Being a value-oriented investor means that the general mindset around a stock’s historical trading ranges is a bit different than what most investors, who tend to focus primarily on growth, tend to pay attention to. Value means looking for stocks trading at a nice price, and that usually means that stocks trading at or near historical lows often offer the shortest path to finding good bargain opportunities. Growth investors, on the other hand, tend to focus on stocks that have clear upward trends – and that includes stocks that are near their all-time highs. In fact, stocks that have recently pushed to new highs are stocks these kinds of investors will usually buy into enthusiastically.

2020 has been an interesting year to contrast between value and growth-oriented investing strategies. The early onset of the COVID-19 pandemic pushed the market to bear market lows, with stocks in practically every industry – including those in defensive-oriented segments like Food Products – down to multiyear lows as well. It wasn’t too surprising to me to start see analysts and talking heads on news media start talking about shifting strategies to value-based stocks; in my experience, they tend to look for the thread that is going to keep viewer’s generally very short attention span (mine included) focused on the TV screen. That’s why, when the market is going up, they focus on growth stocks, and why when it’s going down, a value-oriented discussion is easier; both have a way of appealing to the public’s desire to focus on good short-term information first.

The bear market low came very quickly; faster, in fact, than I have would have expected and faster than I have seen any bear market come in my professional career, spanning more than 25 years in the market. As businesses started to reopen, and social isolation restrictions began to be lifted, it also can’t be said that it has been all that surprising to see investors take a sense of optimism and price it back into a stock market that had plummeted to extreme lows so quickly. As quickly as the talking heads had started talking about value, they’ve started shifting back again to growth. The interesting part is that, while many stocks have followed the broad indices to or near new highs, most of that is relegated to industries that were already well-positioned for the forced consumer and business shift to e-commerce and remote work.

In the meantime, there are lots of stocks that, while enjoying a bump in price over the last few months after hitting their own bear market lows, are still significantly below their respective, pre-pandemic highs. That actually means that while many “experts” are starting to say that value investing is no longer as relevant, the truth is that there are still some really interesting value opportunities to be had. And while a lot of investors don’t get too excited about the Consumer Staples sector, or the Food Products industry because that’s a part of the economy that is just “boring,” the truth is that this is an area that smart investors are going to keep on their radar – especially if, as many economists expect, the economy remains challenged through the rest of the year by ongoing pandemic concerns that are already starting to force some states to pause reopening efforts and in a few cases even re-impose some restrictions.

Mondelez International Inc. (MDLZ) is an interesting case study. This is a snack company that produces familiar brands like Nabisco, Oreo, Cadbury and Toblerone. These aren’t brands that you’d automatically associate with “healthy” eating, but the truth is that demand for convenient snacks is just one reason that this company’s bottom line has remained strong, and even seen some improvement during the pandemic. Despite increasing in value a little under 20% from its bear market low around $41, however the stock is still well below its pre-pandemic high around $60. This is also a stock that I analyzed at the beginning of the year and determined, because of its price performance to that point, didn’t offer a compelling value. Running the numbers now, a couple of quarters later, however prompts me to change my tune. This is another stock in the Food Products industry that I think bears watching.

Fundamental and Value Profile

Mondelez International, Inc. is a snack company. The Company manufactures and markets snack food and beverage products for consumers. It operates through four segments: Latin America, Asia, Middle East, and Africa (AMEA), Europe and North America. As of December 31, 2016, its brands spanned five product categories: Biscuits (including cookies, crackers and salted snacks); Chocolate; Gum and candy; Beverages (including coffee and powdered beverages), and Cheese and grocery. Itsportfolio includes various snack brands, including Nabisco, Oreo, LU and belVita biscuits; Cadbury, Milka, Cadbury Dairy Milk and Toblerone chocolate; Trident gum; Halls candy, and Tang powdered beverages. The Company sells its products to supermarket chains, wholesalers, supercenters, club stores, mass merchandisers, distributors, convenience stores, gasoline stations, drug stores, value stores and retail food outlets. As of December 31, 2016, it sold its products to consumers in approximately 165 countries. MDLZ’s current market cap is $72.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased 6.15%, while sales were flat but rose by 2.58%. In the last quarter, earnings increased 13.11%, while sales dropped almost -3%. MDLZ operates with a better margin profile than most Food stocks; over the last twelve months, Net Income was 14.25% of Revenues, and narrowed somewhat in the last quarter to about 11.23%.

Free Cash Flow: MDLZ’s free cash flow is healthy but modest, at $3.1 billion for the trailing twelve month period; that translates to a Free Cash Flow yield of about 4.25%. The interesting part of the story is that in the last quarter, while most companies were seeing this measurement drop, Free Cash Flow for MDLZ has remained stable, and even increased modestly.

Debt to Equity: MDLZ has a debt/equity ratio of .54, a relatively low number that looks good, but is also misleading. MDLZ’ balance sheet shows a little over $1.9 billion in cash and liquid assets (an increase from $1.3 billion at the beginning of the year) against $13.7 billion in long-term debt (versus about $14.5 billion in January 2020). High leverage isn’t uncommon in the Food industry, and the company’s operating margins indicate servicing their debt isn’t a problem; but the fact is that liquidity is limited, and could be a concern moving forward.

Dividend: MDLZ pays an annual dividend of $1.14 per share, which translates to a yield of 2.27% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $63.50 per share. That means the stock is trading at an interesting, and very useful discount, with about 26% upside from the stock’s current price.

Technical Profile

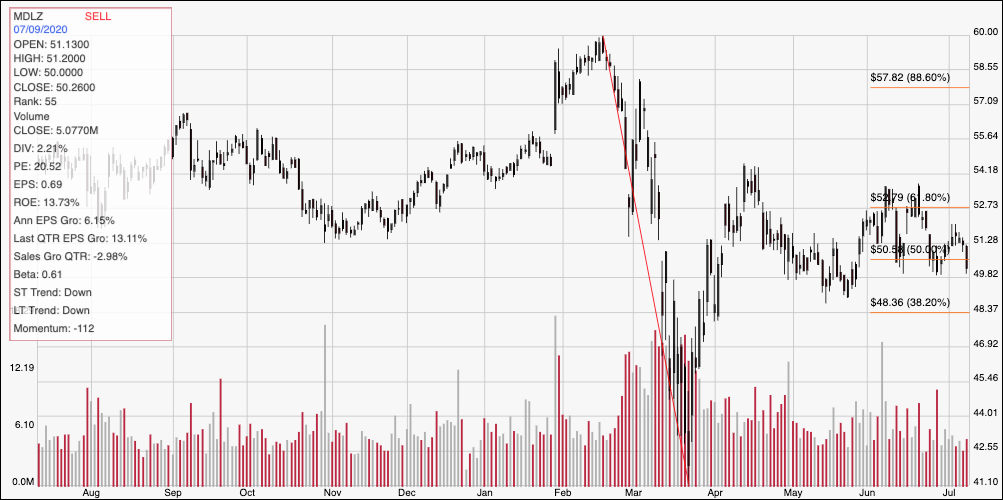

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s upward trend over the past year. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock rebounded quickly from a bear market low around $41 to find a short-term high around $54 before retracing back into late May. From that point, the stock has been consolidating, with support around $50 and resistance just a few dollars higher at around $53. A break above $53 should give the stock room to rally to somewhere between $58 and $60, where its pre-pandemic high sits, while a push below $50 could see the stock fall to at least $48 where the 38.2% retracement line sits, or possibly back to test the stock’s bear market low around $41 if bearish momentum increases.

Near-term Keys: MDLZ’s consolidation range makes it hard to say whether you should be considering a particular type of short-term trading strategy with this stock; but there could some interesting signals to act if and when the stock breaks out of that range. You could use a drop below $50 as a signal to consider shorting the stock or buying put options, using a drop to about $48 as a quick profit target, or possibly hold out to see if the stock tests its March low around $41. A push above $53 could be a good signal to think about buying the stock or working with call options, with an eye on $58 as a useful target on a bullish trade. I actually think the smarter approach with MDLZ is on the value side, since the stock’s bargain argument is already very interesting, and the fact is that the company fits nicely into what I think makes sense as a defensive-oriented investment given current economic pressures and broad concerns that I don’t think are going to go away quickly.