Even before the coronavirus pandemic started to take down entire sectors of the economy beginning in February, the Auto industry was experiencing quite a bit of bearish pressure. Sales were down globally, reflecting economic slowing in various parts of the world as well as the effects of an extended trade war between the U.S. and China that held investor’s attention through most of 2018 and all of 2019. The completion of a Phase One trade deal in late 2019 seemed to give reason for optimism that a turnaround for the industry was just around the corner – until the global economy ground to a halt amid massive quarantine and shelter-in-place orders that closed down businesses and sent consumers home to limit the spread of COVID-19. The news hasn’t really gotten better since then, even as economic activity gradually increases; consumer confidence numbers remain generally low as unemployment numbers hold above 10% nationally.

The Auto industry took its lumps from February to March like every other sector did, and has rallied from that point more than 100% higher as measured by the NASDAQ Global Auto Index Fund ETF (CARZ). Most of that move, presumably is being fueled primarily on hopes that as economic activity continues to increase while still dealing with pandemic issues, consumer demand would increase. If you watch TV, you see just about every auto manufacturer offering big incentives to trade in your existing vehicle and buy a new one right now, so clearly the industry is making the same bet. Whether or not that plays out as hoped, of course, remains to be seen.

BorgWarner Inc. (BWA) is an example of a U.S. company that provides parts and services to major auto manufacturers. At the beginning of this year, the company also announced it had entered into an agreement to acquire Delphi Technologies, which gives the company exposure and opportunity in hybrid and electronic vehicles, where media buzz and many growth forecasts are the highest. BWA agreed to pay $3.3 billion for the deal, which is a big price, and depending on the analyst, could be an onerous premium to pay to gain entry into this segment. The stock began a strong downward trend in November of 2019, dropping from a peak at around $47 to a March low at around $17 per share. The remarkable thing about BWA is that while the pandemic has absolutely had an impact on the company, its last couple of earnings reports show that the company has so far actually managed to absorb the initial blow better than most. The stock has rallied by a factor of a little less than 2.5 times above that $17 low; however, given the industry’s slim prospects for growth in 2020 and 2021 according to most forecasts, and the spectre of continued high levels of unemployment into 2021, it begs the question: does BWA still offers a useful value opportunity, or is this a bad time to bet on a stock that has already made a big move this year?

Fundamental and Value Profile

BorgWarner Inc. is engaged in providing technology solutions for combustion, hybrid and electric vehicles. The Company’s segments include Engine and Drivetrain. The Engine segment’s products include turbochargers, timing devices and chains, emissions systems and thermal systems. The Engine segment develops and manufactures products for gasoline and diesel engines, and alternative powertrains. The Drivetrain segment’s products include transmission components and systems, all-wheel drive (AWD) torque transfer systems and rotating electrical devices. The Company’s products are manufactured and sold across the world, primarily to original equipment manufacturers (OEMs) of light vehicles (passenger cars, sport-utility vehicles (SUVs), vans and light trucks). The Company’s products are also sold to other OEMs of commercial vehicles (medium-duty trucks, heavy-duty trucks and buses) and off-highway vehicles (agricultural and construction machinery and marine applications. BWA has a current market cap of about $8.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased -114%, while revenues slid -44%. In the last quarter, earnings declined a little over -118% while the decrease in sales was not quite -37.5%. The company’s margin profile has been narrowing, which isn’t surprising given broader industry trends right now; over the last twelve months Net Income as a percentage of Revenues was 5.08%, and slipped into negative territory at -6.87% in the last quarter.

Free Cash Flow: BWA’s free cash flow is adequate, at $460 million over the last year; however this number declined from about $750 million in the quarter prior. The current number translates to a modest Free Cash Flow Yield of 5.34%.

Debt to Equity: A has a debt/equity ratio of .58. This is a very manageable number, that suggests the company should have no trouble servicing their debt. Their balance sheet shows $2 billion in cash and liquid assets against about $2.7 billion in long-term debt. These numbers jumped noticeably in the last quarter as BWA assumed more than $1 billion in additional debt ahead of finalization of its Delphi acquisition.

Dividend: BWA’s annual divided is $.68 per share and translates to a yield of 1.64% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $47 per share. That means that BWA is undervalued by 15% from its current price around $40.76.

Technical Profile

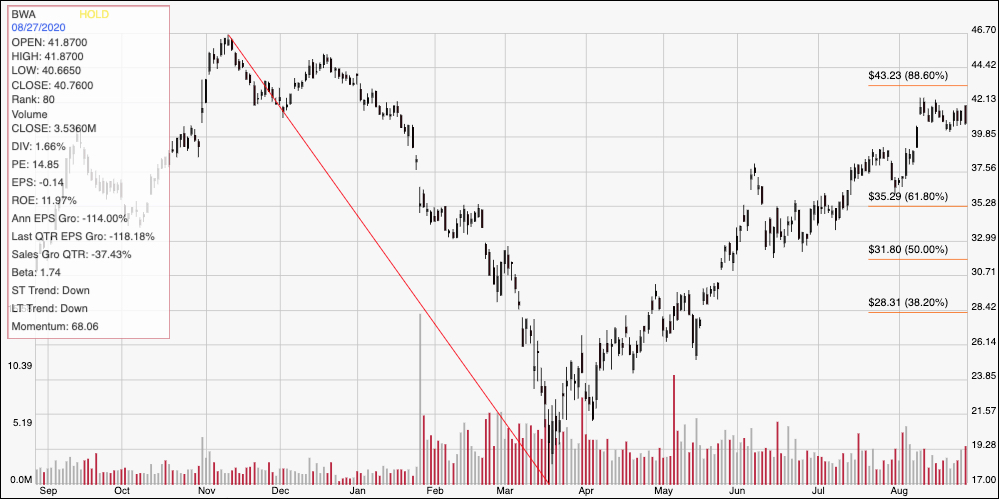

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s downward trend since November 2019, and also informs the Fibonacci trend retracement lines shown on the right side of the chart. Since bottoming in Marc at around $17, BWA has staged an impressive upward trend, pushing above every retracement line except the 88.6% line, which is offering top-end resistance right now a little above $43. If the stock can break above that level, it should test the stock’s 52-week high from November 2019 near $47. Immediate support is around $38, based on resistance in July that the stock broke above earlier this month. A drop below that price should see the stock slide back to at least the $35 level, inline with the 61.8% retracement line.

Near-term Keys: BWA’s upward trend since March is impressive and makes for tempting fodder for growth-oriented investors to look for an entry point. While the company’s balance sheet remains healthy despite industrywide challenges, the fact is that Net Income has turned negative, and Free Cash Flow is declining. That is enough of a concern to distrust the stock’s remaining value proposition right now, which means that if you want to work with this stock, the best probabilities lie in short-term trades. Use a break above $43 to think about buying the stock or using call options, with the stock’s 52-week high around $47 acting as a good profit target. A drop below $38 could be a good signal to consider shorting the stock or working with put options, using $35 as a good initial profit target on a bearish trade.