This ETF may be signaling where the market is headed in the near-term.

Stocks have been on a wild ride this summer, but the fact remains stocks have seen a massive rally off their March lows.

Since March 23, the S&P 500 has gained a whopping 49% and now sits just 1.5% below its all-time high.

Even as the market rallies higher, the economy is still in a precarious spot. The Commerce Department reported last week that the U.S. economy saw its biggest quarterly plunge on record in the second quarter as gross domestic product from April to June fell 32.9%.

Beyond that, the weekly initial jobless claims continue to come in above 1 million week after week, job gains haven’t come anywhere close to keeping up with the losses, and with the economy faltering, Congressional leaders and the White House have yet to come to an agreement on another coronavirus relief bill to help bolster the economy.

“We already know that activity rebounded strongly in May and June, setting the stage for a strong rise in GDP in the third quarter,” said Andrew Hunger, senior U.S. economist at Capital Economics. “Nevertheless, with the more recent resurgence in virus cases starting to weigh on the economy in July, continued ‘V-shaped’ recovery is unlikely.”

With the economy still in recovery, Miller Tabak chief market strategist Matt Maley is looking for signs of the breakout for stocks in one particular corner of the market.

“I’m really lookin at the high-yield market, believe it or not,” Maley said. “I’m kind of looking for a bit of a pullback in August. But after that takes place, I’m really watching the high-yield market because it’s held up very, very well even when we’ve had downturns for a few days.”

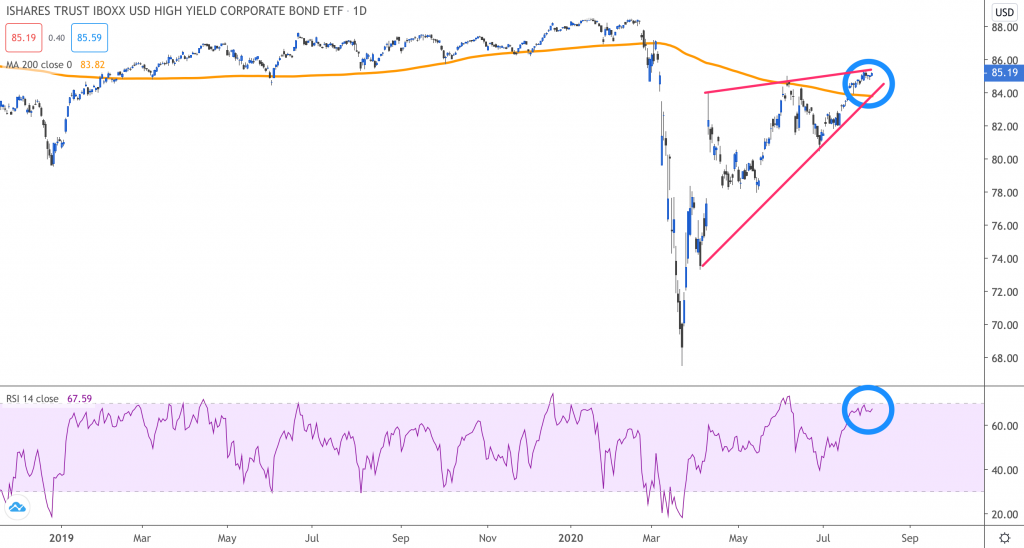

Maley has his eyes on the HYG High Yield Corporate Bond iShares ETF, which is up 3.4% over the last month.

The HYG ETF, which tracks the corporate bond market, “finally pulled above its 200-day moving average,” Maley said. “That is the key resistance for the high yield market, for this ETF, and it’s also getting just above the top end of the sideways range it has been in for two months now, above $85.”

“It might pull back a little bit if the stock market sees a little bit of a pullback, but if you can see the HYG break meaningfully above that $85 level, this does mark a good leading indicator for the stock market many times in the past,” Maley added. “So that would be a very bullish sign that the stock market is going to go back up and test those all-time highs rather soon.”

The HYG closed at $85.19 Wednesday and has closed just above $85 since July 31, which Maley says is a bullish signal. However, Tocqueville Asset Management’s John Petrides believes the current high level of uncertainty could keep the S&P 500 rangebound.

“The market is at a total crossroads,” Petrides said. “I wouldn’t be surprised if the S&P 500 is stuck rangebound between 3,000 and 3,300 over the next couple of months. The problem investors are wrestling with today is that you could put a high probability on top of the bull case and the bear case.”

On the bull side, Petrides sees the possibility for stocks to rally another 30% if the economy improves. But on the bear side, the market could sink if coronavirus cases spike higher and states have to rollback reopening efforts.

“There are cases that we have a repeat of March and April,” Petrides added. “I’m hoping that doesn’t happen, but it’s not out of the question. By and large, I think stocks can be rangebound, probably or possibly, until the election.”