The analysis I apply to the stocks that I write about in this space reflects my preference for value-oriented investing strategies. That’s because, even though value investing falls in and out of favor with popular market news media types and talking heads depending on the shifting winds of change at any given time, I think value analysis provides the best way to find stocks that you can work with in any market or economic environment.

It seems a bit incongruous, but the truth is that value investing is actually counter-intuitive to the mindset that most investors take to the market. I say incongruous because, at its most basic start, the principle of value investing fits well with rule #1 of investing in the stock market – buy low, sell high – but if you listen to talking heads and analysts, stocks that actually are available at significant discounts to historical prices generally get dismissed, while stocks trading at or near all-time highs get pumped even more, with predictions that the prices will continue to move higher – often just because they already have.

Value investing becomes counter-intuitive because investors become conditioned to accept – which is, honestly, often correct – that stocks tend to follow their longer trends. That’s a big reason why, when a stock has been going up, the general expectation is that it will continue to go up. Value investing, however, also understands that all trends are finite, which means that eventually, all trends reverse in the opposite direction. That means that long, upward trends inevitably will fall into a downward pattern, just as extended downward trends eventually, always will find a bottom and move higher. That is where value analysis begins; if a stock is already trading at a significant discount to its historical highs, the chances increase that when the downward movement reverses, the stock won’t just be cheap compared to previous price activity, but also in comparison to the underlying value of the business itself.

The caveat, of course, is that sometimes a cheap stock is just a cheap stock, having been beat down because there are serious problems in the company’s business that need to be corrected. That’s why effective value analysis also doesn’t simply take a historical price discount at face value – it also folds a thorough review of the company’s fundamental strength or weakness into the picture to determine if there is a basis to say the stock should be higher than it is right now. This second component is the reason that I think value analysis is so effective at finding useful opportunities in any market condition, because it gives me the ability to compare the stock’s current price, no matter whether the current price trend is up or down, against the company’s book of business. If the value proposition is in place, then there is an opportunity to work with the stock that, in the long run, should provide healthy profits that I may miss if I simply try to chase the latest growth stocks in an effort to keep up with the market. It also means that when the market turns seriously bearish, I should be able to avoid being on the sharp end of that downturn.

In that vein, let’s turn our attention to today’s highlight. ConAgra Brands Inc. (CAG) is a stock that I’ve followed some time, and make sure to run a fresh analysis on every few months. While most market media WAGs and talking heads tend to dismiss Food stocks because they’re “boring,” I think that they are especially useful under current market conditions. The initial, downward economic push from the COVID-19 pandemic sent a lot of families rushing to the grocery store to stock up on food items they could pack away in the pantry or the freezer so they could get through shelter-in-place and self-isolation orders across the country. While there is concern that increasing infections rates could force a re-imposition of some of those measures, I generally believe that the sales boom that a lot of the stocks in the Food Products industry enjoyed during the last quarter has begun to abate; however, there is also quite a bit of data indicating some stickiness to demand for these products, as parents raising young families have found that the value offered by many of the brands that saw surprising sales increases is useful for an economy that remains troubled by high unemployment and on uncertain footing as long as the pandemic continues.

The last quarter’s struggles meant that while many companies in other sectors were seeing serious sales declines, while stocks in the Food Products industry, including CAG enjoyed significant boosts in sales and earnings. For CAG, that has translated to material gains in critical measurements like free cash flow, liquidity, and Book Value. At the early stage of the pandemic, my analysis put a “fair value” target for the stock at around $38.50 per share; but a few months later, and a new set of financial numbers from the latest earnings report to work with have actually given me a reason to lift that number – which is unexpected, even in this industry, under broadly uncertain economic conditions. That means that if you’re looking for a smart place to put your money to work for you, CAG might be a good stock to focus on.

Fundamental and Value Profile

Conagra Brands, Inc., formerly ConAgra Foods, Inc., operates as a packaged food company. The Company operates through two segments: Consumer Foods and Commercial Foods. The Company sells branded and customized food products, as well as commercially branded foods. It also supplies vegetable, spice and grain products to a range of restaurants, foodservice operators and commercial customers. Conagra Foodservice offers products to restaurants, retailers, commercial customers and other foodservice suppliers. The Company also operates in the countries outside the United States, such as Canada and Mexico. The Company’s brands include Marie Callender’s, Healthy Choice, Slim Jim, Hebrew National, Orville Redenbacher’s, Peter Pan, Reddi-wip, PAM, Snack Pack, Banquet, Chef Boyardee, Egg Beaters, Rosarita, Fleischmann’s and Hunt’s. The Company sells its products in grocery, convenience, mass merchandise and club stores. CAG’s current market cap is $17.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased about 108%, while Revenues rose by nearly 26%. In the last quarter, earnings rose by nearly 60%, while Revenues were about 29% higher. The company’s margin profile over the last twelve months is healthy, with Net Income at 7.6% of Revenues over the past twelve months, and moderating somewhat in the last quarter to 6.13%.

Free Cash Flow: CAG’s free cash flow is healthy, and strengthening at $1.4 billion. That marked an increase from $905.9 million in the quarter prior, and $575.6 million at the beginning of 2019, and translates to a useful Free Cash Flow Yield of about 8.68%.

Debt to Equity: CAG has a debt/equity ratio of 1.12. That number declined from 1.58 at the beginning of 2019, but the number remains high, a reflection of the reality that the company’s liquidity remains a concern, even as it improves. In the last quarter Cash and liquid assets were $553 million (a significant increase from $99 million in the quarter prior) versus $8.9 billion in long-term debt. Most of that debt is attributable to CAG’s acquisition of Pinnacle Foods in the last quarter of 2018. The complexities associated with the transition of the two companies into one is part of the reason the stock struggled into the early part of 2019, but reports in the last two quarters indicate that the synergies the company has worked to achieve have been working. In the last year, long-term debt declined by a little over $2 billion, which is a positive, and is highlighted by a reduction in long-term debt in the last quarter of about $750 million.

Dividend: CAG pays an annual dividend of $.85 per share, which translates to an annual yield that of about 2.73% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $47.5 per share. That means the stock is undervalued, with about 33% upside from its current price.

Technical Profile

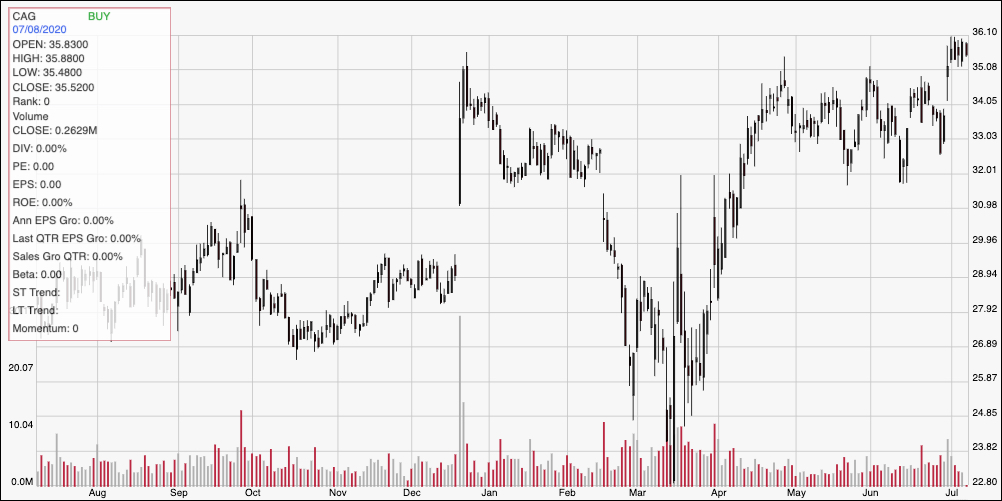

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above marks the stock’s price activity over the last year. The V-shaped pattern of the stock’s drop from the beginning of the year, followed by its rapid rise in April is obvious. Since that time, the stock has mostly hovered between $35 and $32, but broke out in the last week and has begun to set a new, narrow consolidation range, with support at around $35 and resistance a little above $36 – which also marks the stock’s 52-week high. A drop below support at $35 could see the stock drop back to new support between $33 and $32, with additional downside around $29 if bearish momentum increases. Given the current state of the stock’s longer trend, however the stock does appear to be positioned to keep moving higher if bullish sentiment persists. A push to about $36.50 should give the stock room to move higher; if we use the $4 distance between the stock June support low around $32 and its recent resistance break at $35, that would put a short-term, momentum-based target at around $39 per share.

Near-term Keys: From a fundamental standpoint, CAG’s profile is very attractive, and its value proposition is even more interesting than it was a quarter ago. I think that demand for packaged food products such as what CAG offers is going to remain consistent, and that I believe that means CAG will continue to stand out in the stock market through the year. If you prefer to work with short-term strategies, use a break above resistance at $36 as an interesting signal to consider buying the stock or buying a call option with an eye on $39 to $40 as an exit target. A drop below $35, on the other hand could act as a signal to consider shorting the stock or working with put options, using $32 as a quick exit target on a bearish trade.