Surveying the stock market right now is an interesting mix of contradictions. It seems that with very few exceptions, every industry in almost every sector has had to absorb some kind of impact from the global pandemic that forced governments to shutter their economies and issue shelter-in-place orders through most of the second quarter of the year. It’s clear that the spread of infection isn’t slowing now as those economies begin to reopen, and that for small and medium-sized businesses – which make up most of the commerce that takes place across the United States – a true recovery is months in the making, but could take longer.

We’ve heard a lot of experts talking about the pattern that a recovery would look like, in both the financial markets, on the broader economic front, and also from a health care perspective, in a graphic format. I think that it is becoming more and more clear that the patterns of all three will be quite different. A return to “normal” from a health care standpoint is a long-term prospect, something that would probably take the shape of an “L” on a chart from the point infections first began to spread. An “L” pattern means that any return to previous conditions is a long-term prospect; information about the progress of vaccine and antiviral developments for COVID-19 bear that out. An economic recovery, on the other hand is likely to look more like a “U”, with a trough in the middle marking the period where the most difficulty occurred. A “U” shaped pattern is something that would take months to develop, which means uncertainty in the broadest sense could continue into next year, but is nonetheless likely to continue rebounding. As states across the country continue to loosen restrictions and resume nearly normal, albeit modified operations, I think a “U” pattern is pretty fitting.

The stock market, on the other hand, seems to have followed its own pattern. The initial shock of the pandemic’s arrival on American shores sent the market soundly into bear market territory in less than a month, before snapping back in almost equally rapid fashion. The S&P 500 rallies just a couple of hundred points shy of its February, all-time high before starting to retrace a bit in the last couple of weeks as uncertainty about a second wave and its potential impact could be settled in; but in the last week the market appears to have begun stabilizing. Does that mean it’s setting up for a new push to test that February peak, or is it just a temporary pause before investors start to take more profits off the table and push the market lower? That’s hard to say right now.

The market’s contradictory story right now is that while investors are anxious to be more and more bullish, and push stock prices to what many consider to be exaggerated multiples, the fundamentals for a lot of companies, including the biggest and strongest names, aren’t really getting better. Evaluating the market right now, in most cases means determining how bad the damage has been and whether a company has the resources to heal itself in time. There are some good stories in that respect, as a lot of management teams have had the foresight to be conservative about how they managed their balance sheets and so appear to be in good position for the inevitable recovery, whenever it does come. Far rarer, however is the case where I find a company whose stock has mirrored the market’s rebound over the last three months and also seen its fundamental strength hold steady, in a pandemic-drive world.

Garmin Ltd (GRMN) is an intriguing example of what I mean. A lot of stocks in the Technology space have performed pretty well during the pandemic, especially those related to stay-at-home work, streaming entertainment, or fitness. GRMN stands above the crowd in terms of fundamental strength. They haven’t been unaffected in the last few months by shutdown conditions; as is the case for most stocks in the last quarter, earnings and revenues both declined significantly. Even so, this is a company, based in Switzerland, with a very impressive balance sheet, with other important fundamental metrics actually showing signs of improvement.

If you’ve bought a GPS device for your vehicle over the last decade and a half, or a wearable fitness tracker, or even a smart watch, then there’s a good chance you’ve heard of GRMN. And while it’s true that the market they cut their teeth, and are most known for – personal navigation devices – is seeing declining demand as smartphones include their own, free GPS-enabled navigation apps and services, this is a company that has been spending a significant portion of its operating budget on research and development, aggressively expanding its portfolio of GPS devices and solutions into a much broader spectrum of applications. In the soon-to-be ubiquitous world of the “Internet of Things,” GRMN seems to be well-positioned to continue to be a major player in their particular market niche. Is the stock a good value at its current price? That’s a little different question. Let’s dive in.

Fundamental and Value Profile

Garmin Ltd. (Garmin) and subsidiaries offer global positioning system (GPS) navigation and wireless devices and applications. The Company operates through five segments. It offers a range of auto navigation products, as well as a range of products and applications designed for the mobile GPS market. It offers products to consumers around the world, including Outdoor Handhelds, Wearable Devices, Golf Devices, and Dog Tracking and Training/Pet Obedience Devices. It offers a range of products designed for use in fitness and activity tracking. Garmin offers a range of products designed for use in fitness and activity tracking. Its aviation business segment is a provider of solutions to aircraft manufacturers, existing aircraft owners and operators, as well as military and government customers and serves a range of aircraft, including transport aircraft, business aviation, general aviation, experimental/light sport, helicopters, optionally piloted vehicles and unmanned aerial vehicles. GRMN’s current market cap is about $18.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings and sales both increased, at about 24.6% in the case of earning, and 11.75% for Revenues. In the last quarter, earnings decreased, at -29.5% while revenues dropped -22.3%. GRMN operates with an impressive margin profile; Net Income versus Revenues over the past year was 25.3%, and narrowed somewhat in the last quarter to 18.8%. That drop in the last quarter is a good indication that the pandemic has had impact on GRMN, as it has with most stocks; but even so, the company’s operating profile remains very healthy.

Free Cash Flow: GRMN’s free cash flow is modest, but healthy, at about $632.93 million. That number has decreased over the last year, from about $711.92 million in June of 2019. It’s current Free Cash Flow number translates to a Free Cash Flow Yield of 3.37%.

Debt to Equity: GRMN has a debt/equity ratio of .01. GRMN also has more than $1.4 billion in cash and liquid assets. versus just $52.8 million in long-term debt. Along with their healthy operating margins, debt is a minor concern. GRMN has plenty of financial flexibility to pay dividends, buy back shares, and keep investing in themselves to continue innovating and finding new markets to expand into.

Dividend: GRMN pays a dividend of $2.44 per share, which translates to an annual yield of 2.5% at the stock’s current price. It is also worth mentioning that while many companies are reducing, or even eliminating their dividend to save cash, GRMN’s dividend has increased, from $2.28 per share one year ago. This is a strong sign of management’s confidence in their approach.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $67.50 per share. That suggests that, despite the company’s fundamental strength, the stock is significantly overvalued right now, with about -31% downside from its current price. It is also noteworthy that the stock’s Book Value – what I like to consider a good barometer of a company’s intrinsic value – has increased in every quarter of the past year, from around $22 to $25.83.

Technical Profile

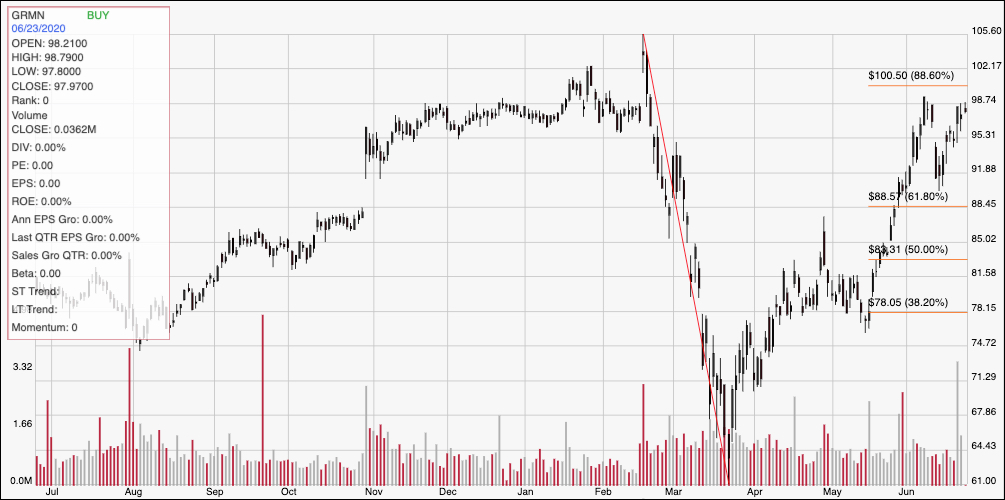

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s downward move from February to March, from a peak at about $105 to its low at around $61 per share. It also provides the basis for the Fibonacci retracement lines shown on the right side of the chart. From that bottom, the stock rebounded strongly into the beginning of May before consolidating a bit between $81 and $78. The upward trend picked up a lot of momentum in mid-May, pushing past the 38.2%, 50% and 61.8% retracement line before peaking earlier this month at almost $99 per share. Renewed pandemic concerns forced the stock to retrace a bit, where it found support at around $92 before rebounding again. It is now very close to that previous high, and just a couple of dollars below the 88.6% retracement line. I have resistance at $100.50, with immediate support back around $95 based on pivot activity in late 2019, with next support between $88 and $90. A push above $100.50 could see the stock rally to its February high at around $105.

Near-term Keys: Given the fact the stock is significantly overvalued, I don’t think it’s practical to consider GRMN as any kind of good value right now. In the long-term, there is more risk than reward for this stock, but its fundamental profile does mean that it is worth keeping in a watchlist and paying attention. If the stock follows through on the bullish momentum it has built, and pushes above $100.50, there could be a good short-term bullish trading opportunity, either by buying the stock or working with call options, using $105 as a top-end target price. If, on the other hand, the stock breaks down, and drops below $95, consider shorting the stock or buying put options, with an eye on $90 as the target for closing that bearish trade.