The last week or so of market activity has put a lot of investors and analysts on edge, and appears to be forcing many to confront the possibility that the market has finally reached levels that mark an increasingly elevated amount of risk. That has given the major indices room to slide back by a little under -10% from their latest highs – which is enough to make a lot of people start wringing their hands and worry that another bear market is just around the corner.

While I frankly believe that significant portions of the market are significantly overvalued and have flipped the reward: risk equation on its head, I also hesitate to start beating the drum of gloom and doom too loudly. The truth is that pullbacks, drawdowns, and even corrections by and large are healthy contributors to longer upward trends, and even with significant risks in place right now such as still high unemployment and increasing infection numbers (again) in various parts of the country, there are also some pretty strong positive factors to provide counterbalance.

The latest earnings season has been far more positive than many analysts had predicted, with a lot of companies seeing healthy earnings and bottom-line numbers when considered against the backdrop of the health crisis that brought the global economy to a standstill earlier in the year. Risks remain, to be sure, but at the same time, I also think much of corporate America is showing the same kind of ability to adapt to changing conditions that it always has. The market may prefer “business as usual” conditions whenever possible, but smart businesses have also always found ways to adjust when “as usual” looks different than it did in the past. That doesn’t automatically mean the way ahead is categorically bullish; but I do think that this is a perspective that helps to leaven some of the bearish sentiment and help keep things in a more constructive context.

Over the last few months, one of the best sectors of the stock market has been the Materials sector. Beginning in mid-May to the end of the last week, the sector had increased in value by more than 71% as measured by the S&P 500 Materials Sector SPDR (XLB). This is a sector that I like to pay attention to as a barometer for the underlying relative health of the economy, because the companies that comprise it produce or mine the building blocks used to create most of the finished goods we use every day. The sector includes industries that cover chemicals and plastics, construction materials, paper, forest, and packaging products, as well as metals and minerals – which means that in some form, this sector touches practically every other segment of the economy in one more or another.

Steel Dynamics Inc. (STLD) is an interesting company in the Metals & Mining industry of this sector. This is a company with a solid balance sheet and fundamental numbers that have held up fairly well despite being pressured by broad economic conditions this year. The stock has also performed well since its bear market low in March, rebounding as of this writing to just a few dollars below its pre-pandemic high around $35. Is the stock is a good value, or has the rally pushed the stock’s price past reasonable valuation levels? Let’s find out.

Fundamental and Value Profile

Steel Dynamics, Inc. is a steel producing and a metal recycling company. The Company is engaged in the manufacture and sale of steel products, processing and sale of recycled ferrous and nonferrous metals, and fabrication and sale of steel joists and deck products. Its segments include steel operations, metals recycling operations, steel fabrication operations and Other Operations. It offers a range of steel products, such as sheet products, long products and steel finishing. The steel operations segment includes Butler Flat Roll Division, Columbus Flat Roll Division, The Techs galvanizing lines, Structural and Rail Division, Engineered Bar Products Division, Roanoke Bar Division, Steel of West Virginia and Iron Dynamics. The metals recycling operations segment consists of OmniSource Corporation. The fabrication operations produce steel building components. The Other Operations segment consists of subsidiary operations and smaller joint ventures. STLD has a current market cap of $6.2 billion.

Earnings and Sales Growth: Over the past year, earnings declined almost -46%, while sales dropped -24.41%. In the last quarter, earnings dropped by -46.5%, while sales were down -6%. STLD operates with a modest margin profile that has been narrowing, which isn’t surprising; over the last twelve months, Net Income was 5.6% of Revenues, and narrowed to about 3.61% in the last quarter.

Free Cash Flow: STLD’s Free Cash Flow is healthy, at $710.92 million, and which translates to an attractive Free Cash Flow Yield of 11.52%. That does mark a decline from around $944 million at the beginning of the year and $811 million in the quarter prior, but the decline isn’t unexpected given broad economic conditions this year; perhaps more interesting is that the decline has been relatively small and is still at healthy levels.

Debt to Equity: STLD has a debt/equity ratio of .66, which is reflects a conservative approach to leverage. The company’s balance sheet shows cash and liquid assets of about $1.56 billion in the last quarter versus long-term debt of $2.6 billion. Along with their healthy Free Cash Flow and mostly healthy operating profile, there should be no problem servicing their debt.

Dividend: STLD pays an annual dividend of $1.00 per share, which at its current price translates to a very attractive dividend yield of about 3.41%. It is also worth noting that management has raised the dividend this year when many others are cutting or eliminating theirs; at the beginning of the year, the dividend was $.96 per share, per annum.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $35 per share. That means that STLD is nicely undervalued, with about 20% upside from its current price.

Technical Profile

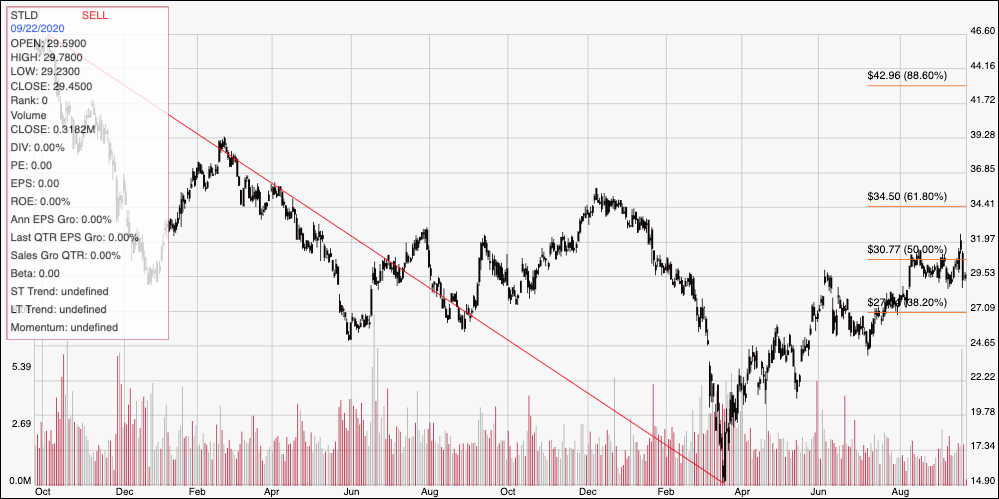

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line marks the stock’s downward trend from October 2018 to March of this year. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. The stock rallied from its bear market low to start a new, intermediate term upward trend, rallying to the 50% retracement line at around $31 before falling back in the last few days. It is showing strong support at around $29, per share with resistance at that recent peak at $31. A break above $31 should give the stock room to push to about $35, a little above the 61.8% retracement line and at the stock’s December 2019, pre-pandemic high. A drop below $29 should see the stock drop to next support at around $27, with $24.50 the next likely level based on previous pivot activity if bearish momentum accelerates.

Near-term Keys: The stock’s current, narrow consolidation pattern could offer some useful short-term trading opportunities depending on which direction the stock moves to break that pattern. A push above $31 would be a good signal to consider buying the stock or working with call options, using $35 as a good, short-term bullish profit target. A drop below $29, on the other hand, could be a good opportunity to think about shorting the stock or buying put options, with $27 acting as a good initial profit target and $24.50 reachable beyond that point if the stock’s current upward trend reverses. What about value? The stock’s Fair Value price points to attractive value, and the stock has some very useful fundamental strengths behind it as well. Sentiment about the industry right now is a bit uncertain amid broader economic and health-related uncertainty; but if you don’t mind the potential for near-term volatility from those factors, this could be a useful opportunity to buy a good company at a nice price.