If you’re like me, you’re undoubtedly getting tired of the seemingly endless discussion and examination of COVID-19. Latest infection numbers, speculation about vaccine development progress, whether governments will reimpose restrictions or mandate common sense measures like wearing masks in public – let’s face it, it gets tiresome to be confronted with what appears to be the same information, all day, every day. I think there is a real sense of exhaustion about the pandemic that is contributing to a number of factors in the United States – including, to some degree, the market’s seeming resilience and resistance over the last couple of weeks to any kind of continued negative news related to the virus.

The holiday weekend had the medical community and health care experts on edge, fearing an even higher increase in infections that could stress a healthcare system that, in some parts of the country, isn’t far from being overwhelmed. Even so, I wasn’t surprised to drive around town in my little corner of the world and see people clustered together, without masks and without apparent regard for social distancing at Little League baseball games or in parks and streets lighting fireworks. There is a clear desire to see life get back to some kind of normal that I think is being reflected not only in social attitudes right now but also in investor sentiment, where positive, bullish news is justifying possible overinflation of stock prices, while negative, potentially bearish news is either ignored or minimized.

The contrarian in me really starts to twitch when markets start to blithely shrug off news or information that runs directly counter to broad sentiment. My experience in the market starts to recall the late 1990’s, when the “dot-com boom” went bust, or the 2007-2008 period when the financial crisis spurred the beginning of what historians now like to call The Great Recession. In both cases, the “irrational exuberance” exhibited by investors at large left a lot of people hanging in the wrong kinds of investments at exactly the wrong time.

At the same time, accommodative monetary policy makes it hard right now to justify repositioning portfolios out of the stock market. With short-term interest rates just above zero, the 10-year Treasury bond below 1%, and no expectation that the bond buying program the Fed has been following since the beginning of the pandemic to keep liquidity strong in the financial system is going to end in the foreseeable future, the only place right now to really put your money to work for you in a constructive way is in the stock market. That could mean the market will simply continue to rally as some economists expect; but I think there is also a risk of continued volatility through the end of the year that could make it hard for average investors to withstand the swings from high to low in a lot of the “popular” stocks and industries that get the most attention.

If you need to keep your money working for you, but you’re also looking for a way to minimize broader market risk, it might make sense to think about the sectors and industries that are likely to remain stable, or possibly continue to grow, even if economic conditions remain stressed or turn even worse. An example of what I mean is the healthcare industry, and the businesses that support it. Demand for basic supplies to keep hospitals running is going to remain high as infections and hospitalizations remain high, and that means that many of the businesses that produce and deliver those supplies are going to stay busy.

If you’ve spent time at a hospital, you probably haven’t taken time to notice the boxes of surgical gloves, protective masks, bottles of hand sanitizer and more. This is actually something has marked a stress point in the medical system since the beginning of pademic in the United States; as the number of infections increases, the number of people needing to be hospitalized will naturally also increase. Consider also that while COVID-19 is dominating the discussion right now, it is not the only malady that the health care system is forced to deal with on a daily basis. Many elective procedures are being shelved or delayed by hospitals and medical professionals to provide capacity for treatment of COVID patients; but there are other ailments and treatments that simply cannot be ignored. That means that there is still a normal level of daily activity that hospitals and clinics have to deal with; coronavirus is an element that not only adds complexity, but also puts pressure on the businesses that produce them to meet the increasing demand.

One of those companies is 3M (MMM). 3M is a conglomerate that works in a number of segments of the economy. One of those is Health Care. The market’s shift to stocks that supply the health care industry has put their operations in greater focus over the last few months, and has helped the stock rebound from its own bear market low in March around $114 to an intermediate-term high in June at nearly $170. The stock dropped lower from that point into the last week of June, but has rebounded in the last several days to its current level around $159. While a number of its operations have been challenged in industrial and consumer end market segments, COVID-19 has provided headwinds to other aspects that have helped offset those declines and keep its balance sheet healthy. For example, the company has been working to quadruple its production of N95 respirators during the crisis, which has helped the health care segment contribute 25% of the company’s revenue in the last quarter (in 2007, health care was 16% of its business). In addition, demand for related protective equipment made by the Safety segment (masks) have provided a useful, secondary offset. Does the stability of those segments provide enough of a basis to make the stock a good value? Maybe, maybe not; but if you’re looking for a place to park your money that could provide a measure of safety against broader market risk, MMM might be a smart stock to watch right now.

Fundamental and Value Profile

3M Company is a technology company. It operates through five segments. The Industrial segment serves a range of markets, such as automotive original equipment manufacturer and automotive aftermarket, appliance, paper and printing, packaging, food and beverage and construction. The Safety and Graphics segment serves a range of markets for the safety, security and productivity of people, facilities and systems. The Health Care segment serves markets that include medical clinics and hospitals, pharmaceuticals, health information systems and food manufacturing and testing. The Consumer segment serves markets that include consumer retail, office business to business, home improvement, drug and pharmacy retail, and other markets. MMM has a current market cap of $90.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined -3.4% while sales increased 2.7%. In the last quarter, with earnings grew 10.77% while sales were flat, but slightly negative at -0.44%. The company operates with an impressive margin profile, with Net Income running at 15.92% of Revenues over the last twelve months and improved somewhat in the last quarter at 16%.

Free Cash Flow: MMM has healthy free cash flow of $5.7 billion over the last twelve months (an improvement from $5.5 billion in the quarter prior). This number equates to a Free Cash Flow Yield of a little over 6.34%.

Debt to Equity: MMM has a debt/equity ratio of 1.94, which is high and implies the company is highly leveraged. As of the last quarter, the company had $4.47 in cash and liquid assets (an increase from $2.5 billion in the last quarter), versus $19.5 billion in long-term debt. Their healthy operating margins, along with their solid cash position suggests, however that servicing their debt is not a concern, and despite their high leverage, the company maintains a healthy level of liquidity.

Dividend: over the last year, MMM has paid an annual dividend of $5.88 per share, which at its current price translates to a yield of about 3.74%. MMM has a long history of maintaining, and growing its dividend, which is useful and constructive right now since bond yields aren’t likely to rise above 1% anytime soon.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $179 per share. That mean that MMM is somewhat undervalued, with about 13% upside from its current price. It is also worth mentioning that in March, my fair value target for MMM was around $173 per share.

Technical Profile

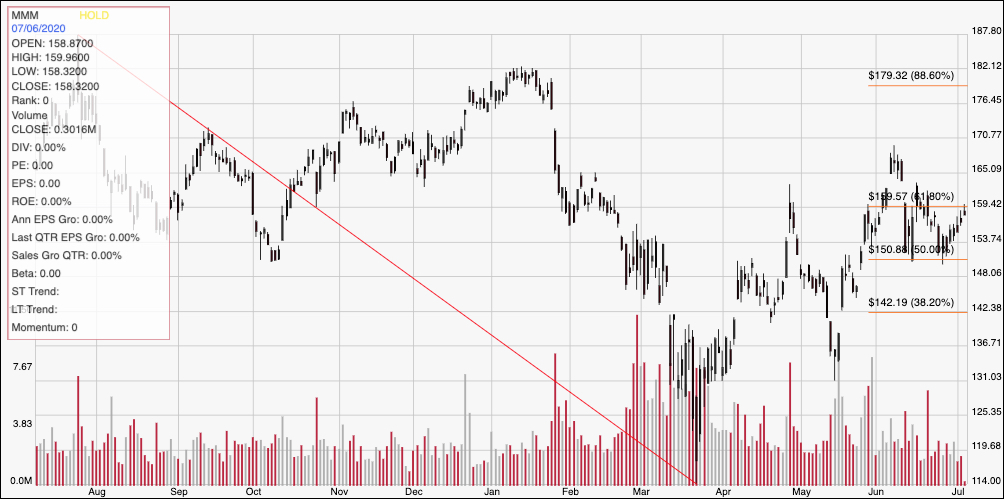

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the last year. The red diagonal line traces the stock’s downward trend to mid-March and provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. In early June, the stock pushed above the 61.8% retracement line and appeared to be building strong bullish momentum to keep driving above its peak at around $170, but instead reversed back to the 50% retracement to find support at around $151. The stock is now just a little below the 61.8% line, putting resistance right around $160. A break above that level should provide momentum to at least test the June high around $170, with additional upside to around $176 or possibly $179, where the 88.6% retracement line sits if bullish momentum remains strong. A drop back below $150 could see the stock fall back to around $142 where the 38.2% retracement line rests, with additional downside in the $133 range if bearish momentum accelerates.

Near-term Keys: Given the MMM’s fundamental strength and favorable, defensive positioning, it’s not hard to see the stock as a good long-term opportunity – even if the value proposition is a little shy of compelling. If you prefer to work with short-term investments, use a push above $160 as a signal to consider buying the stock or working with call options with a profit target around $170, and a drop below $150 to think about shorting the stock or working with put options, using $142 as a bearish target.