In my search for value, I’ve found it useful to develop a watchlist of stocks that I can check on a regular basis. That means that I often recycle stocks that I’ve previously used to make useful investments in, but don’t currently have a position in. That’s useful, because the familiarity that comes with the company and its approach builds a shorthand that I think can help to make the analysis process more efficient. As changes happen over time, it also helps to provide a historical context that aids perspective about current events and changes.

One of the drawbacks, however is that familiarity can also make it easier to gloss over troubling information. The burden on any investor, no matter what your approach may be, is to make your investing decisions as objective and systematic as possible. If you’ve been following a company for a while, it’s natural to start forming an emotional connection with it, or with the management team in one form or another. I think it’s part of the reason that we gravitate to the same brands and products in our personal lives; after a while, the familiarity of that product makes it easier to stick with it. As an investor, I think that can be a risk, because just as the economy ebbs and flows from prosperity to austerity, all companies experience their own ebb and flow in their business models. That also means that as an investor, there are times where even the companies you like the best won’t represent smart investing opportunities.

Westlake Chemical Corporation (WLK) is an example of a stock I’ve followed for a while and have used for some very productive investing opportunities, and that I like quite a bit. Technically speaking, the stock has interesting set up, having reversed a long downward trend that found its bottom in March with the rest of the market and started a nice, intermediate-term upward trend from that point. WLK’s niche in the Chemicals industry is driven primarily by the housing market. Recent reports suggest that, as pandemic-imposed restrictions are loosened and economic activity continues to resume, new home purchases are also starting to pick up from their own previous lows. This morning’s numbers, in fact, suggest that housing demand is even higher than analysts predicted, which means that stocks tied to housing could have a nice headwind to propel their businesses forward for the rest of the year.

While unemployment numbers remain high, their overall trend is continuing to move lower, implying that as economic activity resumes throughout the country, improving employment numbers – even gradual ones – could provide another useful tailwind for homebuilders and the companies that support them. This is true both for new homes as well as existing homes, as existing homeowners will probably be more likely to invest in home improvement projects. WLK is one of the biggest producers of PVC products, which are driven primarily by new home starts, but also by improvement projects in existing homes. While the effect of COVID-19 is going to persist through the rest of the year at least, and even into 2021, the company’s most recent earnings reports suggest that so far WLK has weathered the storm better than most. Even with the stock’s big increase (the stock has more than doubled in value from its bear market bottom), WLK also continues to offer an attractive value proposition that makes it worth paying attention to.

Fundamental and Value Profile

Westlake Chemical Corporation is a global manufacturer and marketer of basic chemicals, vinyls, polymers and building products. The Company’s products include a range of chemicals, which are fundamental to various consumer and industrial markets, including flexible and rigid packaging, automotive products, coatings, water treatment, refrigerants, residential and commercial construction, as well as other durable and non-durable goods. Its segments include Olefins and Vinyls. It manufactures ethylene (through Westlake Chemical OpCo LP (OpCo)), polyethylene, styrene and associated co-products at its manufacturing facility in Lake Charles and polyethylene at its Longview facility. The Company’s products in its Vinyls segment include polyvinyl chloride (PVC), vinyl chloride monomer (VCM), ethylene dichloride (EDC), chlor-alkali (chlorine and caustic soda) and chlorinated derivative products and, through OpCo, ethylene. It also manufactures and sells building products fabricated from PVC. WLK’s current market cap is $7.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -88%, while revenues dropped by -20.29%. In the last quarter, earnings dropped about -83%, while sales were -11.5% higher. The company’s margin profile is narrow, and has narrowed in the last quarter; Net Income was 5.14% of Revenues for the last twelve months, and dropped to 0.88% in the last quarter.

Free Cash Flow: WLK’s free cash flow is generally healthy, at $676 million. This measurement has deteriorated since a peak above $1 billion in the third quarter of 2018, but is significantly higher than the quarter prior, when Free Cash Flow was $467 million. This also acts as an interesting counter to the company’s Net Income pattern. Its current level translates to a Free Cash Flow Yield of 9.32%.

Debt to Equity: WLK’s debt/equity ratio is .64, which is conservative and implies the company takes a careful approach to debt management, and decreased from .64 in the quarter prior. WLK’s cash and liquid assets in the last quarter were about $1.1 billion while long-term debt was about $4.12 billion. While WLK’s operating profile indicates they should have no problem servicing their debt, a continued deterioration of Net Income could present challenges in the quarters ahead.

Dividend: WLK pays an annual dividend of $1.08 per share, which translates to a dividend yield of about 1.81% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $85 per share. That means that WLK is significantly undervalued, offering about 41% upside from its current price. It is also worth observing that over the last three quarters, my fair value target for WLK has increased from $69 to $74 to $85. Few companies under current conditions are providing steady improvement in this measurement, which puts WLK in select territory right now.

Technical Profile

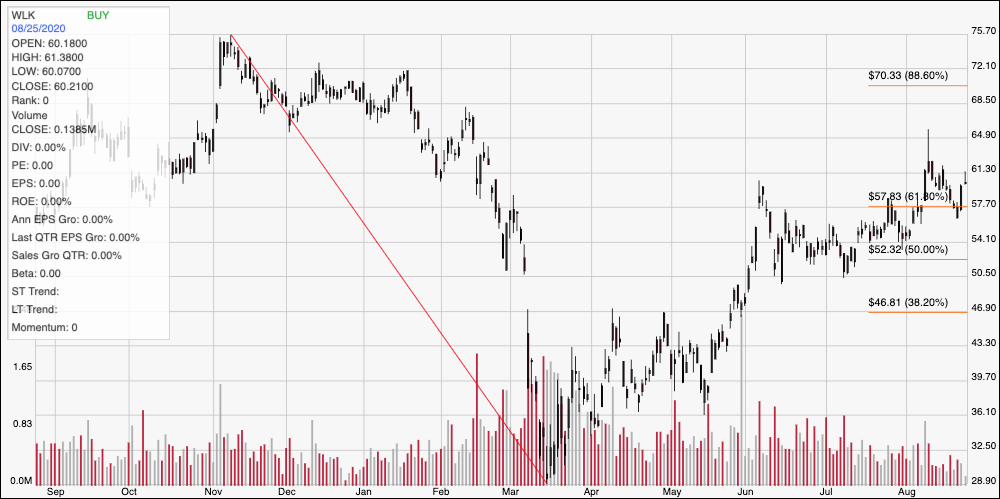

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s downward trend from May of 2018 to its bear market low around $29 in March; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock increased sharply into early April, stabilizing between $45 and $39 until mid-May, when bullish momentum picked up again, driving the stock past the 38.2% and 50% retracement line and briefly pushing above resistance at the 61.8% retracement line around $58. The stock then retraced a bit into a consolidation pattern between the 50% and 61.8% retracement lines until the beginning of August, when it pushed above resistance at $58. After hitting new trend high around $62, the stock dropped back to support, but has bounced higher this week. A push above $62 should give the stock room to keep rallying to next resistance between $68.50 and $70, where the 88.6% retracement line waits. A drop below support at $58 should see next support between $52, where the 50% retracement line sits, and $54.

Near-term Keys: WLK’s fundamentals, which are generally showing useful signs of improvement, lend credence to the stock’s solid value proposition. If you’re willing to accept some volatility associated with the reality that we still aren’t out of the woods when it comes to COVID-19 – either from the standpoint of health risk or continued potential negative economic impact – this is a stock that continues to be worth paying attention to. If you’re looking for a short-term trade, I think there could be a good signal to think about buying the stock or working with call options if the stock can push above $62, with some nice short-term room to look at $68 as a useful exit target. If the stock drops below $58, consider shorting the stock or buying put options, with $54 acting as the first profit target on a bearish trade.