Recent weakness is presenting a buying opportunity for this chipmaker – and it could see double-digit upside just ahead.

Advance Micro Devices (NASDAQ: AMD) shares have had a bit of a rocky start to 2020.

By January 24, AMD shares had gained nearly 13% since the start of the year. Just days later, shares fell 6% – the most in a single day since August when trade war fears had reached their peak after reporting solid earnings, but weaker-than-expected guidance for the year ahead.

AMD shares have recovered a bit since then but are still struggling to break out higher. But according to one expert, a big comeback is on the horizon for the stock.

Ascent Wealth Partners’ Todd Gordon took the recent dip as an opportunity to add to his position, and says the stock is on the cusp of a turnaround.

“I think we’re seeing a little bit of a profit-taking move here coupled with the concern that we’re seeing going forward with guidance, with other things going on with the coronavirus,” Gordon told CNBC. “So I want to view this as an opportunity to add to my stock position and put on a new options trade,”

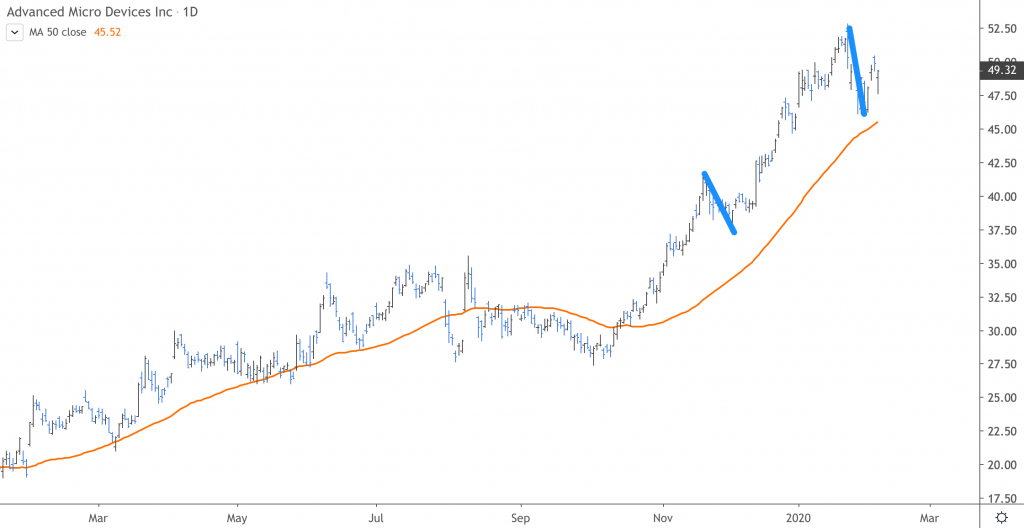

Gordon highlighted technical indicators that signal AMD shares are gearing up for a rally.

Firstly, AMD broke through the $47.50 to $48 level earlier this week, which were the highs for the stock back in 2000. According to Gordon, those levels are now acting as support for the stock, which will aide in the rebound.

With a shorter-term view, Gordon notes two other indicators that build the bull case for the stock: the depth of the pullback in AMD over the last week, which Gordon says is reminiscent of one from November, and that AMD’s moving average is “offering support” at around $44.75. Should shares pull back to that level, the chipmaker should rally from there.

Gordon isn’t the only one who says AMD’s recent weakness is temporary.

Following the chipmaker’s earnings report, Cowen analyst Matthew Ramsay reiterated his Outperform rating on AMD shares and issued a $60 price target for the stock—nearly 22% higher than the price as of this writing—noting weak sales of videogame consoles in the near term.

“Other than some tweaks to console seasonality with virtually zero 1H20 sell-in ahead of the 2H20 refresh, not much fundamentally changed,” Ramsay wrote in a note. “We believe guidance sets the table for upward revisions throughout the year with notebook and console the largest potential upside drivers.”

Like Ramsay, Jeffries analyst Mark Lipacis also reiterated his Buy rating and told investors to keep their eyes on AMD’s long-term story.

“We think AMD is a multi-year share gain and gross margin expansion story,” Lipacis wrote. “AMD’s 2020 outlook seems conservative to us on both revs and margins.”