The market’s plunge from late February to March was perhaps the most rapid descent to bear market levels in history; the road back, while not as rapid, has also been remarkable, taking just about five months for the S&P 500 to follow the NASDAQ above its pre-pandemic highs, with the Dow Jones Industrial Average within striking distance. Those moves seems in many ways to to belie broader economic conditions; COVID-19 concerns, including high infections that persist across a number of areas of the country continue to put pressure on small business at a bad time as the first wave of stimulus, including the Paycheck Protection Program and extended unemployment benefits expire. Pundits, economists and executives are pressing for a second set of federal aid, but Congress is mired in finger-pointing right now and doesn’t seem to be ready to help any time soon. That could push unemployment numbers, which have remained high, but are also generally trending in a positive fashion, back in the wrong direction.

I’m not one to be an alarmist, and I don’t like to take a bearish view, but the truth is that the longer coronavirus continues to weigh – and make no mistake, any anti-viral or vaccine, even if it is given fast-track approval before the end of the year, will not be broadly available until sometime in 2021 at the earliest – the harder it is going to be for even the most optimistic investor to keep pushing the market higher. Forecasts for a lot of industries right now are looking for recovery in demand and so in revenues not this year, but sometime in 2021 as well, and that means that many of the stocks that have followed the market higher over the last five months could be sitting at critically high valuation levels, to the point where risk: reward formulas become dangerously skewed and put the probabilities of continued success very much in doubt.

Newell Brands Inc. (NWL) is an interesting example. After plunging to a bear market low at around $11 in March, the stock has recovered nicely, pushing above $17 as of this writing to post a 60% gain over the last five months. This is a stock with a large footprint in the Household Durables industry, with well-known brands in a portfolio lineup that includes Sharpie and Paper Mate writing utensils, Graco baby products, Rubbermaid, Elmer’s, Mr. Coffee, and much more. The business has been working for most of the last couple of years to implement a transformation plan that recent earnings reports suggest have started to positively impact the company’s bottom line, which has helped give the market justification to push the stock higher. Are those conditions still in place, and if NWL’s fundamentals are still improving, does the stock’s current still represent a useful value? Let’s take a look.

Fundamental and Value Profile

Newell Brands Inc. is a consumer goods company. The Company has a portfolio of brands, including Paper Mate, Sharpie, Dymo, EXPO, Parker, Elmer’s, Coleman, Marmot, Oster, Sunbeam, FoodSaver, Mr. Coffee, Graco, Baby Jogger, NUK, Calphalon, Rubbermaid, Contigo, First Alert and Yankee Candle. The Company operates under three segments: Food and Appliances (comprised of Appliances & Cookware and Food divisions), Home and Outdoor Living (comprised of Home Fragrance, Outdoor & Recreation and Connected Home & Security divisions), and Learning and Development (comprised of Writing and Baby & Parenting divisions). NWL has a current market cap of $7.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings dropped about -33%, while sales declined -0.26%. In the last quarter, earnings improved by 233% while sales increased by almost 12%. The company’s margin profile over the last twelve months is negative, meaning that NWL’s paid more in expenses than it brought in; Net Income versus Revenue was -11.39%, but improved to 3.69% in the last quarter. Before the pandemic, these numbers had reversed a prior negative pattern to show strong operating margin growth, which means that the last few months have put the company’s operations under significant pressure yet again. The fact that the most recent quarter is positive, for earnings and revenue growth as well as Net Income, is an encouraging sign, but it remains to be seen if NWL can sustain that positive pattern in the quarters ahead.

Free Cash Flow: NWL has healthy free cash flow of a little over $941 million over the last twelve months. It’s worth noting that in the first quarter of 2020, this number was $779 million, so this number offers an interesting counterpoint to the negative Income pattern I just described. This number was also just $295 million at the beginning of this 2019, making Free Cash Flow growth a useful benchmark for the success so far of the company’s transformation plan. Their current Free Cash Flow number translates to a useful Free Cash Flow Yield of 12.97%.

Debt to Equity: the company’s debt to equity ratio is 1.78, which is high and is reflected in the company’s balance sheet. As of the last quarter, cash and liquid assets were $619 million versus almost $6.3 billion in long-term debt. NWL is very highly leveraged, and while operating profits are currently sufficient to service their debt, liquidity is a concern. It is also worth noting that in late 2018, long-term debt was about $9.3 billion, so this number has been declining (although it did increase from about $5.9 billion in the first quarter of 2020), which is a net positive.

Dividend: NWL pays an annual dividend of $.92 per share, which translates to a very attractive annual yield of 5.38% at the stock’s current price. It is worth noting that the company’s dividend payout exceeds its earnings per share over the last year; this is a pattern that can’t be sustained in the long term. It implies that as long as fundamentals continue to improve, the dividend should safe; but a continued negative pattern in Net Income or reversal of free cash flow could put the dividend at risk of being cut or suspended altogether.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $23 per share. That means that even with the stock’s rally since March, it remains significantly undervalued, with 34% upside from its current price.

Technical Profile

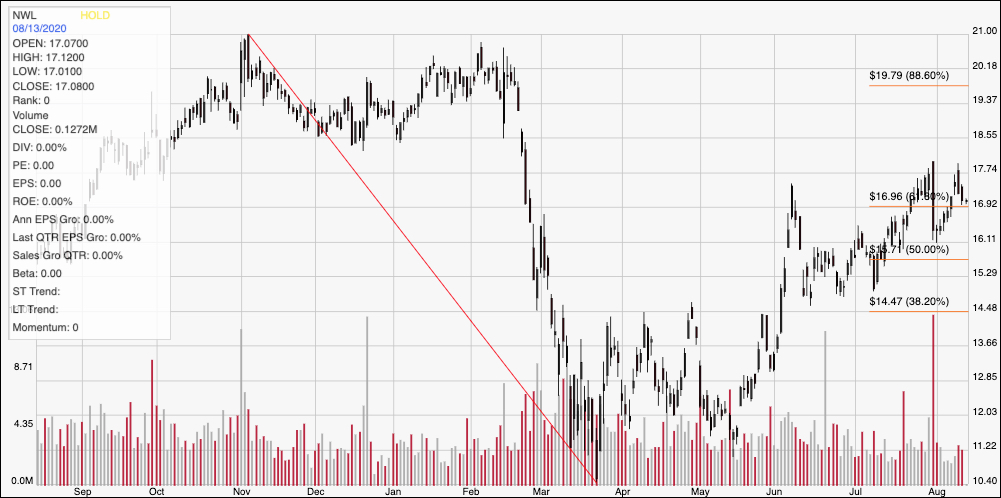

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price performance over the last year. The diagonal red line traces the stock’s downward trend from a November high at around $21 to its bear market low in March at around $10.50. It also informs the Fibonacci retracement lines shown on the right hand side of the chart. From that low, the stock has staged an impressive upward trend and is currently sitting impressively above the 61.8% retracement line, with support a little below $17. Immediate resistance is around $18, with two pivot highs in the last couple of weeks at that level. A push above $18 should give the stock room to push near to $20, while a drop below $17 could see it find next support around $16, and secondary support around $14.50 if bearish momentum continues.

Near-term Keys: Overall, I like NWL’s fundamentals; management has been effective at executing its transformation strategy over the last year, and even with COVID-related pressures, has managed to bolster is balance sheet and operating cash flow. I also think that the company offers products that are useful in any economic environment; however I also think that recessionary economic conditions could continue to dampen demand and put pressure on revenues. That means that while the value proposition is compelling, there are some risks that could keep the stock from continuing its impressive upward trend for the time being. If you prefer to work with short-term trading strategies, a break above $18 could offer a useful opportunity to buy the stock or work with call options, using a range between $19.50 to $20 as a good profit target. A drop below $17 could act as an early signal to think about shorting the stock, but given the strength of the current upward trend the best signal that trend is reversing would come from a drop below $16. That could be a good time to consider shorting the stock or buying put options, using $14.50 as a useful, early profit target on a bearish trade.