I seem to be noticing a new trend, not just among average consumers and investors, but even among people that I think should be hard-wired to know better, and that’s a desire to just write off 2020 and hit the reset switch. A lot of the commentary and debate among talking heads and market news media types lately seems to be following the lead being set by the major market indices; the NASDAQ and S&P 500 keep pushing to new highs, and the Dow seems to be creeping closer and closer each day to carving out a new 52-week high of its own. That seems to be giving people plenty of justification to look ahead and start speculating about how much momentum the market is going to have in 2021. The problem with that mindset is that it doesn’t stop to consider some significant underlying risks that remain.

The disconnect between Wall Street and Main Street – which is how experts generally like to distinguish between big, corporate America and small business America – seems to be getting wider all the time. While the unemployment rate in the United States has dropped, for example from its April high at 14.7% to 10.2% in July, it remains almost triple the 3.5% reported for February before the pandemic struck. It isn’t clear how accurate this number actually is, however because many people are being classified as employed even though they aren’t actually working. And the fact is that where the biggest slices of jobs have been lost, and may never come back, is in small, local and regional businesses. The market also seems to be taking a queue today from weekend news about emergency use authorization of a convalescent plasma treatment for COVID using plasma donated by people who have recovered from the virus, along with indications that infections across the country are dropping, which is positive; however there are still big questions that remain about how effective the plasma treatment truly is, and the reality that it is not a silver bullet for all cases. Infection rates have also proven to be fluid since the pandemic arrived on American shores, and so while declines are encouraging, they don’t signal an end to the need for high levels of caution.

All of this doesn’t mean there is a lack of opportunities to work with – even as a lot of stocks have rallied significantly off of their own bear market bottoms, there remain a lot of them out there that still offer some interesting value opportunities. As we’ve moved a couple of quarters past the initial, massive impact of broad economic shutdowns in virtually every sector of the global economy, we’re starting to see clear distinctions between companies that have been able to absorb those initial blows and are still standing, and those that might not have the resources needed to survive. And even as stocks in the Healthcare sector have gotten a lot of attention – especially those dealing directly with COVID treatment and vaccine development – there are a number of others that still offer some interesting opportunities.

I think that Bristol-Myers Squibb Company (BMY) is a stock that fits the profile I’m describing. From its own bear market low, the stock has rebounded by more than 36%, and is only about -9% below its January high around $68. A big part of the stock’s surge, I think can be attributed to the pharmaceutical industry’s resilience this year as one of the market’s few bright spots during the initial part of the health crisis. In November of last year, the company completed the acquisition of Celgene, which helped to boost the stock’s intrinsic value in a BIG way. Even with the impact of the last couple of quarters on operations, the company still boasts an excellent balance sheet, one of the strongest, long-term development pipelines in the Pharmaceutical industry dovetailing with what I think will inevitably be an increased level scrutiny and attention – appropriately so, and in the long run, to our collective benefit – on proper health and care on an individual level. I think this could be one of the smarter areas to pay attention to if you want to keep your money working for you right now. Let’s run the numbers.

Fundamental and Value Profile

Bristol-Myers Squibb Company is engaged in the discovery, development, licensing, manufacturing, marketing, distribution and sale of biopharmaceutical products. The Company’s pharmaceutical products include chemically synthesized drugs, or small molecules, and products produced from biological processes called biologics. Small molecule drugs are administered orally in the form of a pill or tablet. Biologics are administered to patients through injections or by infusion. The Company’s products include Empliciti, Opdivo, Sprycel, Yervoy, Eliquis, Orencia, Baraclude, Hepatitis C Franchise, Reyataz Franchise and Sustiva Franchise. It offers products for a range of therapeutic classes, which include virology, including human immunodeficiency virus (HIV) infection; oncology; immunoscience, and cardiovascular. Its products are sold to wholesalers, retail pharmacies, hospitals, government entities and the medical profession across the world. BMY has a current market cap of $139.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by more than 38%, while sales increased nearly 61.5%. In the last quarter, earnings dropped by -5.23% while sales were -6.05% lower. BMY’s Net Income versus Revenue pattern is a concern; over the last twelve months this number was -1.61%, which is not impressive, but improved somewhat in the last quarter to -0.84%. That doesn’t sound encouraging, I know, but it also marks progress from the last quarter when Net Income versus Revenues in the three months prior was more than -7%. I attribute the biggest portion of that shift to the transitory period required to integrate two huge operations, Bristol-Myers and Celgene, into a single company. Add to the mix the complication of the pandemic, and I think that while the negative numbers are important, it is also something that will show continue to show improvement in the quarters ahead. Another reflection of this fact is that at the end of 2019, Net Income versus Revenue for the prior three months was -13%.

Free Cash Flow: BMY’s Free Cash Flow is healthy, at nearly $12 billion. That translates to a Free Cash Flow Yield of 8.53%. That is also a significant increase from the last quarter, when Free Cash Flow was about $9.75 billion, and $7.2 billion at the end of 2019.

Debt to Equity: BMY has a debt/equity ratio of .85, which is generally conservative and indicates the company has a disciplined approach to debt management. As of the last quarter, cash and liquid assets were an impressive $21 billion (a continued increase from $18.3 billion in the quarter prior, and $3 billion from the end of 2019) versus $41.85 billion in long-term debt. Pre-merger, BMY had just $5.3 billion in debt versus more than $8 billion in cash; however management as well as most analysts predicted the deal would be immediately accretive; so far that appears to be the case, which means the high debt level continues to be more than serviceable.

Dividend: BMY pays an annual dividend of $1.80 per share, which at its current price translates to a dividend yield of about 2.89%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $118 per share, which means that BMY is massively undervalued, with more than 91% upside from its current price.

Technical Profile

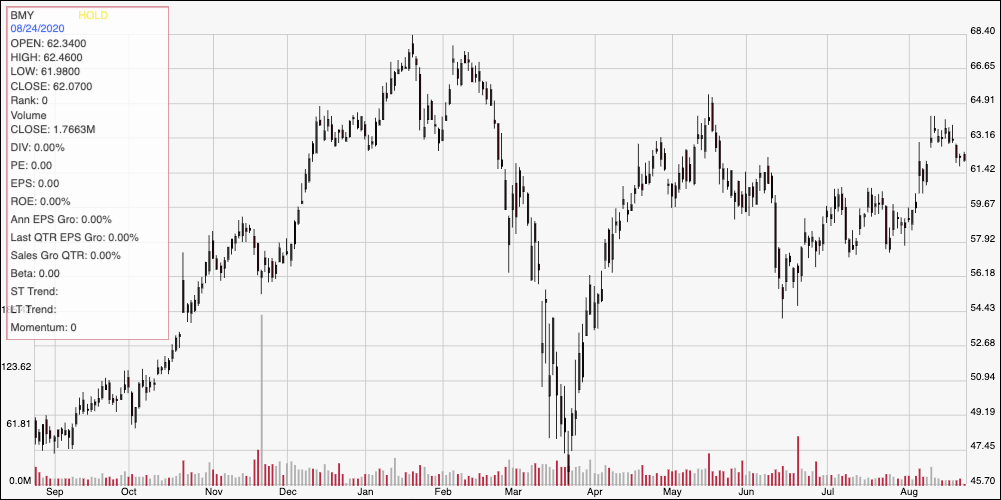

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for BMY. The stock’s rise off of its bear market low in March is clear; but more interesting is the stock’s pattern since June. BMY hit a mid-June low around $56 before picking up bullish momentum, driving to a high a a little above $63 early in August. The stock has retraced a bit from that high point, but is nearing support around $61.50. Immediate resistance is actually around $64.50, based on the stock’s June peak; a push above that price should give the stock room to test its 52-week high around $68.50, with additional room into the mid-$70’s if bullish momentum continues. A drop below $61.50 could see the stock find next support at around $59.50, or $58 if bearish momentum picks up.

Near-term Keys: The only red flag in BMY’s fundamental profile is the negative Net Income pattern; that is significant, and something to pay attention to, but I also remain convinced that is a reflection of the net, temporary effect of integrating Celgene into its organization. The improvement in this measure from the quarter prior is also encouraging. The stock is only about 9% away from its 52-week high, but given the underlying fundamental strength, I still think the stock offers a fantastic value proposition. If you prefer to focus on short-term trading strategies, a pivot to the upside off of current support could offer a signal to consider buying the stock or working with call options, using $65 as a near-term profit target and $68.50 if bullish momentum strengthens. A drop below $61.50, on the other hand could offer a good signal to think about shorting the stock or working with put options with an eye on $58 as a useful price target on a bearish trade.