Markets are naturally cyclical – they swing from high to low and back again on a consistent, if unpredictable basis over a range of time frames. The different time periods associated with any given cycle, or sometimes even the depth of a certain cycle’s direction, can shade the casual investor’s perception about a stock’s opportunity. The most recent major bull market, which extended itself over a more than ten-year time period is good example; because of both the unprecedented time period that market’s bullish run covered, and even more particularly the higher-than-average runs that run covered during its last couple of years, a lot of the average investors made the mistake of assuming that the market would simply continue that run.

Moving into the final quarter of 2020 and looking back is an interesting exercise right now. It’s unusual to be able to describe two major shifts in market momentum in a single year; this year, we saw the market plunge to bear-market lows in less than a month from February to March, with global economic activity grinding to a screeching halt as governments in almost every country imposed strict quarantine and shelter-in-place restrictions in an effort to contain the spread of COVID-19. That slide downward coincided with broad-based concerns not only about how long the pandemic would last, but also how long we would all be forced to follow those restrictive, self-isolation guidelines.

While concern about the pandemic hasn’t decreased – spikes in infections are still an issue throughout the U.S. – economic activity began to resume in the early spring. It has become more apparent that we are going to simply have to get used to living in a world where coronavirus remains a threat and a concern – especially since even the most optimistic medical and scientific professionals in the world aren’t expecting to see any practical vaccines until 2021 at the absolute earliest, and very possibly until 2022. Even anti-viral treatments, which can be used to treat the worst symptoms to help infected patients battle through the virus are not expected to be available in a practical sense until next year. That’s true despite news that some treatments have been given emergency use authorization for extreme cases, and more could be coming for other candidates currently in late-stage clinical trials.

The next major shift in market momentum this year has come as the market has rebounded strongly from that late March, bear-market bottom; the NASDAQ 100 and S&P 500 both pushed above pre-pandemic highs, and the Dow is now only a little off of its February highs. Those moves have marked the quickest recovery from bear market conditions in history, just as the initial drop marked the most rapid drop to a bear market in recorded history. The rally has sent a lot of sectors higher as well, with a wide range of stocks reclaiming 50% or more of their recent declines. That makes the market tempting fodder to start assuming that the good times are back again – but as I just mentioned, there are a lot of risks that remain. That doesn’t mean you should be bearish on the market right now – but you should absolutely be very cautious about taking on new positions.

Oshkosh Corporation (OSK) is a good example of what I mean. The stock dropped more than -50% below its highest point around $95, with the lion’s share of that decline coming as global coronavirus fears took hold. From its own bear market bottom, the stock almost doubled in price to a June peak at around $85 high before dropping back again. Since mid-July, the stock has consolidated in a range between roughly $80 and $76 per share – setting the stage for what could be a new push high to possibly retest pre-pandemic highs, or a drop back to lower levels. Most economic forecasts expect the U.S. economy to continue to improve through the rest of the year even while we continue to manage the reality of continued pandemic-related conditions, with even more growth anticipated in 2021 as the health crisis is expected to abate. Where does that put OSK – at a level that is a good set up for continued growth, or at the teetering edge a new drop in price? Let’s look at their fundamentals and see if we can decide.

Fundamental and Value Profile

Oshkosh Corporation (OSK) is a designer, manufacturer and marketer of a range of specialty vehicles and vehicle bodies, including access equipment, defense trucks and trailers, fire and emergency vehicles, concrete mixers and refuse collection vehicles. The Company’s segments include Access Equipment; Defense; Fire & Emergency, and Commercial. The Access Equipment segment consists of the operations of JLG Industries, Inc. (JLG) and JerrDan Corporation (JerrDan). The Defense segment consists of the operations of Oshkosh Defense, LLC (Oshkosh Defense). The Fire & Emergency segment consists of the operations of Pierce Manufacturing Inc. (Pierce), Oshkosh Airport Products, LLC (Airport Products) and Kewaunee Fabrications LLC (Kewaunee). The Commercial segment includes the operations of Concrete Equipment Company, Inc. (CON-E-CO), London Machinery Inc. (London), Iowa Mold Tooling Co., Inc. (IMT) and Oshkosh Commercial Products, LLC (Oshkosh Commercial). OSK has a current market cap of about $5.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -52.5%, while revenues decreased almost -34%. In the last quarter, earnings increased by 3.2% while sales dropped -12%. The company’s operating margin has managed to be pretty stable, notwithstanding broad conditions this year; over the last twelve months, Net Income was about 5.15% of Revenues, and declined only slightly in the last quarter, to 5.07%. High demand in the company’s defense-related vehicles has provided a useful cushion to declines in their commercial business. Both are expected to grow in 2021.

Free Cash Flow: OSK’s free cash flow is adequate, at about $334.3 million. This number marks an improvement from the last quarter, which was $308.5 million, but is also below its level at the end of 2019, when it was around $400 million.

Dividend: OSK’s annual divided is $1.20 per share, which translates to a yield of about 1.52% at the stock’s current price. That also marks an increase from $.96 per share, per annum around the middle of 2018.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at about $92 per share. That means the stock is trading at a modest, but still interesting discount, with 17% upside from the stock’s current price.

Technical Profile

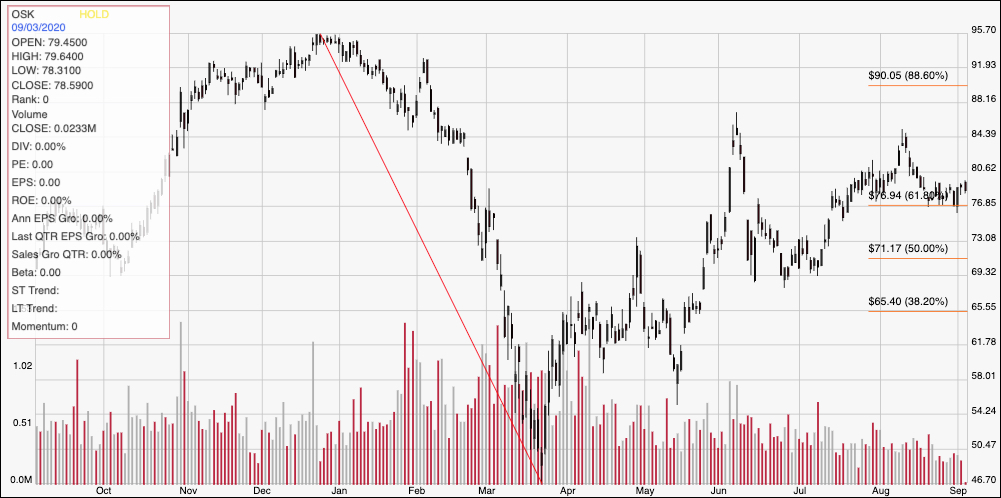

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s downward trend from its peak at around $95 at the beginning of the year to its low in March at around $47; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock rallied strongly into June before dropping back below the 50% retracement line. The beginning of July saw the stock push higher again, moving above the 61.8% retracement line and testing its June high around $85 before settling into a range with support at $77, right at the 61.8% retracement line and resistance around $81 based on late-July pivots.

Near-term Keys: OSK’s value proposition looks interesting right now, and for the most part the company’s balance sheet remains healthy and in better shape than many other companies dealing with the reality of pandemic-imposed shutdowns. If you’re willing to accept the potential for continued near-term volatility, this is a stock that looks like a good value. The stock also has some interesting possibilities for short-term trades; watch for a break above $81 as a strong signal to consider buying the stock or working with call options, using $85 as an effective short-term profit target. A drop back below $77 could act as a good signal to consider shorting the stock or buying put options, with downside to next support at around $71 providing a useful bearish profit target.