The tech sector has been a bright spot during the COVID-19 pandemic. There are multiple factors that I think are contributing to that reality. Those include signs of increasing recovery and economic activity in China, where a major portion of manufacturing activity for semiconductor companies takes place, and the ability of a large number of companies who have been able to rely on remote capabilities provided by some of the largest and most established names in the tech sector to send employees to work from home and keep their business going, to name just two big contributors.

COVID-19 is proving to have a mixed impact on business in all sectors – but is becoming increasingly clear that it is a long-term element that all businesses will have to factor into their strategic planning and operations. There are continued, big concerns about the long-term impact of companies – primarily small, local businesses – that rely heavily on human interaction, and who were forced to shutter their doors at the initial outbreak, many of whom have never reopened and others that continue to struggle to survive. The largest portion of the American workforce is made up by small business activity, and so I don’t think it’s too surprising to see that while unemployment numbers have mostly continued to trend down through the summer, the unemployment rate remains at levels not seen since 2012. That means that while progress is being made, there is still a long way to go – with plenty of risks still in place to shift things back to strongly bearish conditions.

One of the reasons the Tech sector has performed so well is because so much of the shift to remote, work-from-home operations for corporate America, and contactless sales and delivery methods now being used by a lot of retail businesses is driven by technology solutions. That’s driven investors to flock to stocks that specialize in remote networking, conferencing and cloud-based solutions, including digital transaction handling and CRM services. Many of these companies have defied the broader economic trend and managed to post impressive results this year.

Cognizant Technology Solutions (CTSH) is a professional services company that works with companies in a variety of sectors that focuses on software development and digital platform engineering services for its clients. That puts CTSH in the IT Services industry, which is, at least in part, an area that has continued to see healthy demand as more companies have been forced to identify ways to use technology to shift their business focus. Economists are putting a big focus on companies with healthy balance sheets to help ride through any uncertainty that may extend into a longer-term period of time, and CTSH is company that fits that bill as well. The stock followed the rest of the market to a bear market low that was nearly -50% below its February high around $72, but from that point investors shifted to stocks like CTSH – a shift that as of this writing has pushed the stock back near that pre-pandemic high.

As a value-focused investor, my natural inclination when I see a stock hitting a historical high, or driving to a new all-time high is a little different than most growth-oriented investors. Instead of assuming the stock will keep driving to new highs, I tend to question how much gas the stock has left. Of course, I recognize that the fact the stock is at a new high doesn’t automatically mean it is doomed to reverse; but it does prompt me to dive in to the company’s fundamentals to determine if there is a strong, business-based argument case to argue the stock should keep going higher. Let’s see where CTSH sits.

Fundamental and Value Profile

Cognizant Technology Solutions Corporation is a professional services company. The Company operates through four segments: Financial Services, Healthcare, Manufacturing/Retail/Logistics, and Other. The Financial Services segment includes customers providing banking/transaction processing, capital markets and insurance services. The Healthcare segment includes healthcare providers and payers, as well as life sciences customers, including pharmaceutical, biotech and medical device companies. The Manufacturing/Retail/Logistics segment includes manufacturers, retailers, travel and other hospitality customers, as well as customers providing logistics services. The Other segment includes its information, media and entertainment services, communications and high technology operating segments. Its services include consulting and technology services and outsourcing services. Its outsourcing services include application maintenance, IT infrastructure services and business process services. CTSH has a current market cap of $38.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by -12.77%, while sales also dropped by about -3.4%. In the last quarter, earnings declined by -14.58% while Revenues slipped by -5.33%. The negative earnings and sales pattern is a reflection of the reality that the pandemic has had a measurable impact on the company this year. CTSH’s Net Income versus Revenue is healthy, but also reflects a pandemic effect, running at 9.67% over the last twelve months and narrowing somewhat to 9.03% in the last quarter.

Free Cash Flow: CTSH’s Free Cash Flow is healthy, at about $2.7 billion. That number increased from the last quarter, when Free Cash Flow was $2.3 billion, and translates to a Free Cash Flow Yield of 7.19%.

Debt to Equity: CTSH has a debt/equity ratio of .22, which is a good reflection of the company’s conservative approach to leverage. Their balance sheet shows about $2.4 billion in cash and liquid assets against about $4.5 billion in long-term debt. Despite the increase in debt in the last quarter, their operating profile and high liquidity are good indications CTSH has the financial flexibility to weather the current storm and adapt to ongoing changes in the markets it operates in.

Dividend: CTSH pays an annual dividend of $.88 per share, which at its current price translates to a dividend yield of about 1.25%. That is modest, but it is also much less than 50% of the stock’s earnings per share over the last twelve months – a conservative payout ratio that actually helps bolster the company’s balance sheet strength. It is also noteworthy that at the end of 2019, CTSH’s dividend was $.80 per share.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at about $81.68 per share. That means that even with the stock’s push to its February high, it is still trading at a modest discount, with 14% upside from the stock’s current price. It also puts its “bargain price” at around $65 per share.

Technical Profile

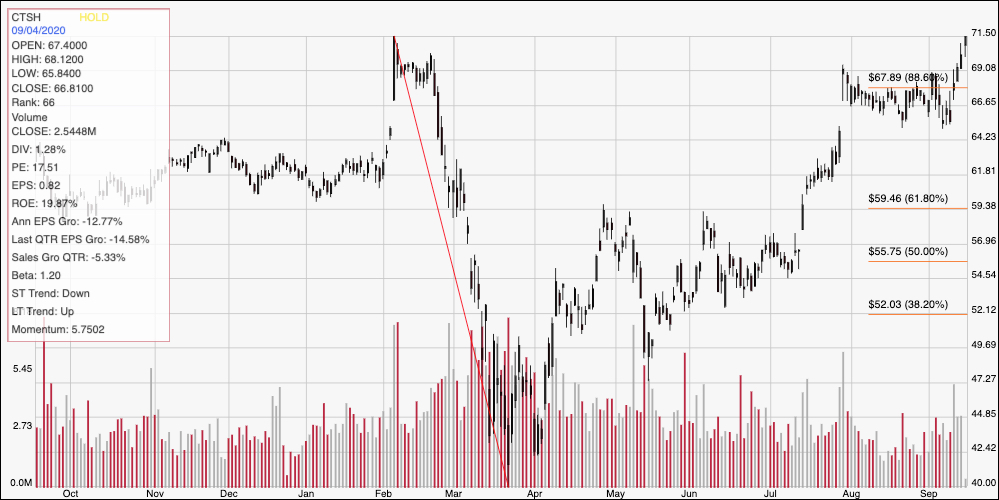

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity; the diagonal red line traces the stock’s downward trend from its February peak above $71 to its March low around $40. The stock rallied strongly in April to a peak at about $59 per share at the 61.8% retracement line before dropping back temporarily, and then resumed its rally higher into August. It consolidated through that month and into the beginning of September right around the 88.6% retracement line, but in the last few days has picked up significant bullish momentum, driving as of this writing back to its February highs just a bit below $72 per share. Immediate support is back at around $68, inline with the 88.6% retracement line, with resistance expected at the stock’s current level. A push above $72 should give the stock room to run to somewhere between $76 and $80, using momentum from previous resistance breaks as a guide, while a drop below support at $68 should see additional support at around $65 based on the low end of the August consolidation range. If bearish momentum picks up, it could fall to $59.50, which is inline with the 61.8% retracement line.

Near-term Keys: The stock’s fundamentals are very strong, even with a clear impact from the pandemic factored in, and the bargain proposition is appealing, if not quite compelling; however it is worth noting that industry analysts right now are forecasting stagnant to tepid growth in revenues and profits for the company for the next year or so, which means that while the stock may be attractive from a valuation standpoint, it could already be at or very near the top of its practical range. If you prefer to work with shorter-term trading strategies, you could use a break above the stock’s immediate resistance around $72 as a signal to buy the stock or work with call options, with a near-term exit target at around $76. There could also be a bearish opportunity, although you’d have to wait to see the stock fall below $68 to see a good signal for a bearish opportunity to short the stock or to buy put options. In that case, the exit target would be around $65 per share, and if the bearish momentum persists, you may be able to extend that trade to around $59.