This week the market has been trying to rebound and reclaim some of the territory it has lost since the broad indices hit a peak in mid-February. Looking at various news reports and opinions, I was interested to see one analyst that used the very graphic phrase, “catching a falling knife” to describe what he thinks many investors who are buying in this week are doing. In other words, buying on a large scale under current market conditions, and betting that the market is going to keep going up – at least in the near-term – is probably a fool’s game. There are just too many unanswered questions right now, all centered around COVID-19.

Last night it was also reported that the number of confirmed cases in the U.S. had officially exceeded China’s total number. I think that throws into sharp view some of the challenges that lie ahead. There isn’t a medical expert in the U.S. that thinks we’ve hit a peak of how many people are going to eventually get COVID-19; in the meantime, the federal government is sending medical military ships – essentially floating hospitals – to the ports of major metropolitan centers including Los Angeles and New York to try to help fill the gap between capacity and volume of cases that hospitals in those areas are likely to see. The push to fast-track anti-virals and other methods of treatment is still ongoing, but somewhere out in an undefined future, and so I think there is more uncertainty ahead than there is reasons to say that it’s time to start buying again on a large scale.

This is a time to be smart, and to be careful about taking on new positions. It’s also important, however, not to turn a blind eye to opportunities you may have to keep your money working for you in useful, practical ways. That’s a big reason that I keep combing the market, and analyzing stocks in as many different segments of the economy as I can – if there is a good opportunity under current conditions, I want to find it and figure out the right way to work with it.

No matter what short-term conditions exist, or how volatile the market gets in the immediate future, I think that one of the smartest areas to pay attention to is the healthcare sector. This week, I’ve looked at medical devices and pharmaceutical stocks that might offer some interesting, and useful opportunities right now. Let’s wrap up the week by extending that discussion with a look at one of the largest drug manufacturers in the world.

Fundamental and Value Profile

Eli Lilly and Company (LLY) is engaged in drug manufacturing business. The Company discovers, develops, manufactures and markets products in two segments: human pharmaceutical products and animal health products. The Company’s human pharmaceutical business segment sells medicines, which are discovered or developed by its scientists. Its animal health business segment develops, manufactures and markets products for both food animals and companion animals. The Company’s human pharmaceutical products include endocrinology products, neuroscience products, oncology products, immunology products and cardiovascular products. The Company’s animal health products segment includes products for food animals and products for companion animals. As of December 31, 2018, the Company manufactured and distributed its products through facilities in the United States, Puerto Rico and 14 other countries.LLY has a current market cap of $128 billion.

Earnings and Sales Growth: Over the last twelve months, earnings improved 30%, while sales declined -5%. In the last quarter, earnings rose almost 17%, while revenue were about 11.5% higher. LLY’s Net Income versus Revenue is very healthy; over the last year this number was 37%, but did decline in the last quarter to 24.4%. Despite the drop, this is still a number that is much higher than many of the company’s competitors.

Free Cash Flow: LLY’s Free Cash Flow is healthy, at a little more than $3.8 billion. This is a number that has declined steadily from about $5 billion in the 4th quarter of 2017, but has improved over the last year, when it was about $2.4 billion.

Debt to Equity: LLY has a debt/equity ratio of 5.3, which makes LLY the most highly leveraged company in its industry. The company’s balance sheet shows that long-term debt increased from about $9 billion at the beginning of 2019 to about $14.3 billion in the last quarter. Over the same period, the company’s liquidity is also showing signs of significant deterioration, since cash and liquid assets has declined from $7.5 billion at the beginning of the year to $2.4 billion in the most recent quarter. Their impressive operating margins mean that they should have no problem servicing their high debt; however any potential shortfall in operating profits could challenge their ability to maintain debt payments.

Dividend: LLY pays an annual dividend of $2.96 per share, which at its current price translates to a dividend yield of about 2.2%. Management has increased the dividend, from $2.58 last summer, which is a strong sign of the company’s confidence in its direction and future.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $68 per share, which means that LLY is significantly overvalue, with more than -49% downside from its current price.

Technical Profile

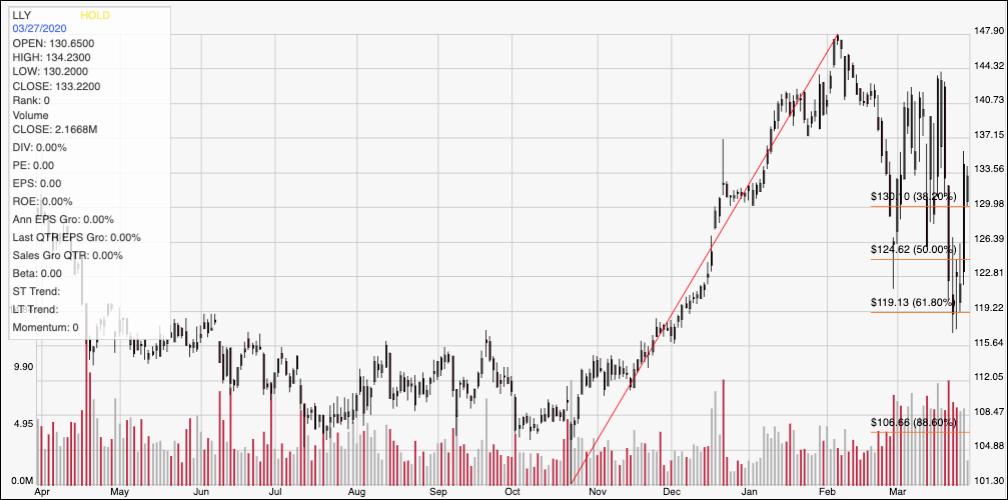

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line defines the stock’s upward trend from October of 2019 to its peak in early February; it also informs the Fibonacci retracement lines shown on the right side of the chart. The stock is about -10.7% below that high as of now, but has been picking up some bullish momentum this week, rebounding from a pivot low at around $119, where the 61.8% retracement line sits. Nearest support is at the 38.2% retracement line, which is around $130, with immediate resistance between $140 and $144. If the stock breaks below support at $130, it could drop to a near-term low at the 61.8% retracement before fining its next support, which is about $11 below current support.

Near-term Keys: LLY is an interesting study in contrasts; they operate with a large, even outsized operating profile, but have seen significant deterioration in the business’ cash flows and its intrinsic value that are alarming to say the least. At least some of the company’s high debt load can be attributed to a 2019 $8 billion acquisition of Loxo Oncology, which added highly selective potential treatments for patients with genomically defined cancers to its development pipeline. Whether that move yields the anticipated results may not be known for some time, but the near-term effect on the balance sheet, as well as on the stock’s valuation metrics to me means that the best probabilities for success with this stock lie on the short-term side, with momentum-based trades offering the most attractive opportunities. If the stock can push higher above its current price around $133, it could rally to around $140 fairly quickly, which could offer an interesting opportunity to buy the stock or to work with call options. If bearish momentum comes back into the market, however, use a drop below $130 to consider shorting the stock or working with put options, with an eye on $120 as a very useful target price on a bearish trade.