The longer you invest in the stock market, the more familiar you become with a lot of the concepts that are used to define and justify the various investing methods that drive them. Years ago, as I began to incorporate technical analysis and shorter-term trading strategies into my system, one of the simplest technical patterns I learned to recognize was a short-term pullback within a longer upward trend. This is a pattern that has a couple of different terms, like “flag” and “pennant” among market technicians, but I learned to associate it in a different way.

Sometimes visuals provide a better frame of reference for putting concepts in their proper context. Stocks in upward trends often form a pattern not very dissimilar from the profile look of a staircase, with each successive high punctuated by periodic pauses in the rise, or even in a shorter-term drop in price. Another common reference for the pattern is “ABC Pattern,” using each letter to identify short-term pivot highs and lows within a longer trend.

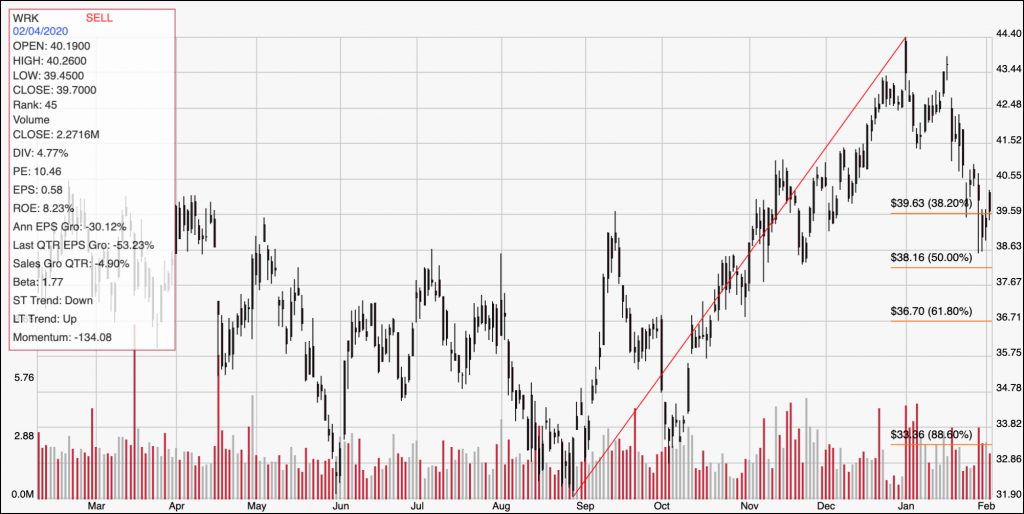

Westrock Company (WRK) is a stock that appears to be setting up exactly the kind of ABC pattern within an upward trend that usually signals a good opportunity for short-term, momentum-focused traders. After forming an intermediate upward trend from September the beginning of January that saw the stock increase by just a little under 50%, the stock has dropped back a little over 10% before pivoting and moving back higher from the end of last week. The ABC pattern is in its earliest, formative stage, but if it can follow through with the rest of the pattern, there’s a solid technical basis to see the stock push above its 52-week high price. Following its latest earnings announcement, the stock also boasts a solid fundamental profile along with a big value proposition. That could make the stock a solid candidate to work with no matter whether you prefer short-term trading strategies or a longer-term method.

Fundamental and Value Profile

WestRock Company, incorporated on March 6, 2015, is a multinational provider of paper and packaging solutions for consumer and corrugated packaging markets. The Company also develops real estate in the Charleston, South Carolina region. The Company’s segments include Corrugated Packaging, Consumer Packaging, and Land and Development. The Corrugated Packaging segment consists of its containerboard mill and corrugated packaging operations, as well as its recycling operations. The Consumer Packaging segment consists of consumer mills, folding carton, beverage, merchandising displays, and partition operations. The Land and Development segment is engaged in the development and sale of real estate primarily in Charleston, South Carolina. WRK has a current market cap of $10.3 billion.

Earnings and Sales Growth: Over the past year, earnings declined -30.12%, while sales rose 2.23%. In the last quarter, earnings dropped by -53%, while sales were -4.9%. WRK operates with a very narrow margin profile, which isn’t especially unusual for stocks in this industry; over the last twelve months, Net Income was 4.67% of Revenues, and narrowed to about 3.13% in the last quarter.

Free Cash Flow: WRK’s Free Cash Flow is healthy, at $1.06 billion, and which translates to an attractive Free Cash Flow Yield of 10.3%.

Debt to Equity: WRK has a debt/equity ratio of .81, which is pretty conservative but has increased since November 2018 from just .49. The company doesn’t have great liquidity, with cash and liquid assets of a little over $151.6 million in the last quarter versus long-term debt of more than $9.6 billion; it is worth noting that the increase in debt, which also corresponds to a significant decline in cash over the last year, is primarily tied to the November 2018 acquisition of KapStone Paper & Packaging.

Dividend: WRK pays an annual dividend of $1.86 per share, which at its current price translates to a very attractive dividend yield of about 4.71%. The passive income the stock’s fat dividend offers could be a compelling factor to consider for holding the stock and letting the price work through whatever market conditions do to the stock in the long term.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for WRK is $45.91 per share. At the stock’s current price, that translates to a Price/Book Ratio of .886. The stock’s historical Price/Book ratio by comparison is 1.13 and puts the top end of the stock’s long-term price target at around $52 per share. The stock’s Price/Cash Flow ratio provides an even more optimistic view, since the stock is currently trading 59% below its historical average. Together, both elements put the stock’s long-term target price between $52 to $63 per share – which is very attractive under any metric. When you factor the KapStone acquisition, which should help to give the company an opportunity to expand its profitability significantly, along with positive progress in trade that is expected to continue through 2020, along with continued strength in the U.S. economy, there is a strong case to make that the market should be able to keep pushing the stock higher for the foreseeable future.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line marks the stock’s upward trend from September to January, with the peak at around $44, and the stock recently bouncing off of pivot support at about $39 to push above the 38.2% Fibonacci retracement line yesterday. The pivot low marks the A point of the ABC pattern I mentioned at the beginning of this article. The B point will come when the stock finds its next resistance point, which is likely to be between $40.50 and $41 per share. A reversal lower, with another pivot low above $39, would mark the C point of the pattern, and which is a good indication the next move should be above the resistance at point B to test the stock’s high around $44. The pattern isn’t guaranteed, of course, which means that if the stock drops back again and moves below $39, the stock could drop as low as about $36 per share, where the 61.8% retracement line rests before finding new support.

Near-term Keys: If the ABC pattern I just outlined materializes, the push upward off of the C pivot would be an excellent signal to buy the stock or work with call options, with a target price at around the stock’s 52-week high at $44. A drop below $39, by comparison, would be a good signal to consider shorting the stock or working with put options, with an eye on $36 as a bearish target price. If you’re looking for the kind of long-term opportunity that Warren Buffett likes to call “a good company at a nice price,” WRK might be exactly the kind of stock to consider.