Ever since the coronavirus pandemic reached North American shores, investors have keyed on the virus more than any other issue in driving market direction. Nationwide shutdown and self-isolation orders brought the U.S. economy to a grinding halt in late February and forced the market to visit bear market lows by mid-March. Hopes that the worst had passed, and the lifting of many of those restrictions to restart the economy nationwide got investors going again, pushing the major indices near to their pre-pandemic highs; the NASDAQ 100 even found a new all-time high earlier this month. A restarting economy should be a good thing, meaning that a return to normal should be seen sooner or later – or at least many people seem to have thought.

The last couple of weeks have challenged that simple idea, and the market has gotten a little frothier over that time as more and more data has come in showing that the virus is definitely NOT contained; in fact, in many states (Texas and Florida are the most attention-grabbing ones right now), governors have paused reopening plans and have even been forced to reinstitute some restrictions as the number of infections have not only increased, but are clearly spiking in many states.

A second wave of infections could be a big problem, not only because of the danger of reimposed restrictions on business and social activity. In some of the most challenged hotspots of the country, indications are already showing that healthcare systems – and the companies that support them – are being stretched to the limit of their capacity as things stand now. The likelihood of a vaccine, or even a productive antiviral, is still a 2021 or possibly even 2022 eventuality, which means that medical researchers and professionals have to find other, creative methods to treat and deal with the pandemic. The remarkable part of that story is that while infections are increasing, mortality rates generally are not, which I believe is attributable to the skill and innovative methods that have been found so far. Even so, if infection rates can’t be contained, it is only reasonable to anticipate that the health crisis will only become more critical in the months ahead, and continue to put significant pressure on just about every sector of the economy along the way.

The Medical Specialities industry of the health care sector include medical equipment manufacturers and suppliers, who are generally considered to be pretty safe, defensive-oriented investments to think about making when economic conditions are difficult. The current picture paints a different story, however, because many of these companies, like Medtronic PLC (MDT), have put launch plans for new, innovative and useful devices for a variety of treatments methods on hold in order to focus on items like ventilators, which the health care system has found in short supply ever since the beginning of the year. That has also meant that in order to help address the health crisis, these companies have invested heavily to adjust production capabilities to ramp up production in those narrowly focused areas at the exclusion of other, more profitable products. MDT’s balance sheet was very strong before the pandemic began, and appears to have absorbed the initial impact relatively well. in the very long term, the stock could represent an interesting opportunity for a very patient investor; but does the fact that the stock has dropped about -12% from a high in June around $103 mean that it is also a good value right now?

Fundamental and Value Profile

Medtronic Public Limited Company (Medtronic) is a medical technology and services company. The Company develops, manufactures and markets its medical devices and technologies to hospitals, physicians, clinicians and patients in approximately 160 countries. The Company operates in four segments: Cardiac and Vascular Group, Minimally Invasive Technologies Group, Restorative Therapies Group and Diabetes Group. The Cardiac and Vascular Group segment includes Cardiac Rhythm & Heart Failure, Coronary & Structural Heart and Aortic & Peripheral Vascula. Its Minimally Invasive Technologies Group segment includes Surgical Solutions and Patient Monitoring and Recovery. Its Restorative Therapies Group segment includes Spine, Neuromodulation, Surgical Technologies and Neurovascular. Its Diabetes Group segment includes Intensive Insulin Management, Non-Intensive Diabetes Therapies and Diabetes Services & Solutions. The Company’s subsidiaries include Medtronic, Inc. and HeartWare International, Inc. MDT has a current market cap of about $118.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -62.34%, while revenues dropped by -26.4%. In the last quarter, earnings were almost -60% lower, and revenues declined by -22,3%. MDT is a company that operates with a healthy margin profile that has been challenged in the last quarter by coronavirus headwinds; in the last twelve months, Net Income was 16.56% of Revenues, but dropped to 10.77% in the last quarter. Most analysts expect declines in

Debit/Equity: MDT’s debt to equity ratio is .43, which is conservative. Their balance sheet shows $10.9 billion in cash and liquid assets (down a bit from earlier in the year, when this number was $11.6 billion), with $22 billion in long-term debt (this number is also lower, from $24.7 billion). Their operating profile is a strong indication that servicing their debt is no problem, even with current decrease in margins from their declining Net Income pattern.

Free Cash Flow: MDT’s free cash flow is $6.02 billion over the last year. This number has increased steadily from around $3.6 billion in April of 2018, but did decline somewhat from the beginning of the year at $6.64 billion, and translates to a current Free Cash Flow yield of 5.06%.

Dividend: MDT’s annual divided is $2.32 (increased in the last quarter from $2.16) per share and translates to a yield of 2.61% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $98 per share, which means that MDT is modestly undervalued, with about 9% upside from its current price. That is unfortunately not quite enough of a discount to mark the stock as a useful value right now.

Technical Profile

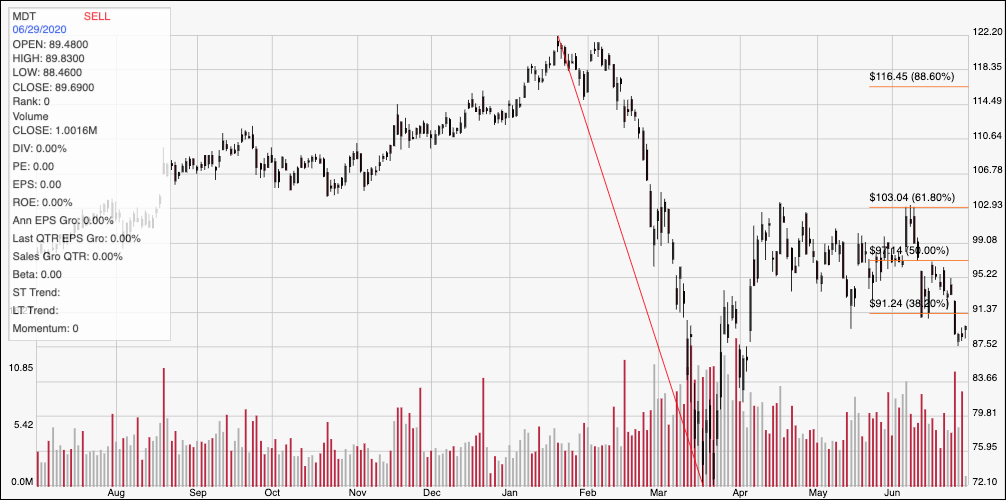

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s recent drop from a January high around $122 to its low in mid-March at around $72. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. MDT rebounded strongly in late March and early April, hitting a peak at around $103 that has since marked the stock’s highest point during the pandemic. Until earlier this month, the stock has been holding in a narrow range between $103 on the top end and $95 on the low end, but in mid-month dropped below that range. Last week the stock marked the beginning of new, short-term downward trend, pushing below support at around $91 where the 38.2% Fibonacci retracement line rests, making that level new resistance, with immediate support at last week’s low point around $87.50. A drop below $87.50 could see the stock fall further, to somewhere between $79 and $83 in the near term, while a push above resistance at $91 could give the stock room to rally to next resistance between $95 and $97, where the 50% retracement line can be seen.

Near-term Keys: While I think MDT has borne the weight of the near-term impact inflicted by coronavirus, not only in the U.S. but also throughout the world, I also can’t say the stock is a good buy right now, from either a value-based perspective or in terms of current momentum. I think the best opportunities to work with MDT lie in short-term trades, with bearish trades offer the best probabilities right now. Treat a drop below $87.50 as an opportunity to short the stock, with a near-term eye on $83 as a quick profit target and $79 possible if bearish momentum remains steady. If the stock pushes above $91, and you don’t mind being aggressive, you can also consider buying the stock or working with call options, using $95 to $97 as good profit target for a bullish trade.