Since the market hit a bear-market low point in March, it has rallied pretty strongly, with the major indices approaching their pre-pandemic highs as investors bet that the economy will continue to restart successfully even as COVID-19 remains an ongoing health concern. A big drop in unemployment claims to close last week boosted optimism that the worst is behind us, and as a result a number of beaten-down industries have been rallying lately.

A lot of the initial surge in April and May was driven by stocks in industries that were showing resiliency in the face of global economic shutdowns. Those included defensive-oriented industries like Food Products as well the Technology sector, where a number of stocks benefitted from a shift by an increasing number of companies to work-at-home business models. That put a lot of attention on companies that provide remote connectivity solutions, including cloud services, video conferencing, virtual private networks, and so on on.

The semiconductor industry was also a big beneficiary of the surge in interest in tech stocks, as this industry is an important hardware provider for many of the services that are driving work-from-home tech demand. That includes storage, where the need for memory and storage capacity have been increasing.

Data storage technology has been under pressure for a few years now, as supply ran pretty consistently higher than demand before the pandemic hit. Consumer demand for traditional storage has been dropping as sales of traditional PC’s have dropped in favor of mobile devices, including smartphones and tablets, which rely primarily on flash and solid-state drive (SSD) technology for short and long-term storage. That, combined with a continued decline in costs of producing these faster, more efficient storage solutions (while also increasing their overall storage capacity) is something that has forced companies in the storage space to rethink their approach to traditional disk drive storage.

Seagate Technology (STX) is one of the biggest providers of storage technology solutions. Where many of its competitors, like Micron (MU) and Western Digital Corporation (WDC) have emphasized innovating in the emerging flash, NAND, and SSD memory space, STX has stayed fixed in traditional disk drives. While demand in traditional PC’s has dropped, the truth is that truly high-capacity storage – the kind required for network and cloud servers, where the tech sector has seen the most growth this year – is still only practical with traditional disk storage technology. That is where STX has put its greatest focus, and where analysts continue to expect to see growth. The work-at-home dynamic has certainly played a role in helping STX’s stock drive nearly 41% higher since it hit a March low at around $39, and that’s good if you bought the stock at that low price; but does that mean the stock has more room to run? Do the company’s fundamentals justify the idea that it could continue to drive higher, or is the reward: risk profile for STX starting to shift away from offering any kind of practical opportunity for a long-term investor? Let’s find out.

Fundamental and Value Profile

Seagate Technology public limited company is a provider of electronic data storage technology and solutions. The Company’s principal products are hard disk drives (HDDs). In addition to HDDs, it produces a range of electronic data storage products, including solid state hybrid drives, solid state drives, peripheral component interconnect express (PCIe) cards and serial advanced technology architecture (SATA) controllers. Its storage technology portfolio also includes storage subsystems and high performance computing solutions. Its products are designed for applications in enterprise servers and storage systems, client compute applications and client non-compute applications. It designs, fabricates and assembles various components found in its disk drives, including read/write heads and recording media. Its design and manufacturing operations are based on technology platforms that are used to produce various disk drive products that serve multiple data storage applications and markets. STX has a current market cap of $14.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by a little more than 55% while sales grew 17.5%. It’s hard to grow earnings faster than sales, and in the long term isn’t really sustainable; even so, I generally take this as a positive sign that management is effective at maximizing their business operations. In the last quarter, where most companies have dealt with significant declines in earnings and revenues, STX posted a 3.2% increase in earnings, with modest revenue growth of about 1%. The company margin profile is generally healthy, but like most companies right now has shown signs of deterioration; over the last twelve months, Net Income was 17.5% of revenues, but shrank to about 11.75% in the last quarter.

Free Cash Flow: STX has generally healthy free cash flow of a little over $1.2 billion over the last twelve months. This number decreased from a high point in September of 2018 at around $2.1 billion. At the stock’s current price, this also translates to a Free Cash Flow Yield of about 9.08%.

Debt to Equity: the company’s debt to equity ratio is 2.28, an elevated number that suggest STX is highly leveraged. The company’s balance sheet indicates their operating profits are more than sufficient to service their debt, with $1.6 billion in cash and liquid assets and a little over $4 billion in long-term debt.

Dividend: STX pays an annual dividend of $2.60 per share, which translates to an annual yield of 4.78% at the stock’s current price. Not only is that remarkable for a tech company, most of which don’t pay any dividend at all, but this is also well above the industry average. It is also worth noting that while competitors like WDC have suspended their dividend payout to preserve cash, STX has increased their dividend from $2.52 about a year ago.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $36 per share. That means that STX is significantly overvalued right now, with about -34% downside from its current price.

Technical Profile

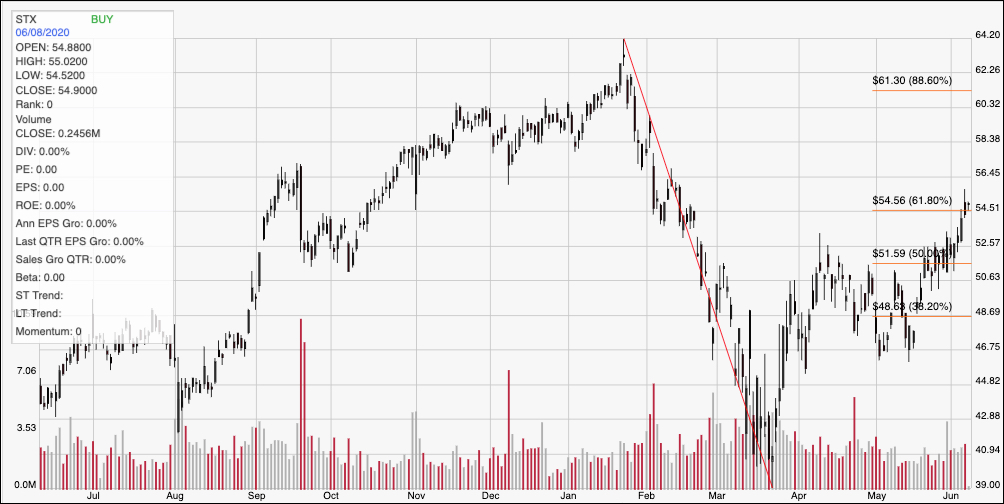

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s downward slid from a January peak at around $64 to its March low at close to $39 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that low, the stock has moved into a clear short-term upward trend that appears to be gaining strength; in the last couple of days the stock has broken its most recent resistance at around $54.50, where the 61.8% retracement line sits. The break means that current support should be between $54 and $54.50, with the next most likely resistance between $58.50 and $60 based on previous pivots in late 2019. If the stock drops below support at $54, it could fallow to about $50.50, where the stock previously found pivot resistance in April and mid-May.

Near-term Keys: STX has some interesting fundamental metrics working in its favor right now; despite those strengths, however, the stock is clearly overvalued. That means that if you want to work with the stock on a long-term basis, you’re doing it strictly on the basis of its growth prospects. The fact is that most analysts aren’t overly bullish on the storage segments long-term prospects right now, as declining consumer trends in the space provide a big counter to the strength of enterprise demand. I think that means that the best probabilities for a stock like STX lie in shorter-term trading strategies. The stock’s recent break above resistance could be an interesting signal to think about buying the stock or working with call options, using $58.50 as an interesting profit target. If the stock reverses course and drops below $54, consider shorting the stock or working with put options, with a range between $51 and $50.50 providing a nice, quick-hit profit target on a bearish trade.