In the early stages of the arrival and spread of COVID-19 in the United States, I wrote in this space about my belief that one of the best places a smart investor should focus their attention is on healthcare stocks, including companies in the pharmacy space. Vaccine commentary and speculation continues to be a daily element of the news cycle, with optimistic opinions suggesting something could be ready by the end of the year; but I believe developing both a vaccine against the virus as well as anti-viral medications that act as a bridge to a vaccine, and then making them broadly available will continue to be a mid-2021 event.

The reality is that states continue to struggle to manage reopening economic, civic, and social activity, so there remains a long road ahead before concerns about coronavirus, and its effects on individuals, families, and organizations of every type are behind us. On an individual level, that means that a big part of the onus is on each of us to see to our own well-being, and that of our loved ones. I think that means, at least in part, that pharmacies are going to continue to be star performers through the rest of the year. On a local level, much of the localized testing that will be available for COVID-19 will come from pharmacies like Walgreens Boots Alliance (WBA) and CVS Corp (CVS), to name just a couple. Along with that is the still, ever-present need to deal with everyday ailments and conditions. It’s pretty safe to say that if the pharmacy isn’t already a regular part of your daily life, it will be in the months ahead in one form or another.

CVS is a stock I’ve kept in my watchlist for years, and that has performed well since finding a bear market low in March around $52 per share. Much of that increase came as part of broad-based market momentum into the beginning of June, when the stock hit a hit point at around $70 per share before dropping back and consolidating in July between $65 and $62 per share. Following the stock’s latest earnings report, the stock has pushed above that range and appears to be setting a new, higher consolidation range. In the meantime, the company fundamental metrics continue to improve, showing the positive traction from ongoing efforts to integrate health insurer Aetna, which was acquired at the end of 2018 into its business organization. All together, the upshot is that CVS looks like an even better bargain now than it did a couple of months ago. If you aren’t already paying attention to this stock, you really should be.

Fundamental and Value Profile

CVS Health Corporation, together with its subsidiaries, is an integrated pharmacy healthcare company. The Company provides pharmacy care for the senior community through Omnicare, Inc. (Omnicare) and Omnicare’s long-term care (LTC) operations, which include distribution of pharmaceuticals, related pharmacy consulting and other ancillary services to chronic care facilities and other care settings. It operates through three segments: Pharmacy Services, Retail/LTC and Corporate. The Pharmacy Services Segment provides a range of pharmacy benefit management (PBM) solutions to its clients. As of December 31, 2016, the Retail/LTC Segment included 9,709 retail locations (of which 7,980 were its stores that operated a pharmacy and 1,674 were its pharmacies located within Target Corporation (Target) stores), its online retail pharmacy Websites, CVS.com, Navarro.com and Onofre.com.br, 38 onsite pharmacy stores, its long-term care pharmacy operations and its retail healthcare clinics. CVS has a market cap of $81 billion. Aetna Inc. is a diversified healthcare benefits company. The Company operates through three segments: Health Care, Group Insurance and Large Case Pensions. It offers a range of traditional, voluntary and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, medical management capabilities, Medicaid healthcare management services, Medicare Advantage and Medicare Supplement plans, workers’ compensation administrative services and health information technology (HIT) products and services. The Health Care segment consists of medical, pharmacy benefit management services, dental, behavioral health and vision plans offered on both an Insured basis and an employer-funded basis, and emerging businesses products and services. The Group Insurance segment includes group life insurance and group disability products. Its products are offered on an Insured basis. CVS has a market cap of $85.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings for CVS improved by almost 40%, while sales growth was narrower, but rose 3%. In the last quarter, earnings were about 38% higher, while sales were somewhat negative, by -2.12%. CVS’ margin profile is narrow, but also gradually improving; over the trailing twelve months, Net Income as a percentage of Revenues was 3.13% (versus 2.76% for the same period a quarter ago), and 4.55% in the last quarter (versus 3.01% in the quarter prior).

Free Cash Flow: CVS’s free cash flow is healthy and continues to improve; over the trailing twelve month period this number was $13.6 billion – an increase from $11.7 billion for the same period in the quarter prior and $8.4 billion in April of 2019. The current figure translates to a Free Cash Flow Yield of 15.86% – a significant improvement from early 2019 when it was 7.28%.

Debt to Equity: CVS has a debt/equity ratio of 1.2. This is higher than I usually prefer to see, but is primarily attributable to the massive increase in debt the company preemptively took on at the end of 2018 when its merger with insurer Aetna was first announced. CVS also took on additional, incremental debt at the beginning of the current pandemic to shore up its cash reserves. Total long-term debt is about $82.1 billion, while cash and liquid assets are about $17.4 billion (versus $12.7 billion in the last quarter, and 6.5 billion in March of 2019). By standard measurements, the company’s liquidity comes into question; however CVS has also laid out an aggressive debt reduction program that they expect will lower the total debt the combined company will be working with to much more conservative levels by 2022. Management has also suspended dividend increases and share repurchase programs for the time being while they work on debt reduction. Along with indications that integration efforts associated with combining two very distinct enterprises with each other are gaining traction, I believe it is safe to say that the company should have no problem servicing their debt.

Dividend: CVS pays an annual dividend of $2.00 per share. At the stock’s current price, that translates to a dividend yield of about 3.08%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $97 per share. It’s worth mentioning that just a quarter ago, my Fair Value target was just a little below $95 per share. That means the stock is trading at a massive discount, with 49% upside from the stock’s current price.

Technical Profile

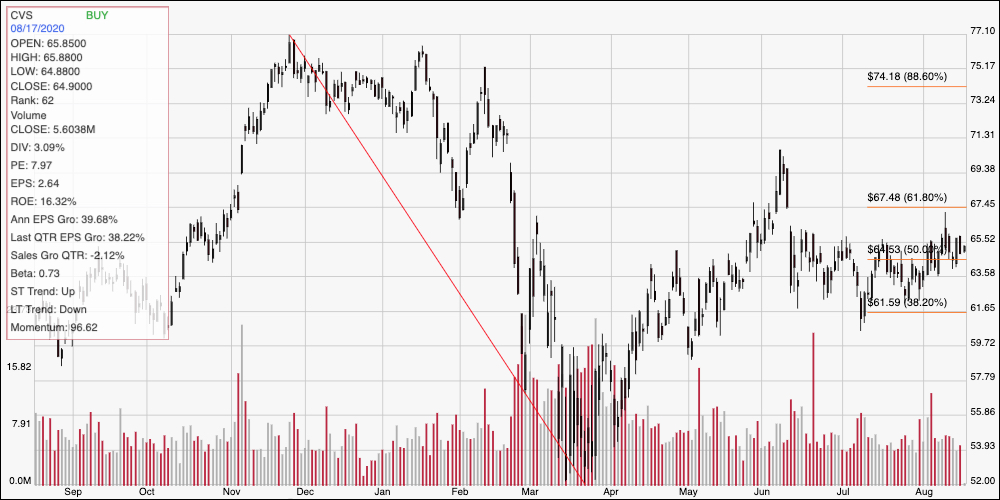

Here’s a look at CVS’ latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line marks the stock’s downward trend from November 2019 to March of this year. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. Throughout July, the stock hovered in a range between the 38.2% and 50% retracement lines before breaking above resistance at around $64.53 at the beginning of August. From that point, the stock hasn’t managed to surge much higher, but instead appears to be setting a new consolidation range, with support at around $64.50 and resistance around $66. A break above $66 has very short-term upside to about $67.50 where the 61.8% retracement line rests, with additional upside to about $70 where the stock peaked in early June. A drop below $64.50 has downside to about $61.50 where next support lies inline with the 38.2% retracement line.

Near-term Keys: If you prefer to work with short-term trading strategies, the best opportunity on the bullish side would come from a push above $67.50; that would be a good signal to buy the stock or work with call options with an eye on $70 as a near-term target. A bearish signal would come from a drop below $64.50; in that case you could consider shorting the stock or buying put options, using $61.50 as a good bearish profit target. The stock’s value proposition is extremely attractive, and from a long-term perspective, I think continues to offer one of the best value opportunities in the stock market right now.