Healthcare stocks remain a prime area of focus for my analysis right now, and will continue to be as all of North America struggles to find a justifiable reason to get national economies restarted. I think that the basis for any kind of reopening of businesses has to come from evidence not merely that infections have peaked, but that they have started to drop. That is most likely to come as effective treatments and therapies are found. Otherwise, governments can authorize businesses to reopen, but I believe that the fear of reinfection, or of a new spike in infections will keep many consumers away. The only effective counterpoint to that fear has to come from scientific evidence showing the infection is treatable, the worst of the pandemic is over, and it is safe to return to normal-ish routines.

One of the interesting phenomenons that I’ve observed in the last week or so is subtextual as it relates to the healthcare industry. While healthcare professionals are doing heroic work in treating the infected, massive amounts of work is being done to research, develop and test treatments and vaccines, and companies on the supply side are doing everything they can to provide the necessary support to keep all of those efforts going, it has also forced drastic measures related to elective procedures. That means that not all healthcare stocks are shielded from the pressures of an economic downturn from the pandemic. There are a number of companies, however that may not be on the front line of the COVID-19 fight, but whose niche fits into still necessary healthcare operations.

Baxter International Inc. (BAX) is an interesting example. This is a global medical products and services company that provides hospital supplies – intravenous solutions and administration sets, vials and syringes, infusion pumps, etc. – as well as renal care to meet the needs of patients in various stages of kidney disease and failure. I think this company’s niche is probably one of the biggest reasons that the stock is actually only a few dollars below the all-time high it reached in February before it followed the broad market into bear market territory. I think the broad market stands a very good chance of testing its bearish, recessionary lows in the not-too-distant future, while BAX’s pattern has diverged from the market to put it into positive territory for the year and within spitting distance of its own highs.

Does that mean BAX is a good bet for investors looking for a safe place to put their money even as market conditions remain uncertain? I’m not so sure; the stock is pretty significantly overvalued right now, with some worrisome holes in its fundamental profile that I think warrant caution right now – especially since how shielded the company really has been from pandemic effects isn’t going to be known until the company releases its next earnings report in a week. Let’s run through the numbers.

Fundamental and Value Profile

Baxter International Inc., through its subsidiaries, provides renal and hospital products. The Company operates through two segments: Hospital Products and Renal. Its Hospital Products business manufactures sterile intravenous (IV) solutions and administration sets, premixed drugs and drug-reconstitution systems, pre-filled vials and syringes for injectable drugs, IV nutrition products, parenteral nutrition therapies, infusion pumps, inhalation anesthetics and biosurgery products. The Renal business offers a portfolio to meet the needs of patients with end-stage renal disease, or irreversible kidney disease and acute kidney injuries, including technologies and therapies for peritoneal dialysis (PD), hemodialysis (HD), continuous renal replacement therapy (CRRT) and additional dialysis services. Its products are used by hospitals, kidney dialysis centers, nursing homes, rehabilitation centers, doctors’ offices and by patients at home under physician supervision. BAX has a current market cap of $45.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings improved modestly, by about over 24.36%. An internal investigation announced earlier this year by the company into the use of foreign currencies forced management to withdraw their last quarter’s earnings, so that number is not available. In the last year, sales improved by almost 7% while in the last quarter they increased about 6.5%. The company’s margin profile shows signs of significant deterioration; over the last twelve months Net Income was 8.81% of Revenues, but plunged in the last quarter to -1.91%.

Free Cash Flow: BAX has free cash flow of a little over $1.4 billion over the last twelve months. This number has declined from March of 2019, when it was $1.0 billion and translates to a Free Cash Flow Yield of 3.08%.

Debt to Equity: the company’s debt to equity ratio is .67, a conservative number that generally indicates a conservative approach to leverage. Long-term debt was $5.3 billion in the last quarter versus about $3.33 billion in cash and liquid assets. Their balance sheet is strong, showing that cash and liquid assets are plentiful to service their debt if operating profits are unable to; however their negative Net income in last quarter is concern; if that pattern continues, or deteriorates further, the current balance between cash and debt is likely to shift dramatically.

Dividend: BAX pays an annual dividend of $.88 per share, which translates to an annual yield of 0.98% at the stock’s current price. While the dividend itself isn’t remarkable, it is noteworthy that company pays a dividend in an industry where the majority of stocks do not. I do think that in the case of BAX, the dividend bears watching. If cash erodes significantly due to a continuation of the current negative Net Income pattern, management could be forced to reduce or even eliminate the dividend to save cash.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $65.47 per share. That means that BAX is significantly overvalued, with about -28% downside from its current price.

Technical Profile

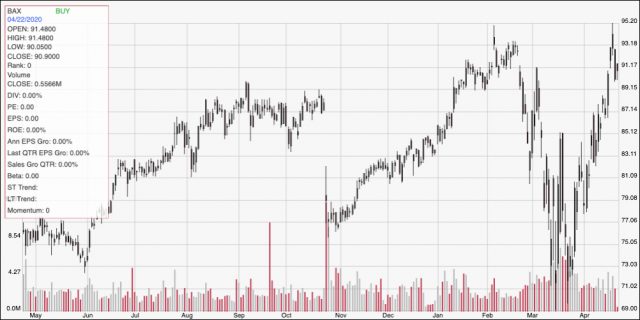

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price movement over the past year. After hitting a peak at around $95 in mid-February, the stock followed the rest of the market into bear market territory until last March, when it bottomed and rebounded sharply from about $71 per share. The really from that point creates exactly the kind of V-shape pattern that I think a lot of people are hoping for from the economy at large. From a recent peak around $94, however, the stock has dropped back a bit. Current support is around $89, with near-term resistance between $93 and $94. If the stock drops below $89, near-term support should be between $86 and $87, but could actually land between $81 and $83 based on pivot activity in late 2019.

Near-term Keys: Negative Net Income is a big red flag in my book, and so even with the general strength in BAX’s current balance sheet, I think this is a stock that represents a risk under current market conditions. If COVID-19 proves to have the slowdown impact on BAX that it is having on companies in every segment of the economy, the stock’s overvalued status means there is a lot of downside in BAX right now. That means the best chance of success right now comes from short-term trades. If the stock can bounce off of support at $89 and keep moving higher, it has some interesting upside to get to about $94 or possibly near its 52-week high at $95. That could be a good opportunity to buy the stock or work with call options. If the stock breaks below its $89 support, take it as a strong signal to think about shorting the stock or working with put options, using $86 as an initial profit target, but being on the lookout for more room to $83 or even $81 if bearish momentum picks up.