My approach to value-oriented investing can’t really be called pure value analysis. The main reason for that is because traditional value investing doesn’t worry about what a stock’s price has been doing; it is only concerned with what the stock’s price is now versus what the combination of fundamental and value metrics suggest it should be. My approach adds a third leg to the process by also considering the stock’s current price activity versus the recent, and even long-term past. If a stock is in the lower end of its historical trading ranges, it’s usually easier to find valuation metrics that line up with a good value proposition; but the fact that a stock may have been in an upward trend doesn’t always mean that it isn’t a good value.

In a world where you simply can’t get away from conversation of COVID-19 and its continued impact on the economy and on society in general, it shouldn’t be too surprising that stocks in certain sectors have been better positioned than others to succeed. Stay-at-home and quarantine orders put Consumer Staples and Food Products stocks in prime position, for example, as they were already trading at interesting valuations before the pandemic, but then got an unexpected lift from sudden, increased consumer to stockpile pantries and freezers and build up food storage. The Health Care sector has also, not surprisingly, been one of the stronger performers as major focus continues to be placed on the progress and pace of development, testing through clinical trials, and eventual, but hopefully fast-tracked approval of vaccines and anti-virals.

One of the companies that straddles both the Consumer Staples and Health Care sectors, and has been a big beneficiary of increased demand for household pantry items, which includes a lot of the over-the-counter medicines that most of us will find in a kitchen or bathroom cupboard, is Perrigo PLC (PRGO). This is a stock that has rebounded from a March low at around $40 to a recent price just a little below $58, which puts the stock’s rally over the last four months at just a little less than 50%. In June, it dropped back from a high around $56 to a low at around $50 before resuming its bullish upward trend, with this week’s surge pushing the stock past that June peak.

PRGO Is an interesting company; they’ve been around since 1887, and were founded in Michigan, but in 2013 moved their legal corporate headquarters to Ireland for tax purposes, a classic example of the kind of expatriation that gave the Trump administration fuel to push through tax reform at the end of 2017. This is a company that still derives about 70% of its revenues from the United States, which to me means despite their legal base in Europe, PRGO is still about as American as they’ve ever been.

PRGO operates in an interesting segment of the pharmaceutical industry, generic OTC consumer goods and specialty pharmaceutical products. If you’ve bought a store-brand generic pain reliever at Wal-Mart, Kroger, or Target stores, for example, there’s a great chance you bought one of their products. In a healthy economy, some analysts think that demand for generics is reduced as consumers have a psychological preference for name brand OTC products, and I think there may be some truth to that idea. If you follow that logic, however, it should also make sense that as economic uncertainty lingers the longer COVID-19 continues to be a question mark, generic producers like PRGO should make more sense, as consumers look to tighten their wallets and become more likely to use generics as a cost-efficient alternative to more expensive store brands. That is almost certainty a big reason for the stock’s big push over the last few months; so where, exactly should PRGO’s price be to mark a useful discount?

Fundamental and Value Profile

Perrigo Company PLC (Perrigo), formerly Perrigo Company Limited, is an over-the-counter (OTC) consumer goods and specialty pharmaceutical company. The Company’s segments include Consumer Healthcare (CHC), Branded Consumer Healthcare (BCH), Prescription Pharmaceuticals (Rx) and Specialty Sciences. It manufactures OTC healthcare products and supplies infant formulas for the store brand market. It is also a provider of generic extended topical prescription products. The CHC segment is focused on the sale of OTC store brand products. The BCH segment develops, manufactures, markets and distributes various European OTC brands. The Rx segment develops, manufactures and markets a portfolio of generic and specialty pharmaceutical prescription drugs. The Specialty Sciences segment consists of assets focused on the treatment of multiple sclerosis, specifically in connection with the drug, Tysabri. PRGO has a current market cap of about $7.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased 6.5%, while revenue also increased by 14.2%. In the last quarter, earnings rose 7.55% while sales tapered, but were still positive by 1.38%. The company’s margin profile shows signs of strengthening as well; Net Income was a very narrow 3.77% of Revenues in the last twelve months, but improved to nearly 8% in the last quarter. That’s a good indication that the company is doing a good job at improving their bottom line.

Free Cash Flow: Over the last twelve months, PRGO had $314.7 million in Free Cash Flow. That’s adequate, if not very remarkable, and translates to a Free Cash Flow Yield of about 4%. It’s also worth noting that Free Cash Flow declined from about $600 in mid-2018 to its current level, a notion which refutes the idea the stock’s improving Net Income suggests, that operational efficiency is improving.

Debt/Equity: PRGO’s debt to equity ratio is .55, which is a generally conservative number. Their balance sheet shows a little over $510 million in cash and liquid assets against about $3.2 billion in long-term debt; however I don’t see any indications servicing their debt might be a problem.

Dividend: PRGO’s dividend is $.90 per share (increased from $.76 per share about a year ago) and translates to a modest annual yield of 1.56% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $60 per share. That means that PRGO is trading only about 4% below that level right now, so it really can’t be called a good value. It’s also worth pointing out a big potential risk that lies in front of the company in the form of a case brought by the Irish government alleging a $1.9 billion discrepancy in taxes paid in 2013 when the company expatriated to that country. The company has been aggressively disputing the case for more than a year, with any resolution likely to be still a year or more away.

Technical Profile

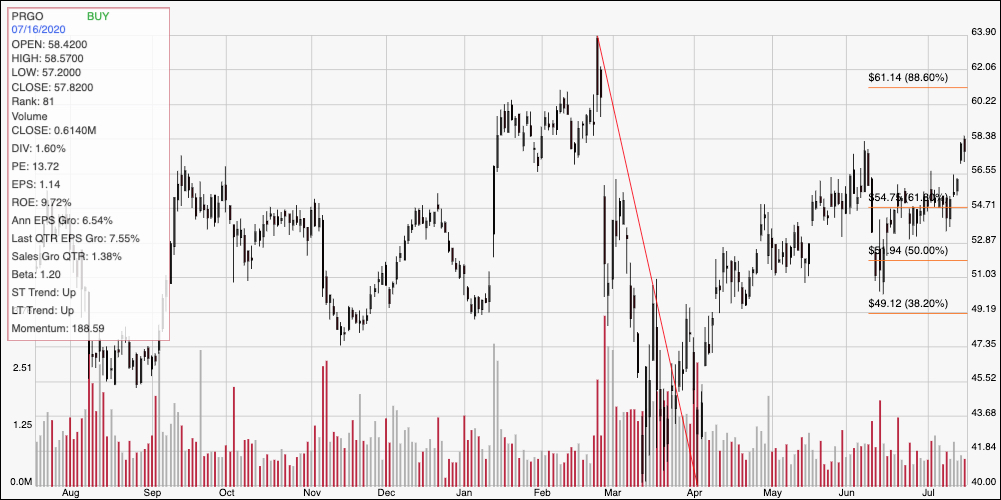

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s downward move from around $67 beginning in February of this year until the beginning of April when it bottomed at around $40; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock’s upward trend from that bottom is pretty clear, with its more recent break above pivot resistance at around $57 in the last couple of trading days also pretty easy to see. The break above resistance could mark an important confirmation of the longer upward trend, with room fro the stock to rally to somewhere between $61 to $63.50 if bullish momentum remains strong. Support is back at that pivot high, which means that a drop below $67 should give the stock room to drop to a little below $55 where the 61.8% retracement line sits, and $52, in line with the 50% retracement line possible if bearish momentum picks up.

Near-term Keys: From a value-oriented standpoint, there really isn’t any way to call PRGO a good value right now, with the stock’s actual discount price sitting back at around $48. If you prefer to look for a short-term oriented trade, continued bullish momentum following the stock’s recent resistance break could mark a good signal to place a bullish, momentum-based trade using call options or just buying the stock outright, with a near-term target between $61 and $63 per share. If, however the stock drops below $57, you might think about using that drop as a signal to short the stock, or to start buying put options with an eye on $55 as an initial profit target, and $52 if downward momentum accelerates for a bearish trade.