The market’s activity over the last couple of weeks, with the S&P 500 and NASDAQ pushing to highs above pre-pandemic levels, and the Dow within shouting distance of its own early 2020 highs, seems to be giving a lot of investors reason to believe broad conditions are better than they really are. While there certainly segments of the market that have managed not only to survive, but even thrive despite ongoing health concerns and the consequent economic pressures that persist, the truth is that wide swaths of the economy continue to operate at sub-optimal levels – or in the case of a number of small businesses, not at all.

One of the trends that a number of investors have gravitated to, and that overall I like, is to start differentiating between companies with the resources, demonstrated by healthy balance sheets, to weather economic storms. The longer economic pressures tied to the pandemic persist, ultimately the longer it will take businesses in a lot of industries to recover. I think that is especially true for stocks in the Consumer Discretionary sector. This is a sector that covers a lot of ground; but if you want to think about it in broad terms, think about the kinds of purchases you like to make when you have a little extra money. Restaurants and specialty retailers fall easily into that description, but that also extends to larger purchases, like vacations and weekend getaways, new cars, and much, much more. This is a sector that is seeing a lot of pressure as global shutdowns amid the health crisis brought consumer demand to a screeching halt, and that, even as economic activity has gradually started to increase, continue to operate at levels far below pre-pandemic levels.

Airline travel is an interesting barometer, I think for the kind of pressure some industries are likely to continue to see well into 2021. Air travel has begun to increase, but many of the most recent reports suggest that it is still around -70% below the levels U.S. airlines were seeing at the beginning of the year. Even the most optimistic airline executives don’t expect to see air travel demand return to pre-pandemic levels for two to three years, with the more conservative forecasts going out four to five. That long, extended path to recovery implies that pressure on other businesses, like resorts, cruise lines, and more will also have to take a very long view in managing their operations.

Walt Disney Company (DIS) is an interesting case in point. When you think about companies that are positioned to recover quickly once pandemic pressures pass and economic conditions return to normal, DIS is likely one of the first. globally recognized names that come to mind. The truth is that DIS is a multimedia conglomerate that is taking its share of lumps right now; parks and resorts have begun reopening on a limited-scale basis, but television and film studios remain in shutdown mode, and the company keeps pushing back studio release of titles it had scheduled for late summer. Its Disney+ streaming service is a lone bright spot in terms of growth right now, but the company’s massive capital investments in building that business mean that it won’t reflect positively on profitability until sometimes in 2024. Since the market hit bear-market bottom, however, the stock has rallied a little over 50% to its current level as investors have seemed to determined to bet a quick recovery and “back to normal” mode of operation. If you’re a growth investor, that could tempt you to think about jumping on the bandwagon – but what does that mean for a value-focused investor?

Fundamental and Value Profile

The Walt Disney Company is an entertainment company. The Company operates in four business segments: Media Networks, Parks and Resorts, Studio Entertainment, and Consumer Products & Interactive Media. The media networks segment includes cable and broadcast television networks, television production and distribution operations, domestic television stations, and radio networks and stations. Under the Parks and Resorts segment, the Company’s Walt Disney Imagineering unit designs and develops new theme park concepts and attractions, as well as resort properties. The studio entertainment segment produces and acquires live-action and animated motion pictures, direct-to-video content, musical recordings and live stage plays. It also develops and publishes games, primarily for mobile platforms, books, magazines and comic books. The Company distributes merchandise directly through retail, online and wholesale businesses. Its cable networks consist of ESPN, the Disney Channels and Freeform. DIS has a current market cap of $233.9 billion.

Earnings and Sales Growth: Earnings declined by a little over -94% over the last twelve months, while sales dropped almost -42%. In the last quarter, earnings were -86.6 lower, while sales declined by a little more than -34.5%. This pattern is also reflected in the company’s operating margins; over the last twelve months, Net Income was -1.58% of Revenues, and deteriorated even more in the last quarter, to -40.08%. This is a big red flag, and should continue to be cause for concern until Net Income returns to positive territory.

Free Cash Flow: Free Cash Flow was a little over $3 billion in the last quarter, and translates to a marginal Free Cash Flow Yield of 1.3%. In the quarter prior, it should be noted that Free Cash Flow was -$314 million. Most of the increase is attributable to increased borrowing to bolster the company’s cash reserves.

Debt to Equity: the company’s debt to equity ratio is .60, which is typically a very low number. Their balance sheet shows about $23.5 billion in cash and liquid assets versus almost $54 billion in long-term debt. At the end of 2019, DIS had $6.8 billion in cash and liquid assets against $38 billion in long-term debt. DIS’ negative Net Income means that they are spending more than they are bringing in right now, and while they have lots of cash to work with and help get through current difficulties it also means that their big cash position is all about survival right now rather than leveraging new opportunities for growth.

Dividend: DIS has suspending its dividend payout, which before the pandemic took effect was $1.76 per share on annual basis. There is no estimate right now about when a dividend might be reinstated.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $97 per share. That means that DIS is overvalued by about -25%, with its bargain price actually down at around $77 per share.

Technical Profile

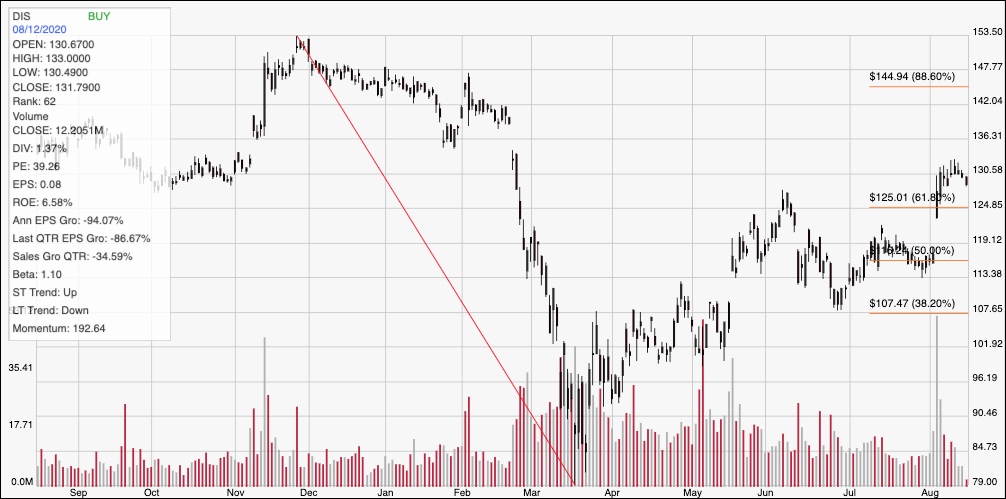

Here’s a look at the stock’s latest technical chart.

Current Price Action: The red diagonal line follows the stock’s decline from late December 2019 to its low point at around $79 in mid-March. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. In April, the stock pushed all the way to the 38.2% retracement line at about $107.50, and even pushed a bit above it before dropping back, but then got a big push to the 61.8% retracement line at around $125 before falling back again. At the beginning of August, and following the stock’s last earnings report, the market pushed the stock back above $125, with new resistance sitting at around $131, and the stock now just a couple of dollars below that point. Immediate support is back around $125. A push above $131 should give the stock room to rally to about $136 in the near-term based on a pivot low in January of this year, and additional room to about $145 where the 88.6% retracement line sits if bullish momentum remains strong. A drop below $125 gives the stock short-term room to fall to somewhere between $116 and $119 to next support, and additional room to around $107 where the 38.2% retracement sits.

Near-term Keys: On a strictly long-term perspective – and more specifically, over the next three to four years, I like DIS – but I don’t like it at its current price, especially under current market conditions and amid persistent questions about any kind of sustainable recovery from the pandemic. That means the best probabilities lie in short-term trades right now. If the stock can push above $131, you could consider buying the stock or working with call options, with an eye on $136 as a useful, quick-hit bullish profit target. A drop below $125 would be a strong signal to consider shorting the stock or working with put options, using $119 as a good profit target on a bearish trade.