One of the interesting threads that comes out of periods of market volatility is a wave of investor rotation into “defensive” sectors, which usually includes Utilities, Consumer Staples and other pockets of the market that investors tend to think of as safe havens when market uncertainty is high. Another favorite topic analysts seem to like to start talking about under these kinds of conditions is dividend-paying stocks; it’s pretty normal to start seeing increasing commentary and reports not only about the utility of dividends, but also others that will compile lists of the “best” dividend stocks to pay attention to right now.

One of those interesting lists is what some people refer to as “dividend kings.” These are stocks that have a long history of consistent dividend payments, supported by a regular pattern of increasing their dividend payout over time. That kind of consistency is a rare thing; for example, there are 10 publicly traded U.S. companies that have managed to maintain dividend payments for more than 120 consecutive years. That is a distinction that strongly suggests not only that a company has a disciplined approach to managing their bottom line, but also a corporate culture dedicated to returning value to its shareholders that stands above the rest of the market.

This select list of stocks – what I’ll call the “Kings of Dividend Kings” – is made up of pretty recognizable names. Proctor & Gamble Company (PG) may stand above all of them; its history of stable dividend payments stretches back 130 years, with 64 years of consecutive increases in its dividend payout. That is a remarkable distinction that arguably makes PG the King of All Dividend Kings. Pandemic conditions haven’t deterred the company’s success, either; in fact the global consumer shift towards stocking households, with increased focus on health and cleanliness has only strengthened their bottom line. Looking past the pandemic, many analysts are also predicting that some of these new behaviors, specifically related to health, hygiene and cleaning will be “sticky” – meaning that demand for these kinds of products will extend well past the current health crisis. The pandemic has also given PG an opportunity to gain market share in both its operating categories, but also in the geographies it competes in, as consumers have relied on familiar, established names for many of the household goods they use. All of these factors are excellent reasons to think about PG as a stock that could offer an interesting combination of growth looking ahead as well as a defensive hedge against risk; but that doesn’t necessarily mean that it also fits the classical description of a good value.

Fundamental and Value Profile

The Procter & Gamble Company is focused on providing branded consumer packaged goods to the consumers across the world. The Company operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care, and Baby, Feminine & Family Care. The Company sells its products in approximately 180 countries and territories primarily through mass merchandisers, grocery stores, membership club stores, drug stores, department stores, distributors, baby stores, specialty beauty stores, e-commerce, high-frequency stores and pharmacies. It offers products under the brands, such as Olay, Old Spice, Safeguard, Head & Shoulders, Pantene, Rejoice, Mach3, Prestobarba, Venus, Cascade, Dawn, Febreze, Mr. Clean, Bounty and Charmin. PG’s current market cap is $342.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased 5.45%, while sales rose 3.53%. In the last quarter, earnings were mostly flat, but slightly negative, at -0.85% and sales grew by 2.81%. PG is a company with a very healthy margin profile that has narrowed in the last quarter – which isn’t surprising under current market conditions. In the last quarter, Net Income as a percentage of Revenues was 15.82% versus 18.36% in the last twelve months. The deterioration is a concern, but doesn’t change the fact PG’s operating profile remains very healthy.

Free Cash Flow: PG’s free cash flow is strong, at $14.3 billion. This is also a number that has increased steadily since the second quarter of 2017; it is also a sizable increase in the last year, when Free Cash Flow was $12.2 billion. The current number translates to a modest dividend yield of 4.2%.

Debt to Equity: PG has a debt/equity ratio of .51. This is a conservative number at first blush that generally suggests the company follows a conservative approach to leverage and debt management. Their balance sheet shows cash and liquid assets of $16.1 billion (versus $10.2 billion a year ago) against long-term debt of $23.5 billion. PG’s strong liquidity and healthy operating profile mean that servicing debt isn’t a problem.

Dividend: PG pays an annual dividend of $3.16 per share, which translates to a yield of about 2.29% at the stock’s current price. Consider also that a year ago, their dividend was $2.98 per share; that means the company has maintained its long history of dividend increases at a time when a lot of fundamentally solid companies are reducing or even eliminating their dividends to conserve cash.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $89 per share. That means that, despite all the strengths I just outlined, PG is significantly overvalued, with -35% downside on a strict valuation basis from its current price.

Technical Profile

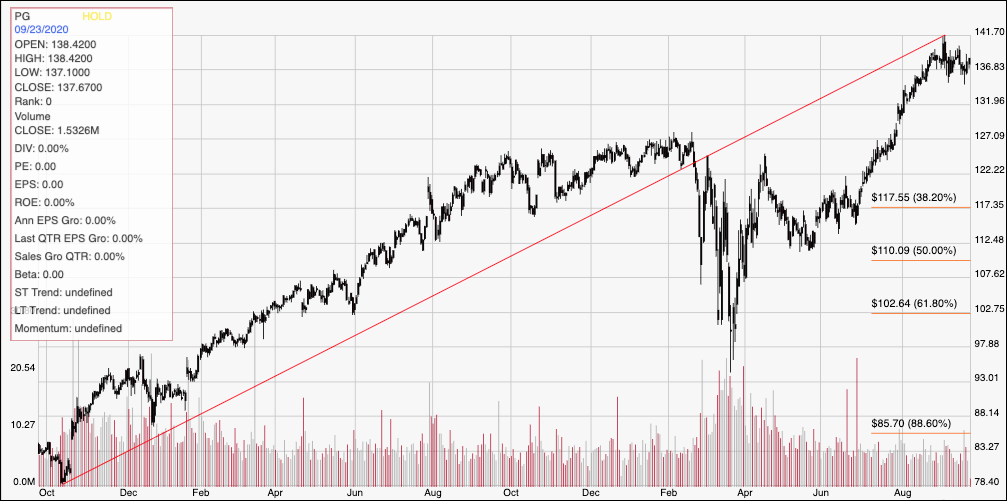

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above traces the last two years of price activity; the diagonal red line traces the stock’s upward trend from October 2018 to its peak earlier this month near to $142. It also provides the reference for calculating the Fibonacci retracement levels indicated by the horizontal red lines on the right side of the chart. PG has fallen back from that recent high, and appears to have pretty strong support around $136. A break above resistance at $142 could be taken as a sign the stock is about rally to yet another set of highs. In that case, putting a new short-term target at around $157 (adding the distance between the last significant resistance break at $127 and the most recent high around $142) is probably a reasonable forecast. If however, the stock does break the $136 support level I just identified, it could drop to as low as $127, where that pre-pandemic high sits.

Near-term Keys: PG has a lot of positives going for it – stable, growing dividend, large cash position, recognizable name and massive market presence in a high-demand sector of the economy, all of which have certainly been factors in the stock’s strong upward trend to this point. The company’s ability to expand its market share in an incredibly competitive industry, with dominating presence in businesses that are anticipated to see continued high demand even past pandemic conditions may even be a good reason to consider stock a good long-term, growth-oriented buy, or a reasonable defensive position if economic conditions deteriorate further; but I wouldn’t describe PG as a good value-based pick right now. If you want to take a short-term approach, look for a break above $142 as a signal to buy the stock or work with call options with an eye on $157 as a price target. If the stock drops below $136, consider shorting the stock or working with put options, using $127 as a useful exit point for a bearish trade.