The question of what sector of the market is the best place to put your money to work is a constant, never-ending quest no matter what current market or economic conditions are. That’s because not all segments of the economy thrive or struggle under the same conditions. The pandemic we’ve all been trying to understand all year long is a great example, because while some, predictable segments have struggled (Consumer Discretionary, Energy, and Financials come quickly to mind), others, like Technology and Health Care, have done surprisingly well.

The natural temptation if you’re using the performance of one sector versus another to inform your investing decisions is to gravitate to the top-performing sectors; it’s a reasonable variation of the trend-following mindset that “a rising tide lifts all ships.” As a value-oriented investor with more than a little bit of a contrarian bent, however, I often find myself looking at out-of-favor sectors to find good companies that offer terrific value.

The caveat to that process is the first description, “good company.” Out of favor sectors often fall into that status because of broad-based concerns facing the entire sector, and so you have to go into it understanding that the simple fact that a stock may be trading significantly lower than it has been doesn’t automatically mean that it also offers a great value. In these kinds of cases, even many of the largest, most established names in a sector or industry can struggle with issues that can take months, or sometimes even years to resolve.

Why bother with the process at all? Because out of what may appear to be nothing but negative news and information, sometimes you’ll find a company that stands out. They might happen to occupy a specialized niche that gives them an unexpected advantage, even under broad-based, difficult conditions; or they may simply be positioned to use those difficult conditions to capture market share while weaker competitors falter.

Pandemic-induced conditions this year have worked strongly against a lot of stocks in the Retail and Specialty Retail industries of the Consumer Discretionary sector – and as it relates to those that specialize in apparel, that’s really just piling on, as many of these companies were already struggling to navigate changing conditions resulting from consumer shifts toward online-focused shopping and away from traditional, brick-and-mortar stores and shopping malls. That trend isn’t likely to get better, even if economic recovery leads to an increase in consumer discretionary purchases; a recent report predicts more than half of department stores anchoring malls in the U.S. will close by 2020 year end.

That brings us to today’s stock highlight. PVH Corp (PVH) is is one the world’s largest apparel companies, offering a wide assortment of merchandise Sub-Industry Apparel, Accessories and Luxury Goods under the Calvin Klein, Tommy Hilfiger and Heritage brands, among others – and a company that has historically relied primarily on department stores to drive revenue. Reopened stores so far across the world have shown nice productivity numbers under current conditions; but stoppages earlier in the year put a big glut in inventory on retailer’s shelves that isn’t anticipated to see material improvement for the rest of the year.

PVH’s stock has rebounded more than 50% from its bear market low in March, and about 17.5% in the last month, primarily because of the productivity improvements I just mentioned; but even with those improvements, the stock remains down more than -50% below its January highs around $108, and down -45.5% year to date. There are elements of PVH’s fundamental profile that look very attractive, including a generally healthy balance sheet that make it likely to survive pandemic-induced slowdowns; but other patterns that should be taken as a warning. Is the net result a stock that offers incredible value right now, or is it a bad risk?

Fundamental and Value Profile

PVH Corp. is an apparel company. The Company operates through three segments: Calvin Klein, which consists of the Calvin Klein North America and Calvin Klein International segments; Tommy Hilfiger, which consists of the Tommy Hilfiger North America and Tommy Hilfiger International segments, and Heritage Brands, which consists of the Heritage Brands Wholesale and Heritage Brands Retail segments. The Company’s brand portfolio consists of various brand names, including Calvin Klein, Tommy Hilfiger, Van Heusen, IZOD, ARROW, Warner’s, Olga and Eagle, which are owned, and Speedo, Geoffrey Beene, Kenneth Cole New York, Kenneth Cole Reaction, Sean John, MICHAEL Michael Kors, Michael Kors Collection and Chaps, which are licensed, as well as various other licensed and private label brands. The Company designs and markets dress shirts, neckwear, sportswear, jeanswear, intimate apparel, swim products and handbags, footwear and other related products. PVH has a current market cap of $4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased about -223%, while sales dropped -43%. In the last quarter, earnings were -261% lower, while revenues declined -48.3%. The company’s margin profile, which before the pandemic reached U.S. shores was a source of strength, is not a big red flag; over the last twelve months, Net Income was -8.56% of Revenues, but plunged to -81.6% in the last quarter. These numbers imply the company is dealing with a lot of stress on its balance sheet right now.

Free Cash Flow: PVH’s Free Cash Flow is healthy, at $685.2 million. This is a number that is remarkably resilient, given that it was $696 million at the end of 2019 and a little more than $372 million in the final quarter of 2018. That is attributable at least in part to increases in borrowing to increase cash, which is described next. PVH’s current Free Cash Flow number translates to a Free Cash Flow Yield of 16.85%.

Debt to Equity: PVH has a debt/equity ratio of .96, which is generally a pretty conservative number, but increased from .73 earlier this year. Their balance sheet shows $800.7 million in cash and liquid assets against $2.85 billion of long-term debt. Their negative Net Income pattern suggests that management is using cash to service its debt; but that is a pattern that can hold for so long, and the longer Net Income remains negative, the more problematic this could become.

Dividend: PVH suspended its dividend payments in April, with no indication when it expects to resume.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $98 per share. That imples PVH is massively undervalued, by 76% from its current price around $56.

Technical Profile

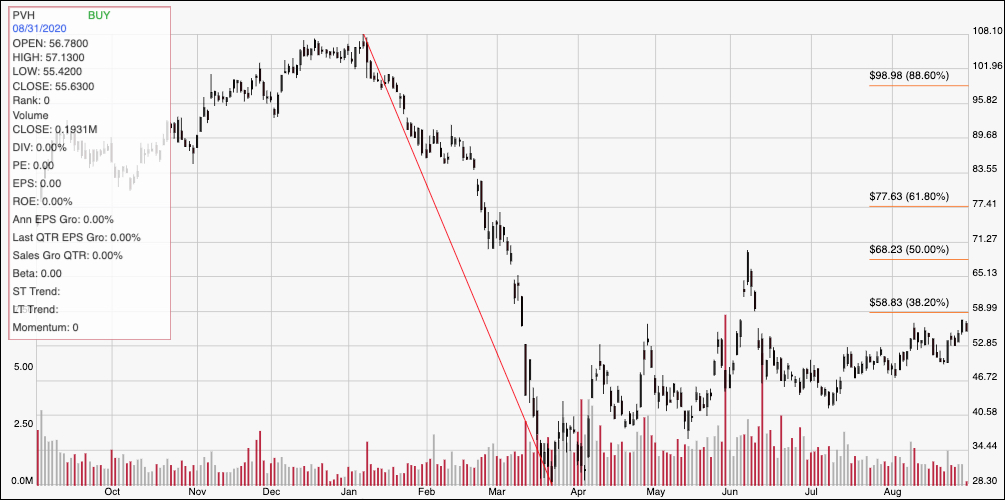

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart displays the last twelve months of stock performance for PVH. The diagonal red line traces the stock’s bear market plunge to a low around $28; it also provides the baseline for the Fibonacci retracement lines on the right side of the chart. From that low, the stock has begun an impressive upward trend that has the stock almost 2x above its March low. In the last month it has approached resistance shown by the 38.2% retracement line at around $59 on two different occasions, and is now about $3 below that level. A push above that line should give the stock room to rally to about $68, which is roughly inline with the stock June peak as well as the 50% retracement line. Immediate support is between $51 and $49, based on pivot activity in that region over the last month. A drop below $49 could see the stock fall to about $42, marking its pivot in July.

Near-term Keys: While I think PVH will be better positioned than many other Specialty Retail companies to ride out current economic conditions, the company’s Net Income pattern is too troubling to say that the value proposition is to be believed right now. That could change when consumer trends shift back into the favor of apparel companies, but I would prefer to see PVH’s Net Income pattern begin to improve, and possibly return to positive territory to confirm that reality before taking the bargain argument seriously. Until then, the best probabilities for PVH lie in short-term trades; use a push above $59 as a signal to buy the stock or work with call options, with a near-term target at around $68. A drop below $49 would be a strong signal to consider shorting the stock or to buy put options, using $42 as a nice bearish profit target.