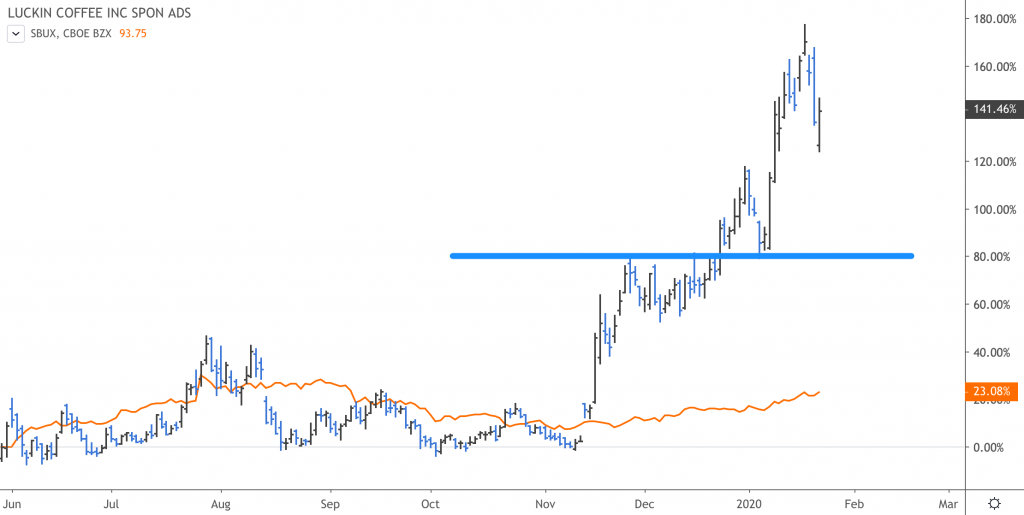

Luckin Coffee (NASDAQ: LK), the $11 billion Chinese coffee giant, has returned more than 90% in the last six months. By comparison, Starbucks has risen just 4% in the same time frame.

Chantico Global, an investment consulting firm, CEO and founder Gina Sanchez says Luckin’s massive run could be a signal that the company is outpacing Starbucks in one key area, and that’s growth.

“I’m not saying that Starbucks is not a well-run company,” Sanchez said. “I think Starbucks is a great company. It’s just that Luckin is at a totally different place in their growth cycle. They really are going for the gold here and I think that they are going to probably be a stronger growth stock than Starbucks.”

Luckin has delivered a breathtaking two-year expansion opening 700 new stores across China just in the last couple of months alone, while Starbucks has opened just 100 new locations in the country. As of the end of December, Luckin had 4,910 locations while Starbucks has 4,300.

The Chinese coffee company is also working on expanding in the Middle East.

While Luckin originally focused on opening grab-and-go stores near existing Starbucks locations with lower price points and a mobile app that made ordering easier, the company now is taking a different approach.

Recent openings show “that Luckin’s latest locations tend to be in more remote areas not already serviced by Starbucks, signaling a slight departure from the coffee startup’s early strategy,” wrote Thinknum Alternative Data’s Joshua Fruhlinger in a note from last month.

Luckin recently issued an upbeat forecast for its fourth quarter, and received a vote of confidence from Keybanc analysts who said the stock will rise to $56 – 25% higher than the price as of this writing.

Keybanc analyst Eric Gonzalez said of the upgrade, “We are raising our price target from $32 to $56 based on strong core business momentum and the addition of new revenue streams into our valuation methodology. Despite the stock’s upward momentum, we believe the profit potential of these channels implies little to no multiple expansion has occurred since the Unmanned Retail Strategy was first announced and the stock remains inexpensive relative to its growth potential and to category leading global peers.”

“They’re earlier in their cycle, they’re doing all the right things and they’re expanding their product lines,” Sanchez said. “I would say that the fundamentals actually still favor Luckin, even over Starbucks, which is a very well-established and very well-run company. It’s impressive to see a company with that kind of discipline this early in their cycle. They got to break even by Q3 2019 at a store level, and that just really paves the road, from a fundamental perspective, for a really interesting long-term buy.”

TradingAnalysis.com’s Todd Gordon added that it’s “hard to argue” with Luckin’s monster rally over the last several months, though he noted that it’s hard to do “any kind of analysis with such a short history” given that Luckin went public in May 2019.

“But obviously we’ve broken through resistance, and after we broke through that ceiling, it was off to he races,” Gordon said.

“Clearly, Starbucks is having no luck against Luckin,” Gordon added.