Stocks like these 4 will benefit over the long term from the massive shift into shopping online.

If you’re anything like the rest of us, your shopping has shifted online amid the coronavirus pandemic.

What with Amazon (NASDAQ: AMZN) Prime’s free next day delivery, Target (NYSE: TGT) and Walmart’s (NYSE: WMT) curbside pick-up for online orders, and enough time at home that you’re compelled to spend hours scrolling through Wayfair’s (NYSE: W) litany of couch options.

And as shoppers have moved online, Amazon, Etsy (NASDAQ: ETSY), Overstock (NASDAQ: OSTK), and Wayfair are among the e-commerce names that have outperformed this year.

Overstock, for one, is up 923% so far this year. Needham analyst Rick Patel initiated coverage on the stock this week with a Buy rating and a $96 price target – 33% higher than the price as of this writing.

Patel wrote in a note that Overstock is “benefiting from external and internal factors that are driving an accelerating in revenue growth and market share gains.” Namely, the huge shift into e-commerce in 2020 as shoppers don’t just spend more time at home, but more money on their homes – which couldn’t be better for a company like Overstock.

Laffer Tengler Investments’ Nancy Tengler says stocks that stocks like Overstock that are at the intersection of home goods and improvement, and e-commerce are the best way to play the massive shift into online shopping.

“We have expressed our views in this space through some of the housing-related stocks like the Overstock upgrade, Home Depot (NYSE: HD), Lowe’s (NYSE: LOW),” Tengler said. “These are companies that have been investing in e-commerce and then also Walmart and Target. Each one of those companies increased quarter-over-quarter e-commerce sales by just about over 100%.”

“We see fundamental reasons for owning stocks like dividend increases which all of the companies have increased their dividends this year, except for Walmart and they’re expected to do so this next quarter,” Tengler added.

But while the secular shift into online shopping looks set to continue for the long-term, which will benefit these stocks, Katie Stockton, founder of Fairlead Strategies, warns that the rally seen this year in names like Overstock, Etsy, and Wayfair could run into trouble in the near term.

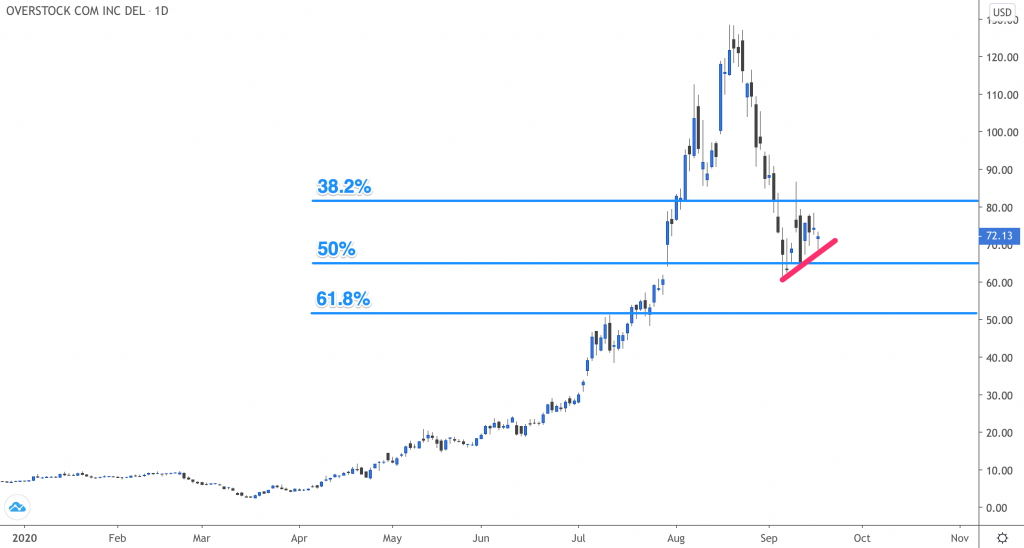

“Looking at Overstock, there is some appeal in that chart because it’s really a high flyer or was so before it’s corrective phase,” Stockton said. “It had very, very strong momentum, very, very strong relative strength versus the major indices. However, we see now how quickly that can come apart.”

While Overstock shares are up more than 2,706% since the stock’s March bottom, shares have sunk nearly -44% off August highs, with the stock consolidating recently around the 50% Fibonacci retracement level of the stock’s climb from March through the August high.

“That kind of decline does serve as a harsh sort of reminder of the risk in adding exposure into parabolic uptrends,” Stockton added.

Stockton believes Overstock will remain in its corrective phase for a few more weeks, or longer, before an oversold signal indicates the downtrend has been exhausted.