The market appears to finally be taking notice of the swan dive in oil prices. Lost in the frenzy and angst of COVID-19, shelter-in-place and stay-at-home orders, at least until now, was the price war between Russia and Saudi Arabia that began at the start of the year and saw West Texas Intermediate crude prices slide from the mid-$50 per barrel range into the low $40’s at the beginning of March. By the time the two countries finally agreed to a resolution, the world at large was so preoccupied with COVID-19 and its spread around the globe that the deal merited no more than a passing mention, even on major market news outlets.

Last week investors used indications that the U.S. might finally be approaching a peak in COVID-19 infections, and state governors along with the White House began talking publicly about plans to gradually start reopening the economy to push the market into a strong sentiment-driven bullish rally that seems to have hit a brick wall this week. Global shutdowns to limit the spread of the pandemic have cratered demand for oil all around the world, to the point that holders of April contracts, which expired this week began paying money to have those obligations removed. Tankers and storage facilities are full, waiting for demand to pick up, but that doesn’t seem to be ready to start happening anytime soon. An interview I watched this morning with the CEO of Saudi oil company Husseini Energy, who stated his opinion that the entire industry would be dealing with a difficult period that could extend into the summer. If that is true, It could create a real problem for the global oil industry that could put a number of U.S. shale producers in truly difficult circumstances. I think it will also be a larger player in market volatility in the weeks ahead, as investors will be prompted to factor in reports of energy consumption with health and other economic indicators to evaluate the health of the economy going forward.

The expectation of continued volatility means that as much as ever, it’s important to be very selective about the stocks you decide to work with right now. Using stringent fundamental analysis, with careful attention to valuations is a good way to determine the chances a company will be able to weather the storms of an extended economic decline, but it doesn’t mean the stock won’t experience its own dramatic swings in price. Being selective means not only paying careful attention to the data you use, but also taking smaller-than-normal positions on the stocks you do decide to work with, with the understanding that you might need to be willing to hold them with a long-term perspective in mind to let those fundamentals be properly seen in the stock’s actual price.

Westrock Company (WRK) is a good example of the kind of stock I’m referring to. This is a company that occupies an interesting niche in the Materials sector, providing paper and packaging solutions for consumer and corrugated packaging markets. That doesn’t sound very glamorous – but it means that the cardboard boxes, paperboard, and merchandising display materials you see on products you use every day, or in the grocery and department store are, in many cases coming from this company. Despite a generally solid fundamental profile, the stock price has suffered over the last couple of years before it finally began to rebound in late 2019. COVID-19 and the economic pressures that have come from it have driven the stock off of that high, which was around $44 in January, and saw the stock bottom at around $21.50 in late March. In the last week or so, the stock has dropped again after rallying to a short-term peak at around $33. That means the stock is either preparing to drop back to retest its 52-week low around $21.50, or it is setting up an interesting pullback pattern to confirm the short-term upward trend that began about a month ago. In the meantime, is the stock a useful value? I think it could be.

Fundamental and Value Profile

WestRock Company, incorporated on March 6, 2015, is a multinational provider of paper and packaging solutions for consumer and corrugated packaging markets. The Company also develops real estate in the Charleston, South Carolina region. The Company’s segments include Corrugated Packaging, Consumer Packaging, and Land and Development. The Corrugated Packaging segment consists of its containerboard mill and corrugated packaging operations, as well as its recycling operations. The Consumer Packaging segment consists of consumer mills, folding carton, beverage, merchandising displays, and partition operations. The Land and Development segment is engaged in the development and sale of real estate primarily in Charleston, South Carolina. WRK has a current market cap of $7.5 billion.

Earnings and Sales Growth: Over the past year, earnings declined -30.12%, while sales rose 2.23%. In the last quarter, earnings dropped by -53%, while sales were -4.9%. WRK operates with a very narrow margin profile, which isn’t especially unusual for stocks in this industry; over the last twelve months, Net Income was 4.67% of Revenues, and narrowed to about 3.13% in the last quarter.

Free Cash Flow: WRK’s Free Cash Flow is healthy, at $1.06 billion, and which translates to an attractive Free Cash Flow Yield of 13.3%.

Debt to Equity: WRK has a debt/equity ratio of .81, which is pretty conservative but has increased since November 2018 from just .49. The company doesn’t have great liquidity, with cash and liquid assets of a little over $151.6 million in the last quarter versus long-term debt of more than $9.6 billion; it is worth noting that the increase in debt, which also corresponds to a significant decline in cash over the last year, is primarily tied to the November 2018 acquisition of KapStone Paper & Packaging.

Dividend: WRK pays an annual dividend of $1.86 per share, which at its current price translates to a very attractive dividend yield of about 6.27%. The passive income the stock’s fat dividend offers could be a compelling factor to consider for holding the stock and letting the price work through whatever market conditions do to the stock in the long term.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $44 per share. That means that despite the stock’s increase over the last month, it remains compellingly undervalued, with about 48% upside from its current price.

Technical Profile

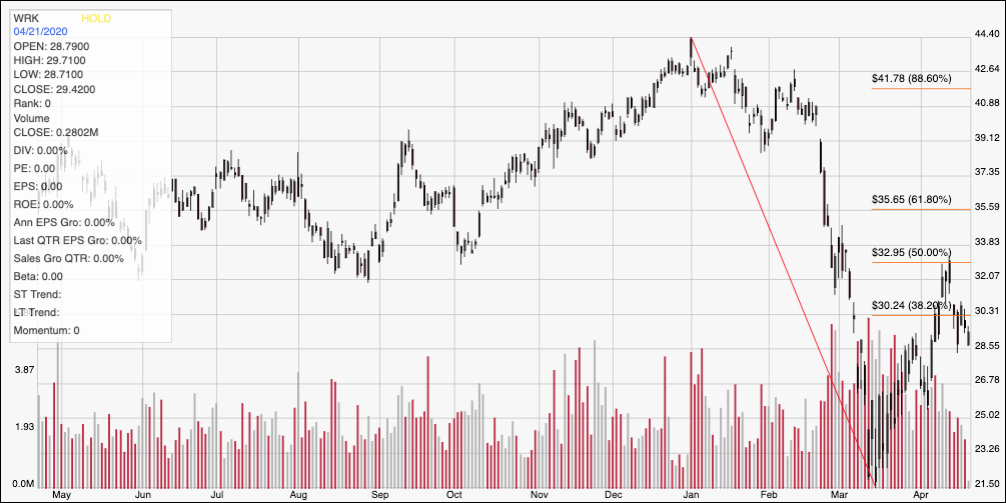

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line marks the stock’s downward trend from January to March; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The rallied strongly from its bottom at around $21.50 to touch the 50% retracement line about a week ago; that peak was around $33 before the stock began dropping back again. Current support is around $28.50, with the stock looking to test that level right now. If it can hold this level and turn back upward, its next resistance should come from the 38.2% retracement line at about $30, with further upside to $33 beyond that if bullish momentum continues. If the stock drops below $28.50, its next likely support point is around $25.50, and if bearish momentum continues from that point, the stock could easily retest its multiyear low at $21.50.

Near-term Keys: While WRK has a solid fundamental profile and a compelling value proposition, the truth is that making a long-term investment in this stock right now means being willing to accept the very real likelihood the stock could drop back near to its low point around $21.50. That requires a long-term perspective, betting on the company’s long-term growth prospects looking beyond 2020 and into 2021. That is counter-balanced nicely by the fact that the company’s dividend is very attractive and offers a yield well in excess of what you can find even in long-term bonds right now. If you prefer to work with short-term trading strategies, the greatest likelihood with this stock right now is on the bearish side. Use a drop below $28.50 as a signal to consider shorting the stock or buying put options, using $25 to $25.50 as an immediate potential exit point, and $21.50 as an attractive profit target if bearish momentum increases. A turn off of current support, however, could be an interesting signal to think about buying the stock or working with call options, using $30 as a quick exit target and $33 if bullish momentum remains healthy.