If you listen to analysts and talking heads on popular news media, the best places to be in the stock market include the Technology sector, which makes a certain kind of sense since Tech stocks have generally been the highest performers since the market hit a bear market bottom in March of this year. A lot of that momentum has been most obviously focused on stocks that are clearly built for remote work, e-commerce, and cloud-based services, but has also extended impressively into the Semiconductor industry. As measured by the PHLX Semiconductor iShares ETF (SOXX), the industry is up a little over 68% since mid-March, and has continued to press to new highs even as the broad indices have begun to wobble a bit.

While seeing stocks at or near fresh highs makes a lot of growth-focused investors anxious to look for their next entry point, value investors like me tend to automatically dismiss these stocks, simply because the odds are very good that the stock is priced well above its normal valuation levels. The contrarian side of my experience and education asserts that the more extended a stock gets above those levels, the more likely it is to reverse and go lower, which is why in these situations I usually see more risk than opportunity.

One of the biggest Semiconductor stocks is Texas Instruments Inc (TXN), which based on revenue stands as the world’s fourth-largest semi company. This is a company that makes a variety of products that you may not recognize easily, but that are integral to just about all electronic equipment. The company is also less sensitive to commodity pricing pressures that other semi companies, such as those that are focused in the storage and memory segment since their focus on analog semiconductor products means thousands of different products, a broad customer base, and a fixed price for those products, since they tend to contain proprietary design content and are sole-sourced. That means they are less subject to the kinds of intense competitive and pricing pressures that other companies in the segment are.

While TXN’s revenues can be cyclical and reflective of broader economic trends, and has not been immune to the pressures and realities of a pandemic-driven global economy, it has also followed the broader trend in the Technology sector, posting improvements in earnings and profitability while revenues have declined at lower levels that companies in many other sectors. The stock is also about -7.5% below its most recent high following its most recent earnings report. How does that translate to the stock’s value proposition?

Fundamental and Value Profile

Texas Instruments Incorporated designs, makes and sells semiconductors to electronics designers and manufacturers across the world. The Company operates through two segments: Analog and Embedded Processing. As of December 31, 2016, the Company had design, manufacturing or sales operations in more than 30 countries. The Company’s Analog segment’s product line includes High Volume Analog & Logic (HVAL), Power Management (Power), High Performance Analog (HPA) and Silicon Valley Analog (SVA). HVAL products support appliTXNions, such as automotive safety devices, touchscreen controllers, low-voltage motor drivers and integrated motor controllers. The Company’s Embedded Processing segment’s product line includes Processor, Microcontrollers and Connectivity. Processor products include digital signal processors (DSPs) and appliTXNions processors. DSPs perform mathematical computations to process digital data. TXN’s current market cap is $117.5 billion.

Earnings and Sales Growth: Over the last twelve months, TXN’s earnings grew 14.73%, while revenues declined -11.7%. In the last quarter, earnings growth was more than 19%, while sales were -2.7% lower. The company also operates with a very impressive margin profile that strengthened in the last quarter; Net Income over the last twelve months was almost 37%, and increased in the last quarter to more than 42.5%.

Free Cash Flow: TXN’s free cash flow is healthy, at more than $5.7 billion for the last twelve months. That translates to a Free Cash Flow Yield of 4.71%. It is also worth noting that while Free Cash Flow declined from $5.8 billion for the quarter prior, the drop was much more negligible than has been seen in a lot of other stocks in current market and economic conditions.

Debt to Equity: TXN has a debt/equity ratio of .82. This number is generally low, and reflects a conservative management philosophy about its use of leverage. The company also has excellent liquidity, with more than $4.9 billion in cash and liquid assets against about $6.2 billion in long-term debt.

Dividend: TXN pays an annual dividend of $3.6 per share, which translates to a yield of 2.73% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $92 per share. That means the stock is very overvalued, with -29% downside from its current price, with a useful bargain discount at around $74.

Technical Profile

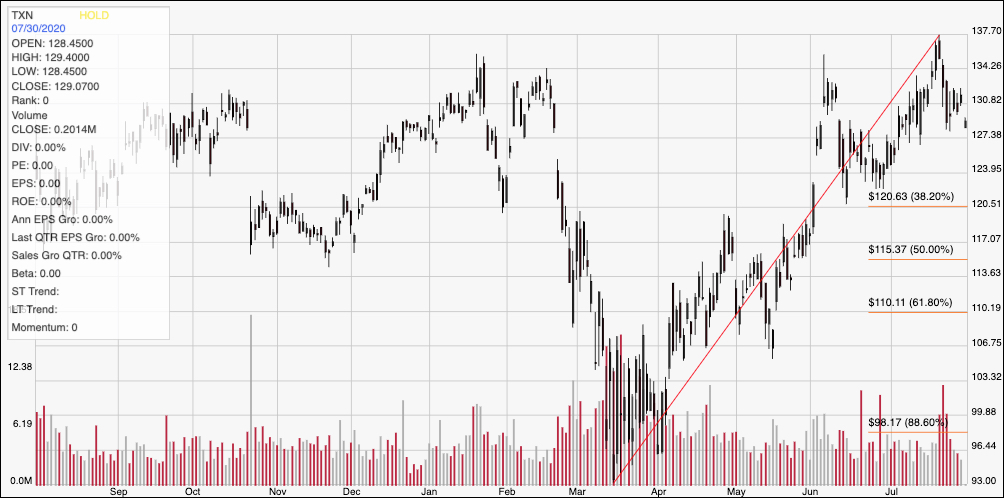

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above outlines the stock’s movement over the past year. The red diagonal line traces the stock’s upward trend from its March low around $93 to its recent high at almost $138 per share; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has retraced a bit from that high, and could be approaching support from previous pivots at around $127 per share. A drop below $127 has additional downside to about $120.50, where the 38.2% retracement line rests. Immediate resistance is around $130; a break above that level should give the stock enough momentum to test its June high around $138.

Near-term Keys: Fundamentals notwithstanding, there really isn’t any way to call TXN good value right now. That means that the best opportunities to work with this stock lie on the short-term side, with momentum and swing-based strategies. Use a break above $130 as a signal to buy the stock or work with call options, using $137 to $138 as a good bullish profit target. A drop below $127 would be a good signal to consider shorting the stock or working with put options, using $120 as a practical exit target on a bearish trade.