One of the big challenges during any economic period of being a value-oriented investor isn’t merely finding stocks that are trading at a discount to valuation metrics like Book Value. It is determining if the stock’s discount is due to temporary market forces like investor sentiment, which is often influenced by short-term uncertainty more than fundamental problems, or larger, more concerning problems in the way a business is being run.

Recessionary conditions can actually complicate the issue even more. The plus side for a value investor is that recessions, and the bear markets that usually go along with them, is that the number of stocks trading at interesting discounts increases. The difficulty comes in the reality that recessions are driven by broad economic forces that can filter down to a company’s core business, which means that the longer those issues persist, the longer that business is likely to struggle. This can be true no matter how strong the management team running the company is, or how disciplined they may be about managing the bottom line. Even worse when management missteps, along with broad economic forces come to play, which usually means the stock is cheap for very good reasons.

The latest economic recession, triggered by the global coronavirus pandemic is an interesting case in point. The market took only about a month to push every major market average into bear market territory once economic shutdowns and shelter-in-place orders took effect, with just about every single sector in the market feeling the heat as well. After that initial drop, the market has staged its own, V-shaped recovery on the seeming anticipation that the net economic impact of the virus will be more temporary than long-term, but certain sectors of the market have more accurately reflected the fact that true, broad-based economic recovery is going to take some time. Bargain-level discounts in the energy sector, for example, not only reached extreme lows that coincided with the broad index lows; but the collapse of demand for oil and refined crude products including gasoline has created a long-term, deflationary effect in the sector that has yet to be resolved. So while the number of stocks trading at interesting, or even compelling discounts remains high, the question of whether those stocks should be worth more than their current prices, or whether they should simply be cheap right now is a tough nugget to crack.

Marathon Petroleum Corporation (MPC) is a good example of the quandary I’m referring to. From a November 2019 high around $70, the stock begin to drop into the beginning of 2020 on oversupply concerns that persisted through the first part of the year, but only slid back to about $61 per share by mid-February. Coronavirus then took center stage, pushing the stock to an extreme low in mid-March at around $15 per share. While the stock has more than doubled in price from that point, current sitting a bit below $40, it also remains more than 30% below that November high and even deeper below its current fair value. Those are compelling metrics, to be sure, but does the impact of coronavirus on the company’s fundamental profile bolster or weaken the value proposition? Let’s find out.

Fundamental and Value Profile

Marathon Petroleum Corporation is engaged in refining, marketing, retail and transportation businesses in the United States and the largest east of the Mississippi. The Company operates through three segments: Refining & Marketing; Speedway; and Midstream. The Refining & Marketing segment refines crude oil and other feedstocks at the Company’s seven refineries in the Gulf Coast and Midwest regions of the United States. Its Speedway segment sells transportation fuels and convenience products in the retail market in the Midwest, East Coast and Southeast regions of the United States. The Company’s Midstream is engaged in the operations of MPLX LP and certain other related operations. It gathers, processes and transports natural gas, natural gas liquids (NGLs), crude oil and refined products. MPLX is a limited partnership which owns, operates, develops and acquires midstream energy infrastructure assets. MPC has a current market cap of about $25.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased by -77.78%, while revenues dropped by -15.85%. In the last quarter, earnings declined more than -110% while sales dropped about -23.25%. The company’s margin profile was very narrow before the pandemic began cutting massive swaths throughout the energy sector; the picture has weakened considerably since, with Net Income as a percentage of Revenues over the last twelve months at -5.45% and that weakness accelerating to -36.62% in the last quarter.

Free Cash Flow: MPC’s free cash flow is $2.01 billion over the last twelve months; it was about $4.2 billion at the end of 2019. The current number translates to a Free Cash Flow Yield of 7.97%.

Debt to Equity: MPC’s debt to equity is 1.02, which is high and marks an increase from .71 at the end of 2019. The company’s balance sheet shows about $1.69 billion in cash and liquid assets in the last quarter compared to $877 million in June of 2019, which is a big improvement. Long-term debt, however is increasing, at a little over $31.8 billion in the last quarter versus $18.4 billion in the last quarter of 2018. At least a portion of the increase can be explained by MPC’s acquisition in October of last year of competitor Andeavor for $23 billion in cash and stock. A concern is that the company faces the maturity of a large portion of this debt in the third quarter of 2021, and current operating conditions put that debt service into serious question.

Dividend: MPC’s annual divided is $2.32 per share, which translates to a yield of about 5.97% at the stock’s current price. The sustainability of the company’s dividend is in question, however management has so far not given any indication that a cut is being considered.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target for DKS at around $56 per share. That suggest that at the stock’s current price, it is significantly undervalued, by about 45% from from its current price.

Technical Profile

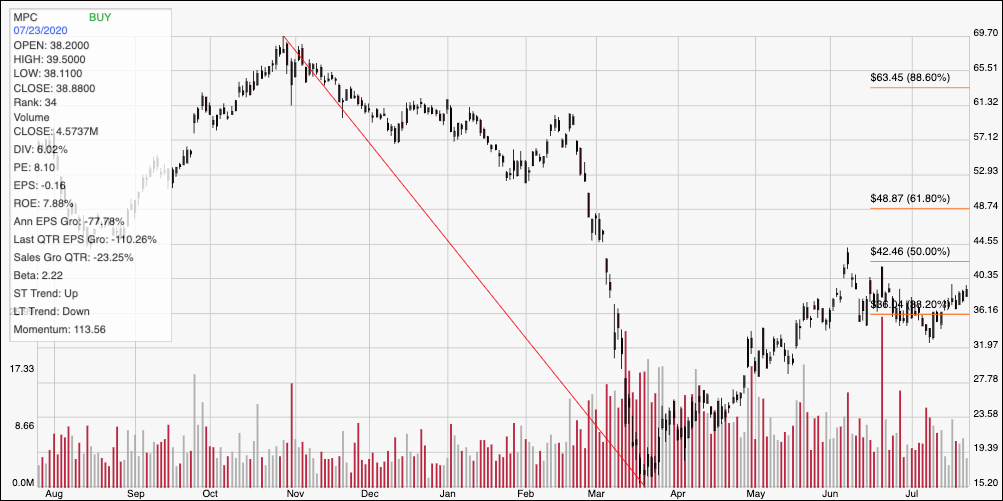

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s downward trend beginning in November 2019 to its March low at around $15. It also informs the Fibonacci retracement lines shown on the right side of the chart. The stock staged an interesting upward trend until early June, increasing to a high at around $42.50 where the 50% retracement sits. After sliding back a bit to a near-term low around $32, it pushed back above the 38.2% retracement line in the last week or so to its current price at around $39 per share. Current support is inline with the 38.2% retracement line at about $36; a drop below that point should see the stock test its last pivot support at $32, with room to fall into the mid-$20 range if $32 doesn’t hold. Current resistance is around the 50% retracement line, and the June high at around $42.50. A break above that line should give the stock room to rally to at least $49, about where the 61.8% retracement line sits, with additional room to about $53 based on pivot lows that occurred in late January and early February.

Near-term Keys: Looking only at the stock’s discount based on its valuation metrics is tempting, and the stock’s momentum from its March low adds to the temptation, even with the mostly sideways movement of the last couple of months. The problem comes from the fundamental profile. MPC has a massive amount of debt, limited liquidity, and is spending significantly more money right now than it is bringing in. A reversal of the negative Net Income pattern would go a long way toward righting the ship and improving the fundamental picture, so the next quarter or so bears watching. If demand for refined products remains low, as many analysts expect to be the case through the rest of 2020, it’s unlikely the story will change for MPC. That means that the best probabilities lie in short-term trades. A break above $42 could mark a good signal to buy the stock or work with call options, with a profit target sitting at around $49, while a drop below $36 should be taken as a signal to consider shorting the stock or buying put options, using $32 as an initial profit target on a bearish trade, and somewhere between $27 and $25 possible if bearish momentum persists.