2020 has been a rough year for energy stocks. Even before COVID-19 became a global health crisis, the sector was rocked by an all-out price war between Russia and Saudi Arabia. At the beginning of the year, Brent crude – the benchmark for oil exported from OPEC and OPEC+ countries – was around $70 per barrel. but declined into the mid-$50 range in February. Amid signs the two countries had worked out an agreement, the commodity started to stabilize and increase, but global shutdowns and shelter-in-place orders due to rapidly increasing coronavirus infections put a hammer down on consumer oil demand. Brent crude, the benchmark for crude produced everywhere but the U.S., hit a low in May around $20 per barrel, while West Texas Intermediate (WTI), the U.S. benchmark saw its bottom around $10 (not counting a mind-boggling, overnight plunge in April into negative territory that recovered almost immediately). As global pandemic restrictions have been lifted and economies have begun to move again, demand for oil has increased enough to push both benchmark into the low-$40 range.

Economists generally don’t expect to see oil demand approach pre-pandemic levels until possibly 2022, which has a lot of analysts issuing neutral to bearish recommendations on most stocks in the Energy sector right now, which could mean that a sector that was already seeing a fair bit of economic pressure is looking at even tougher times ahead. Economists often point to recessions and the extreme drops in some sectors that come along with them as “washouts” – meaning that the vaporization of demand for a sector’s good and services wipes out companies that weren’t sufficiently prepared to weather the storm. In the energy sector, that doesn’t automatically mean small producers – but it does put a big focus on a company’s balance sheet, liquidity, and debt leverage. That’s why a lot of people that I’ve seen begin talking about playing the recent rise in oil prices have generally been focusing on the biggest players.

To start this week, Chevron Corporation (CVX) made waves before the market opened with its announcement it planned to acquire Houston-based Noble Energy (NBL) in a $5 billion deal that includes the assumption of NBL’s $13 billion of long-term debt. Across the world, there are only a few energy companies that fall under the description of “supermajor,” with operations that span the globe and touch multiple industries within the Energy sector. CVX is one of those companies as the second-largest U.S. producer, and a market cap in excess of $160 billion. Recessionary conditions in the energy sector – and to be clear, that is still where the sector finds itself – are challenges for companies that lack the balance sheet strength to weather the downturn, and NBL was one of a handful, but also an increasing number of smaller players that have either filed for bankruptcy protection or appeared on the precipice. For larger players, and those with the balance sheet strength to take advantage, those situations often spell opportunities to acquire useful assets at incredible bargains.

This deal appears, at least initially, to fit that description, as the $5 billion price tag translates to a cost of about $.11 per share of CVX stock, and gives CVX even greater access to oil-rich shale regions of the U.S. as well as to properties in the Eastern Mediterranean area. CVX management expects the deal to expand the company’s free cash flow and earnings per share and help reduce its run-rate costs by about $300 million within the next year. The stock is more than $40 below its late 2019 highs near to $130 as of right now. Does this deal, along with the company’s existing fundamental strength, make the stock a good value? Let’s find out.

Fundamental and Value Profile

Chevron Corporation (Chevron) manages its investments in subsidiaries and affiliates, and provides administrative, financial, management and technology support to the United States and international subsidiaries that engage in integrated energy and chemicals operations. The Company operates through two business segments: Upstream and Downstream. Upstream operations consist primarily of exploring for, developing and producing crude oil and natural gas; liquefaction, transportation and regasification associated with liquefied natural gas; transporting crude oil by international oil export pipelines; processing, transporting, storage and marketing of natural gas, and a gas-to-liquids plant. Downstream operations consist primarily of refining of crude oil into petroleum products; marketing of crude oil and refined products; transporting of crude oil and refined products, and manufacturing and marketing of commodity petrochemicals. CVX’s current market cap is $160.6 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined -7.16%, while revenues dropped by -10.5%. In the last quarter, earnings were -13.4% lower while revenues declined by about -13.3%. The company’s margin profile is narrow, but is showing signs of strong improvement; in the last twelve months, Net Income was 2.22% of Revenues, but strengthened to 11.43% in the last quarter.

Free Cash Flow: CVX’s free cash flow is generally healthy at $12.68 billion and translates to a modest Free Cash Flow Yield of 7.79%. It is worth noting that Free Cash Flow was about $18.4 billion in June of 2019.

Debt to Equity: CVX has a debt/equity ratio of .16. This is a conservative number that reflects a generally disciplined approach to debt management. The company reported around $8.5 billion in cash and liquid assets against about $23.6 billion in long-term debt as of the last quarter. The NBL means that long-term debt will increase by $13 billion as soon as the deal closes, which is significant. Management has observed the recent stabilization of oil prices in the low $40 range and noted that if oil remains around this level, current run rates for both organizations should make the deal easy to manage.

Dividend: CVX pays an annual dividend of $5.16 per share, which translates to an annual yield that of about 5.92%. That is an impressive number that puts their yield far above even long-term bonds, and like other oil supermajors makes them a “dividend king.”

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $115 per share. That suggest that CVX is undervalued by about 36% – which is a very tempting long-term opportunity for any value-focused investor.

Technical Profile

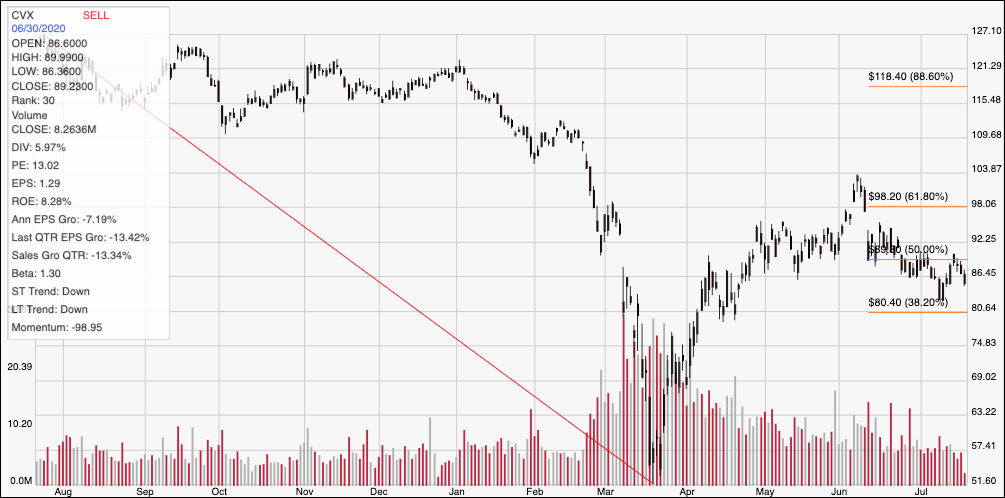

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line on the chart above traces the stock’s downward trend from July of last year to its low point in March. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. CVX rallied strongly until early June, hitting a short-term peak at around $104, above the 61.8% retracement line before dropping back to support around $81 a couple of weeks ago. After a quick push to about $89, the stock has dropped back again and as of this writing is just a little above $85 – about midway between immediate support and resistance. A push above $89 should give the stock room to rally to around $98, inline with the 61.8% retracement line, while a drop below $81 could give the stock bearish momentum to fall to somewhere between $75 and $69 based on previous pivot levels before finding new support.

Near-term Keys: Despite the early buzz the NBL deal is generating, I don’t think it’s a game-changer for CVX. It looks like exactly the kind of pennies-on-the-dollar acquisition that the big boys of an industry look to take advantage of when conditions are dire enough on smaller players. That said, the price performance of CVX stock over the last several weeks has pushed the stock low enough to make it a very interesting value proposition – if you’re willing to accept the kind of price volatility that is normal for energy stocks in the kind of broad economic conditions we’re seeing right now. If you prefer to work with short-term trading strategies, you’ll need to wait to see which direction sentiment drives the stock’s momentum. A push above $89 could be a good signal to think about buying the stock or buying call options, using $98 as a useful bullish profit target. A drop below $81 could be a useful signal to consider shorting the stock or working with put options, using $75 as a good first bearish profit target and $68 possible if bearish momentum picks up.