As an analyst, I take a lot of interest in trying to find reasons the market stages some of the moves it makes. The factors, geopolitical, economic, or emotional, that drives trends over any time period can be widely varied, and sometimes it’s interesting to see not only what is influencing the market today, but also to look back and, with the advantage of hindsight, being able to evaluate whether a certain condition or element played a role in driving the market to the point it is at today.

Among the various macroeconomic factors I try to pay attention to is the ebb and flow of oil prices. I think oil is one of the most interesting commodities of all; no matter whether you drive a gas-guzzler, an electric vehicle or a hybrid, the truth is that oil is a factor in every sector of the market, with tentacles that reach into economic policy and most certainly into geopolitics.

Sometimes oil is a leading indicator for other economic data, and sometimes it is simply forced to go with the flow. At the beginning of this year, both West Texas Intermediate (WTI) and Brent crude prices started to move sharply lower from last year’s highs as Saudi Arabia engaged in a brief, but sharp price war with Russia. That effect drove WTI crude from a peak at around $65 to around $45 barrel, where it appeared to begin stabilizing in February. That had started to put investors a little on edge, especially as it related to oil stocks, but of course that was just the beginning of the story. The global COVID-19 pandemic shut down economies and brought all types of activity to a standstill beginning in February. The effect for oil was to crater demand and turn oil’s correction into a free fall. WTI didn’t stop dropping until May, hitting a support low below $15 per barrel. From that point, crude followed the path of the rest of the market; the resumption of business and other economic activities as governments have relaxed restrictions and begun to allow economic activity to resume. As of this writing, WTI is a little below $40 per barrel and appears to be stabilizing for the time being in the mid-to-upper $30 per barrel range.

The impact on energy-related stocks throughout the market over the time period I just described, of course, has been dramatic and decisive, with revenue plunging and Net Income in most cases turning to negative territory in the last quarter. With demand gradually increasing, there are a couple of questions to consider: whether the initial pandemic impact will have an extended economic impact (very possible), and who are the companies who have the strength in their balance sheets to weather that impact and still be able to operate efficiently. Those are the companies that I think make the most sense to think about in the energy sector for long-term growth potential. I also think that this is a good time to start watching the oil supermajors, the handful of global oil stocks that make up the largest players in the energy sector.

ConocoPhillips (COP) is a supermajor that saw its prices plunge from a January peak around $67 to a March low around $21 before it began to rebound, increasing to around $46 per share by mid-May and settling from that point into a consolidation pattern between support at around $42 and resistance a little below $46. Forecasts suggest that Brent oil, which is the primary supply source for COP’s business, should stabilize around $38 per barrel through the rest of the year, with demand in 2021 pushing it to around $50 per barrel. If that is the case, COP’s already strong balance sheet should improve even further, mitigating the immediate effect of this year’s bear market, recessive downturn and offering an opportunity to work with a stock that still remains significantly undervalued and below its 52-week high. Let’s run the numbers so you can decide for yourself if you agree with my analysis.

Fundamental and Value Profile

ConocoPhillips is an independent exploration and production company. The Company explores for, produces, transports and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG) and natural gas liquids. The Company operates through five segments: Alaska, Lower 48, Canada, Europe and North Africa, Asia Pacific and Middle East, and Other International. The Alaska segment explores for, produces, transports and markets crude oil, natural gas liquids, natural gas and LNG. The Lower 48 segment consists of operations located in the United States Lower 48 states and the Gulf of Mexico. Its Canadian operations consists of oil sands developments in the Athabasca Region of northeastern Alberta. The Europe and North Africa segment consists of operations and exploration activities in Norway, the United Kingdom and Libya. The Asia Pacific and Middle East segment has exploration and production operations in China, Indonesia, Malaysia and Australia. COP’s current market cap is $46.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined -55%, while sales shrank -52%. In the last quarter, earnings declined by almost -41%, while sales also declined by -41%. COP’s margin profile, which has historically been impressive, has been under pressure amid the pandemic-induced downturn, with Net Income over the last twelve months that was 11.5% of Revenues, and turned sharply negative, to -37.7% in the last quarter.

Free Cash Flow: COP’s free cash flow is healthy, at more than $7.06 billion for the trailing twelve month period and which translates to a Free Cash Flow yield of 15.17%. I think another sign of strength in COP’s case is that, even amid the pricing pressures that have persisted throughout 2020, Free Cash Flow is only somewhat lower from its 2019 peak last September at around $8.85 billion.

Debt to Equity: COP has a debt/equity ratio of .47, a relatively low number that indicates the company operates with a conservative philosophy about leverage. They reported about $8.2 billion in cash and liquid assets in the last quarter against $14.8 billion in long-term debt. While negative Net Income is a concern, since it will erode liquidity the longer it persists, COP’s balance sheet is more than adequate to service the debt they have.

Dividend: COP pays an annual dividend of $1.68 per share, which translates to a yield of 3.83% at the stock’s current price. It is also noteworthy that in the last year, COP increased their dividend from around $1.22 per share, and have also reiterated their commitment to maintaining the dividend.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $64.50 per share – just a little below the stock’s 52-week high. That suggests that, the stock is significantly undervalued right now, with about 50% upside from its current price.

Technical Profile

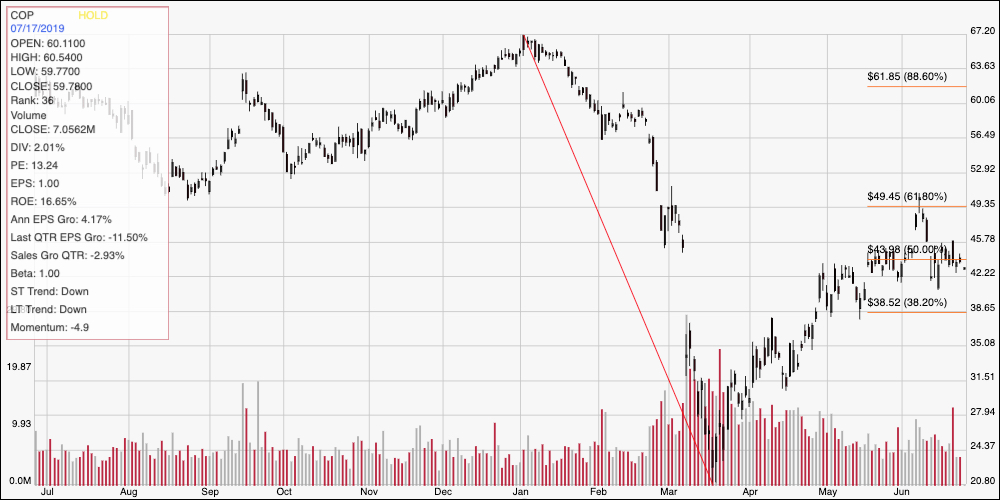

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s slide from January to March of this year; it also informs the Fibonacci retracement lines shown on the right side of the chart. From its bear market low, the stock rebounded to a peak in May at around $45, right around the 50% retracement line, and since then has settled into a fairly narrow trading range with resistance a little above $45 and support around $42. A push above $46 should give the stock momentum to revisit an early June peak around the 61.8% retracement line a little above $49, with even more upside beyond that point if bullish momentum remains strong. A drop below $42 could see the stock fall to the 38.2% retracement line, around $38.50 before finding new support, with additional downside to between $32 and $35 if bearish momentum accelerates.

Near-term Keys: While COP’s value proposition is intriguing, and is even sitting at compelling levels, I am concerned about the company’s declining Net Income status. I think the value proposition is easier to buy if and when Net Income shows signs of stabilizing; that would be a good indication that demand for crude oil is improving again, and that the financial difficulties the pandemic has imposed on COP are likely behind it. That means that the best probabilities for now lie in using the stock for shorter-term, momentum-based trades. A break above $46 would be a good signal to consider buying the stock or working with call options, using the stock’s peak earlier this month between $49 and $50 as an early profit target. A push below $42, on the other hand would offer a good opportunity to consider shorting the stock or buying put options, with an initial price target on a bearish trade at around $38.50.