Sometimes there are forces that affect a sector or industry in such a way that it creates a storyline that extends into not merely weeks, or months, but years. These can be positive or negative, but one of the things that I find interesting as an analyst is to look for those threads and try to measure the way they influence the stocks in that industry or sector.

It’s true that the global COVID-19 pandemic is an easy one to think about, simply because the virus is proving to be a much more prolonged issue than many hoped; but for today’s highlight I’m talking about a different storyline – one that extends all the way back into 2018 and specifically impacts the energy sector.

One of the really interesting segments of the Energy sector is the Oil Storage and Transportation industry. These are companies that deal with the infrastructure that brings crude oil to market, providing the links between explorers and drillers to refiners and ultimately to consumers. Infrastructure primarily includes pipeline and storage facilities. The industry has struggled in the U.S. for more than two years, primarily because shale exploring and drilling companies continued to increase production into 2019 to the point that the capacity of existing pipelines could not keep up with the supply. Existing pipeline capacity from many of those areas was dated and limited, which meant that shale companies had to keep large amount of crude inventory in the Basin, waiting in storage facilities for transport to the Gulf of Mexico where it is then distributed to end markets around the world. That reality kept U.S. shale prices depressed and forced producers to deal with supply delays and look for costly alternative transportation methods.

New projects to expand pipeline capacity began in 2018, and have begun to come online this year; but then, of course, 2020 has been the year that demand for crude oil has cratered as travel demand – airline or otherwise – has plunged in the wake of the global pandemic. It’s logical to think that as economic activity continues to gradually increase in the U.S. that oil demand should increase as well; however that logic hasn’t really found a way to be reflected in crude prices; West Texas Intermediate (WTI) crude, the benchmark for U.S.-produced oil has been hovering in the mid-$30 to low-$40 range through the summer, and remains well below its January highs above $60 per barrel. If the months ahead – and by that I’m really looking into 2021 – see enough of an increase of economic activity, including increasing air travel then it does follow that there is plenty of room for oil to move higher, which should be good news for the stocks in the Oil Storage and Transportation industry, which moving into 2021 should finally possess the capacity to keep oil flowing from the rich shale areas of the Permian Basin and Bakken Ford region.

Among the stocks that I think represent the best opportunities is MPLX LP (MPLX), a master limited partnership created by Marathon Petroleum Corp (MPC), another large-cap energy stock that I’ve been following for some time. Based on its valuation metrics, MPLX looks like it could be very compelling long-term opportunity. What about the company’s fundamentals? Let’s dive in.

Fundamental and Value Profile

MPLX LP is a master limited partnership (MLP) formed by Marathon Petroleum Corporation (MPC) to own, operate, develop and acquire midstream energy infrastructure assets. The Company is engaged in the gathering, processing and transportation of natural gas; the gathering, transportation, fractionation, storage and marketing of natural gas liquids (NGLs), and the gathering, transportation and storage of crude oil and refined petroleum products. Its segments are Logistics and Storage (L&S), and Gathering and Processing (G&P). The L&S segment includes transportation and storage of crude oil, refined products and other hydrocarbon-based products. As of December 31, 2017, the G&P segment operated various natural gas gathering systems that had a combined 5,439 million cubic feet per day (mmcf/d) throughput capacity. As of December 31, 2017, its assets included infrastructure to support MPC, including approximately 2,194 miles of crude oil and refined product pipelines across 17 states. MPLX has a current market cap of about $18.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 5.45%, while revenues were 33% 27.75% higher. in the last quarter, earnings declined almost -5% while sales rose almost 110%. The company’s margin profile has been volatile this year, as Net Income as a percentage of Revenues in the last quarter was a healthy 31.14% versus an alarming -26.44% over the last twelve months. I think the difference is a good reflection of the effect the pandemic has played on the industry, as shutdown imposed in the beginning of the year closed down business operations of all kinds, including oil production. Increasing production has been difficult this year as oil demand has remained low while supply was still high, with plenty of crude sitting in storage facilities waiting to be used.

Free Cash Flow: MPLX’s free cash flow is healthy, at $2.57 billion. That translates to a modest Free Cash Flow Yield of 6.22% and marks a steady, multiyear improvement from -$65.8 million in June of 2016 and $1.55 billion at the end of 2019. Improvement in this number, this year, is a strong sign of management strength.

Debt to Equity: MPLX’s debt to equity is 1.65, which is higher than I prefer to see; however the company’s balance sheet – strong Net Income in the last quarter along with improving Free Cash Flow – indicates operating profits should be adequate to service their debt. Liquidity is a bit of a concern, since their balance sheet shows just $67 million in cash and liquid assets (down from $293 million in June of 2017) versus $20.8 billion in long-term debt, which has also increased, from about $6.9 billion at the end of 2017 and $19 billion at the end of 2019.

Dividend: MPLX’s annual divided is $2.75 per share, among the highest in the industry, and which translates to a yield of about 15.63% at the stock’s current price. The remarkable element of the dividend isn’t just its yield, but also the fact that the company increased the dividend this year from $2.71 in 2019.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $29 per share. That means that MPLX is trading at a compelling 64% discount right now, which along with its high dividend yield makes the stock pretty tempting.

Technical Profile

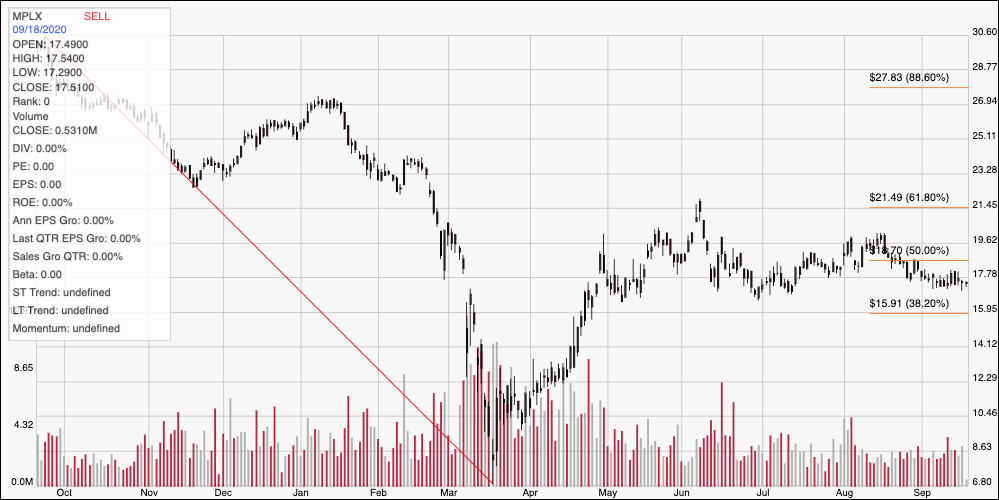

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red line traces the stock’s downward trend from October of last year from a peak at around $30 per share to its multiyear, bear market low around $7. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock saw a healthy increase in price into June, rising to the 61.8% retracement line at around $21.50 before settling back into a consolidation range in July that has continued to hold to the present time. Support is around $16, with resistance around $19 per share, right around the 50% retracement line. A drop below $16 could give the stock bearish momentum to fall to at least $12, with potential to test its multiyear lows around $7 if momentum remains strong. A break above $19, on the other hand should give the stock room to retest its June high around $21.50, with additional room to a little above $23 and beyond if bullish sentiment increases.

Near-term Keys: MPLX’s value proposition is very tempting; the stock is trading at an extreme discount, paying an outsized dividend, and has some useful signs of fundamental improvement working in its favor. I am concerned, however about the company’s liquidity, and would probably prefer to see improvement in that area in the form of increased cash and liquid assets, along with a reduction in its long-term debt before considering the stock for a long-term, value-based investment. If you prefer to work with short-term trading strategies, look for a break above $19 to provide a useful signal to buy the stock or work with call options, using $21.50 as an early profit target. A drop below $16 would be a strong signal to consider shorting the stock or buying put options, with an eye on $12 at least as a good profit target on a bearish trade.