With the entire world’s focus – financial market or otherwise – turned almost exclusively to coronavirus, social distancing, and how long it is going to take for the world to return to any kind of normalcy in the foreseeable future, it isn’t all that surprising to see market commentary emphasizing health care. I’ve spent enough time at the hospital in the last month to be convinced that, with or without a pandemic on their hands, medical and healthcare professionals are doing God’s work. Just as we often do with military, law enforcement, and first responders, those individuals deserve our gratitude and unqualified support.

The problem the medical community is facing is, frankly exacerbated not only by the increasing volume of COVID-19 cases, but also by major shortfalls in capacity, which is reflected not only by space or number of beds, but also by the availability of the equipment and supplies they need. In and of itself, that is a multi-tiered logistical challenge, since that need extends not only to proper and effective treatment but also in giving healthcare professionals the ability to do their work safely. The system is being severely constrained right now in both respects, and that is an ongoing concern that has to be addressed.

From the standpoint of being a shameless capitalist, recognizing that challenge exists also means that the companies that are working – feverishly, and in many cases, selflessly, I would add – to address those shortfalls take up an interesting spot in the current economic picture. While companies in more consumer-oriented industries and sectors are dealing with significant drawdowns in their business, even to the point of laying off a record number of workers, these healthcare companies are not only keeping their employees, but in many cases looking for more and trying to find ways to keep expanding their productive and distribution capacity. That could mean there could useful opportunities to keep your investing capital working in constructive ways, even as broader economic uncertainty persists.

Stryker Corp (SYK) is one of the more interesting Healthcare Equipment companies I’ve evaluated so far this week. The is significantly off of its own set of record highs, reached in late February at around $226 per share. As of this writing, it is down about -34% from that point, and is currently around lows not seen since the end of 2018. As you’ll see, the fundamentals are solid, and the value proposition might be useful enough to offer a good, value-based investing opportunity. Let’s run the numbers so you can decide for yourself.

Fundamental and Value Profile

Stryker Corporation is a medical technology company. The Company offers a range of medical technologies, including orthopedic, medical and surgical, and neurotechnology and spine products. The Company’s segments include Orthopaedics; MedSurg; Neurotechnology and Spine, and Corporate and Other. The Orthopaedics segment includes reconstructive (hip and knee) and trauma implant systems and other related products. The MedSurg segment includes surgical equipment and surgical navigation systems; endoscopic and communications systems; patient handling, emergency medical equipment, intensive care disposable products; reprocessed and remanufactured medical devices, and other related products. The Neurotechnology and Spine segment includes neurovascular products, spinal implant systems and other related products. The Company’s products include implants, which are used in joint replacement and trauma surgeries, and other products that are used in a range of medical specialties. SYK has a current market cap of $55.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings grew by 14.22%, while sales increased 8.8%. In the last quarter, earnings improved by 30.3% while Revenues increased a little over 15%. SYK’s Net Income versus Revenue is healthy, and getting stronger; Net Income as a percentage of Revenues rose from a very healthy 13.99% in the last twelve months to 17.55% in the last quarter.

Free Cash Flow: SYK’s Free Cash Flow is modest, but healthy at $1.5 billion. That translates to a Free Cash Flow Yield of 2.75%. It is worth noting this number was a little above $2 billion at the end of 2018, which is a concern, but also not a glaring problem.

Debt to Equity: SYK has a debt/equity ratio of .80, which is pretty conservative. SYK’s balance sheet shows $4.4 billion in cash and liquid assets versus about $10.2 billion in long-term debt. Their operating profile suggests that operating margins are more than adequate to service their debt, with good liquidity to draw on if needed as well.

Dividend: SYK pays an annual dividend of $2.30 per share, which translates to a yield of 1.54%. More remarkable is the fact that their dividend payout is modest – at less than 50% of earnings per share, along with a consistent pattern of raising its dividend per share over the last eight years, with no cuts.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $175 per share, which means that SYK is undervalued, with about 18% upside from its current price.

Technical Profile

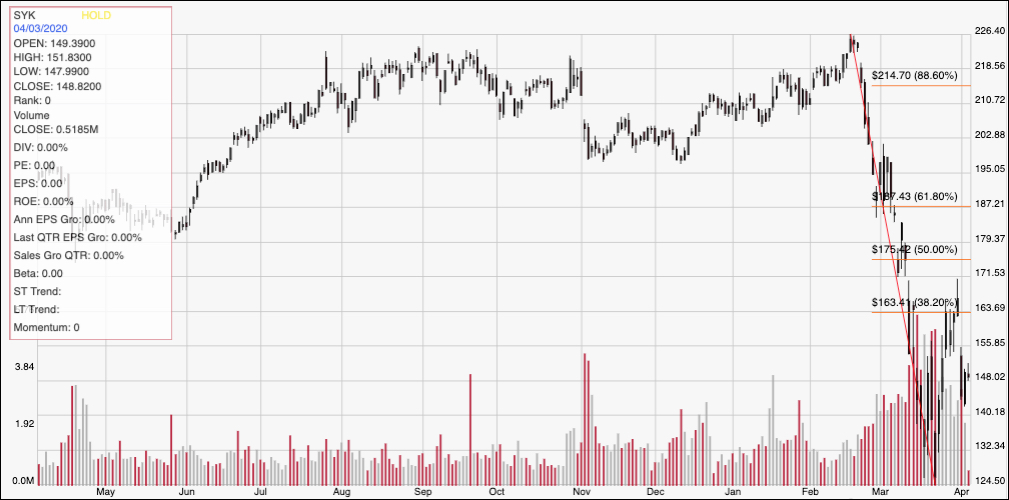

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s downward trend from its peak in late February to its low about a month later. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After rebounding from that low at around $124.50, the stock rallied to the 38.2% Fibonacci line before dropping back this week. It currently appears to be finding support in the $145 – $148 level, which is right around its current price. If it can turn and rally higher, it could rally about $15 to resistance around $164, where the 38.2% retracement line sits. If, however, the stock turns bearish again, and drops below $145, it could easily retest its 52-week low around $124.50.

Near-term Keys: SYK’s fundamentals are among the strongest of the Healthcare Equipment stock’s I’ve considered this week. The question of value is a little bit in the eye of the beholder, 18% upside is interesting, but a little short of the 20% mark I usually like to see for a truly useful value-based opportunity. If you prefer to work short-term trading strategies, you could use a push to $150 as an interesting, perhaps aggressive signal to think about buying the stock or working with call options. A drop below $145, on the other should be taken as a strong, high-probability signal to consider shorting the stock or working with put options, with about $20 of downside to work with as profit potential on a bearish trade.