Over the last several months, the Aerospace industry, which includes commercial airlines has been one of the biggest, unquestioned losers in the stock market. Yes, the biggest portion of that drop comes from the reality that the industry took some of the biggest drawdowns in the market starting in February as commercial travel dried up to practically nothing because of global shutdowns and shelter-in-place orders. Even before COVID-19 began dominating the world’s attention, though, this is an industry that was already experiencing its share of trouble.

There are two principle commercial airline producers in the world: Boeing and Airbus. Boeing spent practically all of 2019 dealing with the negative impact of fatal crashes of its popular 737 MAX jet that killed all passengers on board. Those crashes were attributed to failures in the planes’ sensor system, resulting in the global grounding of the jet all over the world as the company went back to the drawing board. As of this writing, the 737 MAX has still not been returned to service, and this week reports filtered out that Boeing had ordered on its primary turbine suppliers to halt production. Without a concrete explanation, analysts are left to assume that either the regulatory process is being slowed (the FAA was about to begin certification test flights) or the company is planning to roll out new aircraft at a slower-than-originally-expected pace once the grounding order is lifted. Either way, the near-term prospects for Boeing still don’t look very favorable.

This is where sometimes my contrarian nature sometimes proves useful. I certainly don’t downplay the seriousness of the global pandemic, of which we appear to be seeing the emergence of a much-feared second infection wave. I also have no illusions about the reality that even when consumers begin traveling again, it will probably be under dramatically different conditions and rules than were in place at the beginning of the year – or that the concerns related to Boeing are going to be resolved soon. That said, the negative pressure these elements have put on the industry have pushed prices on stocks throughout the Aerospace industry to extreme lows.

Being a contrarian means that even in seriously depressed industries, I’m used to sifting through through a lot of data to dig the occasional gem out of what might otherwise look like a complete wreck to everybody else. In Aerospace, I think there are still bright spots to find opportunity right now. Raytheon Technologies Corp. (RTX) is an example.

In the commercial airline segment, RTX’s biggest customer isn’t Boeing – it’s Airbus, which before COVID-19 became a global issue was drawing a number of Boeing customers to its business. It also is a major player in the government-funded Defense space, which has historically proven to be resilient and even resistance to economic downturns. I believe the upshot is that while the commercial side is likely to remain under pressure for the foreseeable future, it will probably also recover more quickly than other companies whose businesses are closely tied to Boeing. As of their most recent earnings report in early May, the strength in their Defense business helped their balance sheet absorb the hit in the last quarter that in many other cases has prompted management to take drastic measures, including eliminating dividend payouts to preserve cash. The last week’s volatility and nervousness has pushed the stock about -7% below its most recent pivot high, and if the market can stabilize, that looks like it could be a nice set up to buy a good company at a nice price.

Fundamental and Value Profile

Raytheon Technologies Corp, formerly, United Technologies Corporation is engaged in providing high technology products and services to the building systems and aerospace industries around the world. The Company operates through segments such as Pratt & Whitney and Collins Aerospace Systems. The Pratt & Whitney segment supplies aircraft engines for the commercial, military, business jet and general aviation markets. Pratt & Whitney segment provides fleet management services and aftermarket maintenance, repair and overhaul services. The Collins Aerospace Systems segment provides aerospace products and aftermarket service solutions for aircraft manufacturers, airlines, regional, business and general aviation markets, military, space and undersea operations. RTX has a current market cap of $98.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -6.8%, while sales were flat, but slightly negative at -0.84%. In the last quarter, earnings dropped -8.25% while Revenues decreased -6.86%. RTX’s Net Income versus Revenue shows the impact of global economic shutdowns; over the last year this number was 5.34%, and dropped in the last quarter to -0.46%. I think Net Income does bear watching carefully in the quarters ahead; a continued decline in this measurement will put heavier pressure on their balance sheet, which for now is healthy enough to absorb it.

Free Cash Flow: RTX’s Free Cash Flow remains healthy, at a little more than $5.7 billion. That does represent a decline from $6.6 billion in the quarter prior, and translates to a Free Cash Flow Yield of 9.69%.

Debt to Equity: RTX has a debt/equity ratio of 1.08, which is a bit high, and marks an increase from .9 in the quarter prior. Their balance sheet shows a little over $8 billion in cash and liquid assets against $45.3 billion in long-term debt. Servicing their debt is no problem, but continued declines in Net Income could put pressure on the company’s liquidity.

Dividend: RTX pays an annual dividend of $1.90 per share, which at its current price translates to a yield of 3.02%. It should be noted that in the last earnings report, management announced it was reducing the dividend from $2.94 per share, a cost-cutting measure that can be interpreted as positive or negative depending on your general view. Under current circumstances, I think the fact that the dividend was reduced, and not eliminated, which many companies are doing right now, is generally a positive indication, but it does mean that the company’s next couple of earnings reports bear watching as well.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $123 per share. That means that RTX is significantly undervalued, with a little more than 87% upside from its current price. RTX’ current target price is quite a bit below the level I identified before the most recent earnings report, when I put their “Fair Value” price around $132 per share.

Technical Profile

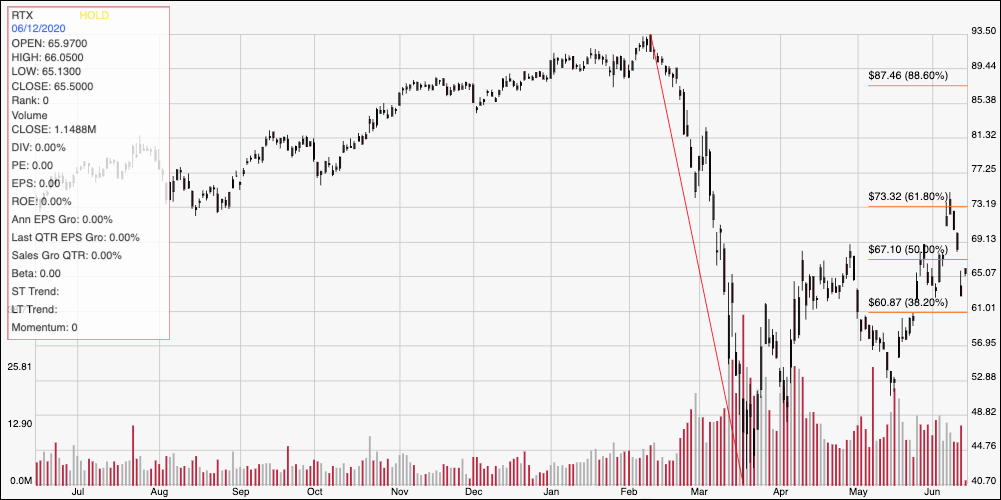

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line defines the stock’s downward trend from the third quarter of 2018 to its low point in March at around $41. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. RTX had been following a modest, intermediate upward trend through the last half of 2019, peaking at about $92, before collapsing to its March low under the weight of COVID-19-induced concerns. The stock picked up bullish momentum from that point, rallying to a high above the 50% retracement line at around $67 before dropping back again until mid-May. From that point, the stock pushed up to the 61.8% retracement line and appeared to be picking up bullish momentum until the uncertainty of the last week pushed the stock back to near the 38.2% retracement line, a little above $61 per share. Current resistance is a little above the 50% retracement line, around $69; a push above that level should give the stock short-term room to rally to about $73 around the last pivot high, with additional room to at least $77 based on late-2019 pivot activity if bullish momentum remains steady. Current support is around $61; a drop below that point could give the stock bearish momentum to fall to the mid-May low point around $53 before finding new support.

Near-term Keys: RTX’s fundamentals remain generally favorable, despite the sizable headwinds in its commercial business, and the inevitable impact they carried in the last quarter. I think that resilience is a reflection of the company’s operations in the Defense space, as well as the fact that it isn’t heavily reliant on Boeing on the commercial side. I also really like their value proposition, but don’t ignore the stock’s exposure to broad market-based volatility right now; a resumption of the broad market’s bearish momentum has already brought the latest rally to a grinding halt, and as COVID-19 uncertainty continues, don’t be surprised to see the market continue to be volatile. That could also mean that the best probabilities lie with short-term trades; a push above current resistance at $69 could be a good signal to buy the stock or work with call options, using $73 as a first, quick-hit profit target, while a drop below $61 would be a good signal to think about shorting the stock or buying put options, using the stock’s low point in mid-May around $53 as a useful target for bearish trade.