When it comes to identifying stocks that might make useful investments, there are as many strategies as there are people. You can break these strategies into any different number of categories. I like to differentiate between strategies by thinking first about the amount of time I might actually plan to hold the stock in question; for example, long term versus short term. When I think about long term investments, I think it makes sense to focus on the business underlying a stock. There are a ton of different fundamental measurements people like to focus on, but one of the measurements that I think makes the most sense is whether or not a stock pays a dividend.

Dividend-paying stocks, in my book, should be a no-brainer for anybody thinking about long term investments, no matter whether you are trying to generate income, or if your focus is on building wealth. Why? Because dividends are the low-hanging fruit of investment returns that require the last work or analysis on your part. All you have to do to qualify for a dividend is to own the stock before the scheduled ex-dividend date. Another great thing about dividends in our current market environment is that an increasing number of stocks currently boast annualized dividend yields in access of 3% or more – which makes them far more attractive than standard interest-bearing instruments like bonds and CD’s in our current, near-zero interest rate environment.

Dividend-paying stocks are also generally expected to be among the most resilient stocks in troubled economic times – especially if the company’s balance sheet can indicate that the dividend is likely to remain stable or, even better, increase in the future. It doesn’t mean they won’t decrease in price if the market returns to bear-market conditions that coincided with the country’s coronavirus-driven, nearly immediate plunge into recessionary conditions; but since stocks that pay stable dividends generally have the balance sheet strength to ride through difficult, even tumultuous economic conditions, they are usually among the few that are in position on the other side of the downturn to return to previous patterns of growth in relatively short order.

Valero Energy Corp. (VLO) is a good example of the kind of dividend-paying stock I’m referring to. The stock followed the entire energy sector dramatically lower from November 2019 to March of this year, driven first by oil price war tensions, and then exacerbated by global economic shutdowns as countries tried to limit the spread of COVID-19. After declining more than -70% in price, the stock bottomed at about $31 per share, but then more than doubled in price at the beginning of May. The stock appears to be consolidating now, looking for a point to either confirm the current short-term upward trend, or to possibly reverse back lower and possibly retest pivot points anywhere between $52 and the stock’s March low. This could be a good opportunity to buy a stock that is still more than -40% below its November 2019 high around $102, if the upward trend can hold.

The other question that I think is important, however is whether the stock’s current price represents a useful value. It’s one thing to recognize whether the stock is trading at a discount relative to its historical highs, and another to say that there is a strong reason to suggest the stock should revisit those highs at some point in the future. So VLO pays a terrific dividend, and as you’ll see, they have some solid fundamentals to back them up as well; but what about the value story?

Fundamental and Value Profile

Valero Energy Corporation (Valero) is an independent petroleum refiner and ethanol producer. The Company’s segments include refining, ethanol and Valero Energy Partners LP (VLP). The refining segment includes its refining operations and the associated marketing activities. The ethanol segment includes its ethanol operations and the associated marketing activities, and logistics assets that support its ethanol operations. The Company owns logistics assets (crude oil pipelines, refined petroleum product pipelines, terminals, tanks, marine docks, truck rack bays and other assets) that support its refining operations. Some of these assets are owned by VLP, which is a midstream master limited partnership owned by the Company. VLP’s assets include crude oil and refined petroleum products pipeline and terminal systems in the United States Gulf Coast and the United States Mid-Continent regions. Its refineries produce conventional gasolines, premium gasolines and lubricants, among others.VLO’s current market cap is $24.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings were flat (exactly 0%) while sales declined about -9%. In the last quarter, earnings were -84% lower while sales dropped by nearly -21%. The company operates with a narrow margin profile that, like most stocks in the energy sector, turned negative in the last quarter; over the last twelve months, Net Income was 0.41% of Revenues over the past year and -8.37% in the last quarter. Both measurements are dramatically lower than at the beginning of the year, when operating margins were narrow, but positive. If oil prices can continue to recover, this could be a temporary, anomalous condition, but that won’t truthfully be known for at least another quarter, and possibly more.

Free Cash Flow: VLO’s free cash flow is generally healthy, although their negative Net Income pattern has had an impact on this measurement, at $1.87 billion. That marks a decline from earlier this year from $3.6 billion and also translates to a Free Cash Flow Yield of 6.94%.

Dividend: VLO pays an annual dividend of $3.92 per share, which translates to an impressive 6.19% yield at the stock’s current price – much higher than the S&P 500 average dividend yield and well above the yield offered even by long-term bonds. That is a tempting

Debt to Equity: VLO has a debt/equity ratio of .54. This is a low number that generally suggests debt management shouldn’t be a problem. The company’s balance sheet shows $1.5 billion in cash and liquid assets – down from about $2.1 billion at the beginning of the year – while the company completely wiped out $9.2 billion in long-term debt at the end of 2019.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $66 per share. That means that VLO is modestly undervalued, by about 9%.

Technical Profile

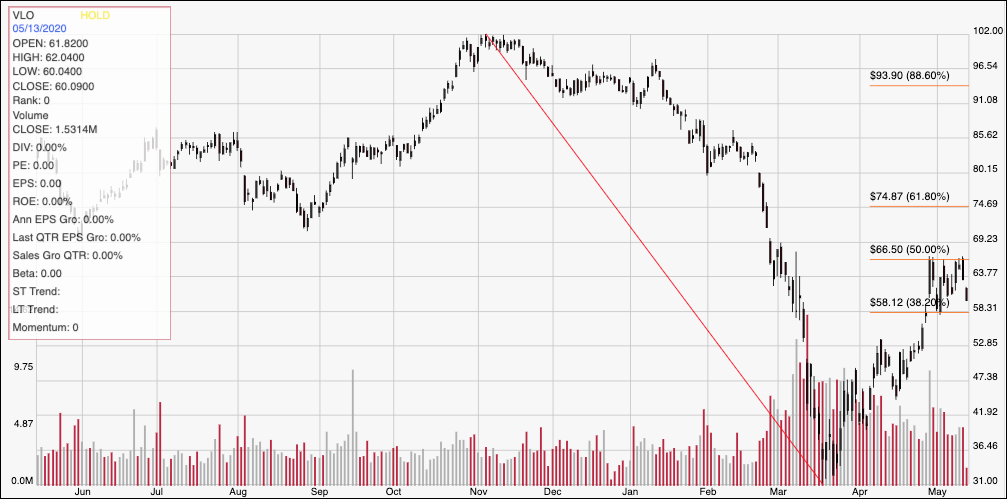

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last year’s worth of price movement for VLO. The red diagonal line marks the stock’s downward trend from November 2019 to mid-March of this year; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After bottoming at around $31, the stock staged a strong upward trend, rallying to about $66.50 before beginning to consolidate in the last few weeks between the 38.2% and 50% Fibonacci retracement lines. That provides an easy reference for immediate support and resistance, with resistance at $66.50 and support around $58. A drop below $58 could see the stock fall quickly to about $53 based on prior pivots seen in April, while a push above $66.50 should give the stock near-term upside to about $75, where the 61.8% retracement line rests.

Near-term Keys: There could be some useful, short-term, momentum-based opportunities in the stock. A break above $66.50 would be an excellent signal for a bullish, momentum-based trade, by either buying the stock outright or working with call options. If the stock pushes below $58, there could be a good short-term opportunity to short the stock or work with put options. From a value-oriented standpoint, the stock really doesn’t offer a great value unless it drops back below $53; at that point, it would mark a significant, and useful value price. Without that discount, even with the stock’s generally solid balance sheet and excellent dividend, it’s hard to forecast much more long-term upside than its current price level.