The market seems intent on keying off of encouraging news on the vaccine front, using it as the primary reason to keep pushing the market higher this week. It’s tempting to think that a fast-tracked vaccine is good news across the board, and so you should be “all in” on the market. I think that is still a risky mindset to take. Let’s not forget that even if the latest data about the vaccine candidates that are making news with encouraging trial results holds in broader-based trials and leads to faster-than-normal approval, the earliest we expect to see broad-based distribution of a vaccine is early 2021 by even the most optimistic estimates.

In the meantime, there are plenty of other questions about other economic elements that should be cause for concern. The real effect of lapsing, federally-funded PPP money and extended unemployment benefits this month remains to be seen, but should naturally expect to be taken as a headwind for consumer strength and confidence.

I think there is enough reason to be concerned about whether the economy will continue to strengthen from the recessionary levels the pandemic forced it to retreat to, or possibly slip back that it is still smart to think about defensive options. That’s why I think that some of the smartest areas of the economy to focus on are going to be the same segments I’ve been focusing pretty heavily on since late last year. That means sectors that have proven to remain stable, or even resistant to economic downturns. Consumer Staples have been one of the best places to put your money in the last couple of months, and I think that is going to continue to be the case.

Archer Daniels Midland (ADM) is one of the biggest food processing companies in the U.S. The stock has been struggling for most of the last two years; pressures include tariffs from the U.S. – China trade war that started in 2018 and lasted until late last year, along with competition in an already crowded market space that got even more so when Amazon bought Whole Foods. As a result, the stock fell from a peak in October 2018 around $52 to a low in late March at around $29 – a drop of not quite -50%. From that point, the stock rebounded to a peak around $43 in early June. The stock has since retraced the short-term upward trend that rebound formed, but in the last week picked up momentum as Food Products stock have shifted back into favor.Do the stock’s fundamentals support that technical thesis, along with its value proposition? Let’s find out.

Fundamental and Value Profile

Archer-Daniels-Midland Company is a processor of oilseeds, corn, wheat, cocoa and other agricultural commodities. The Company manufactures protein meal, vegetable oil, corn sweeteners, flour, biodiesel, ethanol, and other food and feed ingredients. Its segments include Agricultural Services, which utilizes its United States grain elevator, global transportation network and port operations to buy, store, clean and transport agricultural commodities, such as oilseeds, wheat, milo, oats, rice and barley, and resells these commodities primarily as food and feed ingredients and as raw materials for the agricultural processing industry; Corn Processing, which is engaged in corn wet milling and dry milling activities; Oilseeds Processing, which includes global activities related to the origination, merchandising, crushing and further processing of oilseeds; Wild Flavors and Specialty Ingredients products, which include flavors, sweeteners and health ingredients; Other, and Corporate. ADM’s current market cap is about $22.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased more than 39.13%, while sales declined modestly, by -2.18%. In the last quarter, earnings dropped nearly -55% while sales declined -8.32%. The company operates with a very narrow margin profile, which isn’t that uncommon in its industry. Net Income versus Revenues over the past year is 2.39%, but improved somewhat in the last quarter to 2.61%.

Free Cash Flow: ADM’s free cash flow is negative, by about -$4.8 billion, and that is a big red flag; it is an indication that the company’s financial flexibility is becoming more restrictive. This is a number that, like Net Income, has been negative since the beginning of 2017, only briefly touching positive territory in the first quarter of 2018. It is worth noting that this number has improved from earlier in the year at around -$6.2 billion.

Debt to Equity: ADM has a debt/equity ratio of .45. This is a conservative number. The company’s balance sheet indicates that operating profits are adequate to service their debt, with about $9.8 billion in cash and liquid assets (an increase from $5.3 billion at the beginning of the year) versus more than $8.6 billion in long-term debt; however ADM’s negative Free Cash Flow suggests that the company is having to rely largely on cash to service its debt. The longer that condition persists, the more likely liquidity is to become a question mark.

Dividend: ADM pays an annual dividend of $1.44 per share, which translates to an attractive yield of 3.56%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $37.50 per share. That means that ADM is a bit overvalued, with a little more than -7% downside from its current price.

Technical Profile

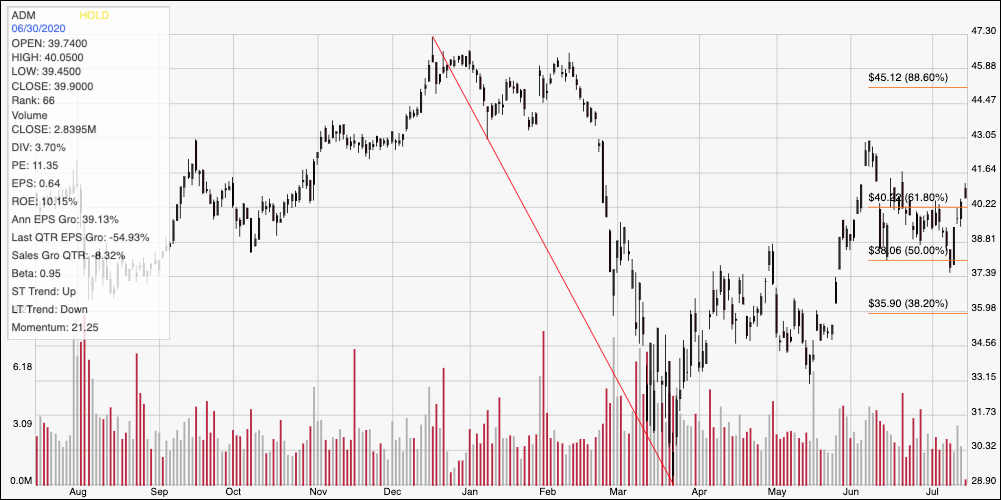

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity for the past year. The diagonal red line traces the stock’s downward trend from October of 2018 to its most recent bottom in March, and provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock formed an upward trend from that low to its June high around $43, but more recently retraced back to about the 50% retracement line before picking up new bullish momentum in the last week that drove the stock above the 61.8% retracement line. Current support is around $40, in-line with the 61.8% retracement line, with immediate resistance around $43. A push above $43 should give the stock room to rally to around $46, while a drop below $40 has about $2 of downside to the 50% retracement line. Continued bearish momentum from that point could see the stock fall to between $35 and $36.

Near-term Keys: While ADM doesn’t offer a useful value proposition, the stock’s current bullish rally looks like it could be a good set up for a continuation of the trend that started in mid-March. That means that short-term trading strategies could still be useful. The stock’s recent break above $40 could be taken as a signal to buy the stock or work with call options, using $43 as an initial, quick-hit profit target, and $45 attainable from that point if bullish momentum continues. A drop below $40 could be a signal to think about shorting the stock or buying put options, using $38 to $36 as practical profit targets on a bearish trade.