The tech sector has been a bright spot during the COVID-19 pandemic. There are multiple factors that I think are contributing to that reality. Those include signs of increasing recovery and economic activity in China, where a major portion of manufacturing activity for semiconductor companies takes place, and the ability of a large number of companies who have been able to rely on remote capabilities provided by some of the largest and most established names in the tech sector to send employees to work from home and keep their business going, to name just two big contributors.

COVID-19 is proving to have a mixed impact on business in all sectors. There are big concerns about the long-term impact of companies – primarily small, local businesses – that rely heavily on human interaction, and who were forced to shutter their doors at the initial outbreak and now may never reopen. The largest portion of the American workforce is made up by small business activity, and so I don’t think it’s too surprising to see unemployment numbers still above 30 million as of this week’s report. Questions remain whether workers whose initial claims were categorized as temporary – meaning they expect to return to work shortly – or permanent, meaning that the job they were laid off or furloughed from may not come back at all. I think that risk as it relates to small businesses is increasing right now, and that is a concern that bears watching.

Negativity and small business risk aside, it is also remarkable to see how well a number of other companies have managed to transition successfully into a modified form of operation. That includes work-at-home operations, and even extends to retail businesses who have pivoted their in-store operations into a contactless delivery model. It’s safe to say that for most of those companies that have been able to surprise analysts and experts by their ability to evolve, the transition depended largely on work and investment they had already been making in technology. That is where today’s stock comes into play.

Cognizant Technology Solutions (CTSH) is a professional services company that works with companies in a variety of sectors that focuses on software development and digital platform engineering services for its clients. That puts CTSH in the IT Services industry, which is, at least in part, an area that has continued to see healthy demand as more companies have been forced to identify ways to use technology to shift their business focus. Economists are putting a big focus on companies with healthy balance sheets to help ride through any uncertainty that may extend into a longer-term period of time, and CTSH is company that fits that bill as well. Since the beginning of the outbreak in February, the stock is down about -26%, but it has also followed the tech sector higher from its bottom and is currently setting up what looks like a good bullish opportunity as it drops back off an April high at around $59 in late April. The value proposition also remains pretty attractive, which means that CTSH is worth a long look right now no matter what your preference is.

Fundamental and Value Profile

Cognizant Technology Solutions Corporation is a professional services company. The Company operates through four segments: Financial Services, Healthcare, Manufacturing/Retail/Logistics, and Other. The Financial Services segment includes customers providing banking/transaction processing, capital markets and insurance services. The Healthcare segment includes healthcare providers and payers, as well as life sciences customers, including pharmaceutical, biotech and medical device companies. The Manufacturing/Retail/Logistics segment includes manufacturers, retailers, travel and other hospitality customers, as well as customers providing logistics services. The Other segment includes its information, media and entertainment services, communications and high technology operating segments. Its services include consulting and technology services and outsourcing services. Its outsourcing services include application maintenance, IT infrastructure services and business process services. CTSH has a current market cap of $28.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 5.5%, while sales increased by about 2%. In the last quarter, earnings declined by -10.2% while Revenues slipped by -1.4%. The negative earnings pattern in the last quarter is a reflection of the reality that the pandemic has still had an impact on the company in the near term. CTSH’s Net Income versus Revenue is healthy, but also reflects a pandemic effect, running at 10.46% over the last twelve months and 8.69% in the last quarter. These are a reason that I think the stock’s decline from February highs are justified, but if these prove to be a temporary effect, should also turn around in the quarters ahead.

Free Cash Flow: CTSH’s Free Cash Flow is healthy, at about $2.3 billion. That number increased from the end of 2019, when Free Cash Flow was $1.6 billion. That translates to a Free Cash Flow Yield of 8.19%.

Debt to Equity: CTSH has a debt/equity ratio of .30, which is a good reflection of the company’s conservative approach to leverage. Their balance sheet shows about $3.2 billion in cash and liquid assets against about $4.2 billion in long-term debt. Despite the increase in debt in the last quarter, their operating profile and high liquidity are good indications CTSH has the financial flexibility to weather the current storm and adapt to ongoing changes in the markets it operates in.

Dividend: CTSH pays an annual dividend of $.88 per share, which at its current price translates to a dividend yield of about 1.67%. That is modest, but it is also much less than 50% of the stock’s earnings per share over the last twelve months – a conservative payout ratio that actually helps bolster the company’s balance sheet strength. It is also noteworthy that at the end of 2019, CTSH’s dividend was $.80 per share.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at about $69.50 per share. That means the stock is trading at a sizable discount, with 32% upside from the stock’s current price.

Technical Profile

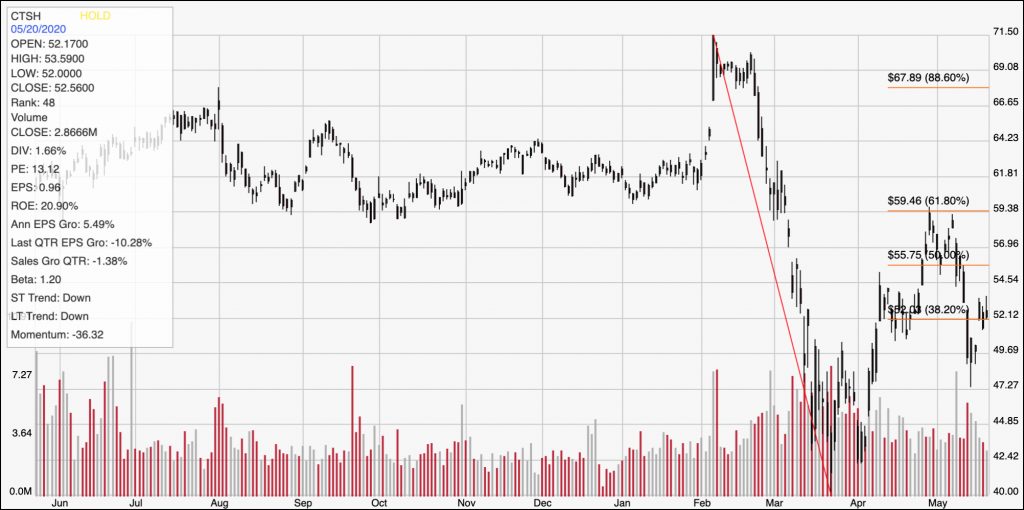

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the year of price activity; the diagonal red line traces the stock’s downward trend from its February peak above $71 to its March low around $40. The stock rallied strongly in April to a peak at about $59 per share at the 61.8% retracement line before dropping back last week to a new pivot low at around $49. From that point, the stock has started to rebound again, with a new push to the 38.2% retracement at around $52. That could mark the stock’s current resistance point, which means that a continued push higher has strong upside to the previous peak at around $59. If the stock drops below support at $49, it could fall quickly to anywhere between $42 and its March low near $40.

Near-term Keys: The stock’s fundamentals are very strong, even with a clear impact from the current pandemic factored in, and the bargain proposition is very appealing; however it is worth noting that industry analysts right now are forecasting stagnant to tepid growth in revenues and profits for the company for the next year or so, which means that while the stock looks attractive from a valuation standpoint, a push back near to its all-time highs is likely to be an extended, very long-term prospect. If you prefer to work with shorter-term trading strategies, you could use a break above the stock’s immediate resistance around $52 as a signal to buy the stock or work with call options, with a near-term exit target at around $59. There could also be a bearish opportunity, although you’d have to wait to see the stock fall below $49 to see a good signal for a bearish opportunity to short the stock or to buy put options. In that case, the exit target would be around $42 per share, and if the bearish momentum persists, you may be able to extend that trade to around $40.