As economies throughout the world begin to reopen on a gradual basis, economic reports are starting to come in reflecting the very real, and very dramatic impact that COVID-19 and global shutdowns have had on corporate operations. While that impact is very surprising at all, I do think that as investors look for constructive places to put your money to work for you, the question is not whether the stock you’re looking at has been affected, or been fortunate enough to shield itself in some way from that impact.

If you look at the stocks that have actually managed to increase in value over the last couple of months, you’ll see that most of those are in a very narrow segment of the economy, specifically in either the healthcare industry, where companies that are involved in COVID-19 vaccine or antiviral development have seen positive stock price moves, or technology – centered primarily around companies involved in remote workforce solutions. That’s interesting, but it generally also means that those stocks have already been pushed well beyond useful valuation metrics.

If you’re looking at value, the question becomes whether or not a stock that is now trading at a major discount has the resources it needs to ride through current economic and business turmoil, and still be standing in a favorable position once those concerns eventually fade. That means recognizing the impact current conditions have had, and may continue to have in the near term, and balancing them against the company’s balance sheet. Does the company possess a healthy combination of cash and liquid assets to provide near-term stability relative to its debt? And is their current debt load manageable enough that the company might be able to prudently take on more debt to further extend its financial stability and flexibility? Those are questions that can help to delineate between the stocks that offer the best long-term opportunities at nice prices versus those that are just plain cheap.

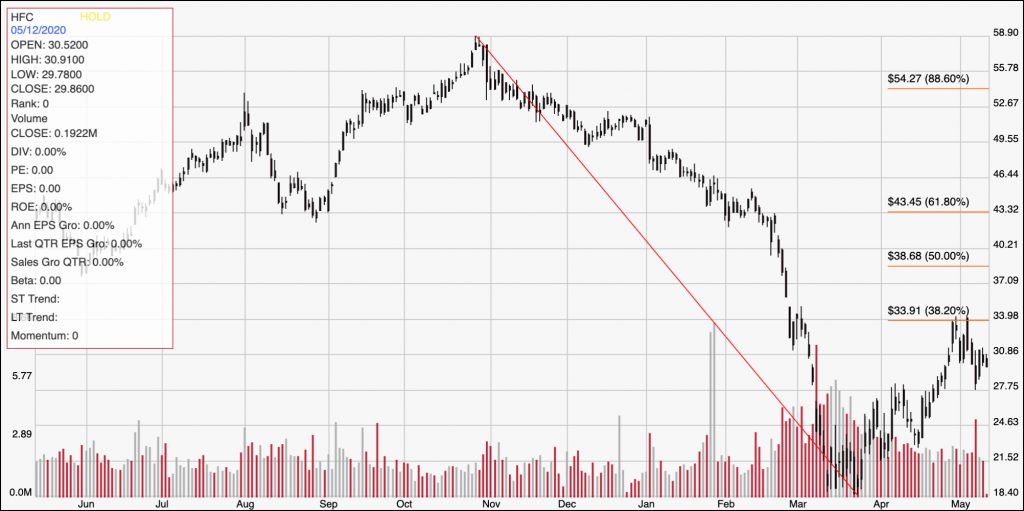

HollyFrontier Corporation (HFC) is a case in point. The last two quarters have shown significant declines in their operating margins, which isn’t surprising given the collapse in crude prices that began at the beginning of the year resulting from a price war between Russia and Saudi Arabia, and then exacerbated by the vaporization of demand that came from global shutdowns to limit the spread of COVID-19. The stock cratered in the meantime, plunging from a November high at around $59 to a March low below $19 per share. The stock has rebounded from that point, now pushing near to $30 per share. The recovery in share price is interesting, and could even be useful from the standpoint of momentum; but more interesting is the way the company’s balance sheet has held up even as the company was forced, as most energy stocks to absorb a big, but likely temporary hit. Despite the increase, the stock carries a compelling value proposition that looks too good to pass up – provided you’re willing to deal with near-term volatility. Let’s dive in.

Fundamental and Value Profile

HollyFrontier Corporation is an independent petroleum refiner. The Company produces various light products, such as gasoline, diesel fuel, jet fuel, specialty lubricant products, and specialty and modified asphalt. It segments include Refining and Holly Energy Partners, L.P. (HEP). The Refining segment includes the operations of the Company’s El Dorado, Kansas (the El Dorado Refinery); refinery facilities located in Tulsa, Oklahoma (collectively, the Tulsa Refineries); a refinery in Artesia, New Mexico that is operated in conjunction with crude oil distillation and vacuum distillation and other facilities situated 65 miles away in Lovington, New Mexico (collectively, the Navajo Refinery); refinery located in Cheyenne, Wyoming (the Cheyenne Refinery); a refinery in Woods Cross, Utah (the Woods Cross Refinery), and HollyFrontier Asphalt Company (HFC Asphalt). The HEP segment involves all of the operations of HEP. HEP is a limited partnership, which owns and operates logistic assets. HFC has a current market cap of about $4.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased by about -1.5%, while revenues declined by -12.74%. in the last quarter, earnings managed to improve by 10.42% while sales dropped -22.4%. The company’s narrow margin profile, which was just 1.27% over the last twelve months, turned negative in the last quarter, at almost -9%.

Free Cash Flow: HFC’s free cash flow is healthy, at $1.06 billion, and marks a modest, but smaller than expected decline from around $1.25 billion in the last quarter. That translates to a still highly attractive Free Cash Flow Yield of almost 19.5%.

Debt to Equity: HFC’s debt to equity is .46, a generally conservative number. The company’s balance sheet indicates liquidity and debt management remains healthy despite the current negative Net Income pattern, with more than $909 million in cash and liquid assets in the last quarter versus about $2.8 billion of long-term debt. It’s worth noting that at the beginning of 2019, HFC reported just $496 million in cash, which makes the latest number all the more impressive.

Dividend: HFC’s annual divided is $1.40 per share, which translates to a yield of about 4.63% at the stock’s current price. The dividend was also increased in the last quarter from $1.32 per share, which I take as another sign of the company’s ability to manage their bottom line and confidence in the future. It is also an encouraging sign, as other energy companies are reducing, suspending or eliminating their dividends to conserve cash.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at almost $51 per share. That means the stock is trading at a major discount, with about 66% upside from the stock’s current price.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red line traces the stock’s downward trend from November of last year to low at around $18.50 per share in March. By the end of April, the stock had managed to stage a short-term upward trend, peaking at the 38.2% Fibonacci retracement line at about $34. Immediate resistance is at $31, with support around $27.75. A push above $31 should give the stock good short-term momentum to $34, with even more upside to about $43 if bullish momentum remains strong. A drop below $27.75 has downside to between $24 and $23 per share based on pivot activity in March and April.

Near-term Keys: HFC’s current upward trend is interesting, with the recent pullback providing what looks like a good continuation setup. The value proposition is compelling, even with the likelihood of continued price volatility as broad conditions remain uncertain. If you prefer to work with short-term trading strategies, use a break above $31 as an opportunity to buy the stock or work with call options, using $34 as a quick-hit profit target, and even more upside from there if bullish momentum remains strong. A drop below $27.75 would be a strong signal to consider shorting the stock or buying put options, with $24 as a useful profit target for a bearish trade.