Throughout the year, I’ve been fascinated to watch market and consumer trend shift and adjust to pandemic-induced conditions. Not all of those shifts have been pleasant, even if they were necessary; as an analyst, though it is important to understand where those changes fit into the current market and economic landscape. It is also useful to try to think about what they mean for future conditions. Whether it comes in 2021 or later, there will be an end to coronavirus and the restrictions that it has imposed on the entire world; but the longer it lasts, the more likely that many of the behaviors we’ve had to adopt, individually and collectively to get by and learn to live with the virus every day will also become hard-wired.

Let me use a story to try to illustrate what I mean. As a boy, I loved to listen to my grandmother. Grandma Opal was a genuine Southern belle, born and raised in Alabama. She was a talented artist, and she passed her appreciation of art (if not quite her ability to produce it) to me. She was also a gifted storyteller, keeping me captivated with stories of growing up in the deep South. As I grew older, she also started to tell me about some of the difficulties she and her family struggled with. The Great Depression naturally had a profound effect on that generation, and the things she and her family had to do to simply get by left a permanent imprint on many of her attitudes, behaviors and even her daily activities. She was extremely frugal throughout her adult life, for example, almost always making do with less than she could afford. She rarely bought new clothes unless and until what she already had been worn threadbare – and even then she shopped exclusively from bargain and clearance racks.

Extreme conditions, like the Great Depression for Grandma Opal and her generation, or our current pandemic are the rare, once-in-a-generation kind of pressures that I think leave lasting marks on the way we interact with the world we’re in. In a COVID-19 world, for example, health experts have consistently pushed and evangelized the need to regular hand washing and cleaning surfaces with powerful disinfectants – even more than we were probably already used to. These are just a couple of examples of a lot of the behaviors that I think will become permanently imprinted on the psyche of the generations who have had to learn to live with the daily reality of coronavirus as a risk.

That increased focus on basic elements of good health like proper hygiene and general cleanliness is just one of the reason that household products have remained in high demand throughout the year, which is why a lot of companies that fill that space – Proctor & Gamble (PG), Colgate-Palmolive (CL), to name just a couple – have been star performers since March. One company stands even above those, however, since it not only did NOT drop to bear market levels with the rest of the market, but has seen a continuous, impressive increase in its stock price throughout the year.

Under normal circumstances, Clorox Co. (CLX) isn’t likely to be the kind of stock that really draws a ton of interest. You undoubtedly know about the company and its primary products, because Clorox bleach is just one example of the kind of products this company produces that have always been a staple of practically every household – but that also means that, like most companies in the Consumer Staples sector, they aren’t considered “sexy.” If you’ve been shopping for household items during the pandemic, though, you know just how valuable those products have become – because you probably had to get up early in the morning just to get a single bottle of bleach or container of disinfectant wipes. If cigarettes are currency for prison inmates, then Clorox wipes have been the Ben Franklins of this pandemic.

As a contrarian-oriented investor, the truth is that seeing CLX make a big move this year is something that prompts me NOT to want to look into the stock in detail. After all, it started the year at around $150, didn’t even test a correction while the broad market dropped below bear market levels in February and March, and year-to-date is up more than 38%. That’s an amazing story for a growth stock, and it’s great for those investors that have been in the stock to enjoy the run, but it tends to decrease the chances there is much upside left. Perhaps as a reflection of the world we live in, however, the stock’s performance is more than just a reflection of investor sentiment; it also appears to reflect the reality that CLX’s business has managed to grow even while other companies, even in the Household Products industry have had to weather downturns. Does that also mean the stock could still offer a useful value? Maybe – let’s find out.

Fundamental and Value Profile

The Clorox Company is a manufacturer and marketer of consumer and professional products. The Company sells its products primarily through mass retail outlets, e-commerce channels, wholesale distributors and medical supply distributors. The Company operates through four segments: Cleaning, Household, Lifestyle and International. Its Cleaning segment consists of laundry, home care and professional products marketed and sold in the United States. Its Household segment consists of charcoal, cat litter and plastic bags, wraps and container products marketed and sold in the United States. Its Lifestyle segment consists of food products, water-filtration systems and filters, and natural personal care products marketed and sold in the United States. Its International segment consists of products sold outside the United States. It markets some of the consumer brand names, such as namesake bleach and cleaning products, Pine-Sol cleaners, Liquid-Plumr clog removers and Kingsford charcoal. CLX’s current market cap is $27 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased 28.19%, while sales grew almost 22%. In the last quarter, earnings increased 27.5% while sales improved 11.22%. The company also operates with a strong margin profile, since Net Income versus Revenues was 13.97% over the last twelve months, and strengthened to 15.63% in the last quarter.

Free Cash Flow: CLX’s free cash flow is healthy and growing, at almost $1.3 billion over the last twelve months. That also marks an increase over the last quarter from $966 million and relatively healthy and $780 million a year ago.

Debt to Equity: CLX has a debt/equity ratio of 3.06. This is a high number, and is confirmed by the fact the company’s balance sheet shows more than $2.7 billion in long-term debt versus $871 million in cash and liquid assets. Liquidity has improved dramatically over the last year, when cash and liquid assets were only a little over $130 million. Their balance sheet shows their operating profits are sufficient to pay their debt, with improving liquidity as well.

Dividend: CLX pays an annual dividend of $4.44 per share, which translates to a current yield of about 2.09 at the stock’s current price. It also marks an increase from $3.84 per share a year ago, and follows a consistent pattern of increasing dividends since the company began paying a dividend more than a decade ago in the last quarter of 2008, beginning their dividend payout at $1.84.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $261.50 per share. That means that CLX is nicely undervalued, with 22% upside from its current price.

Technical Profile

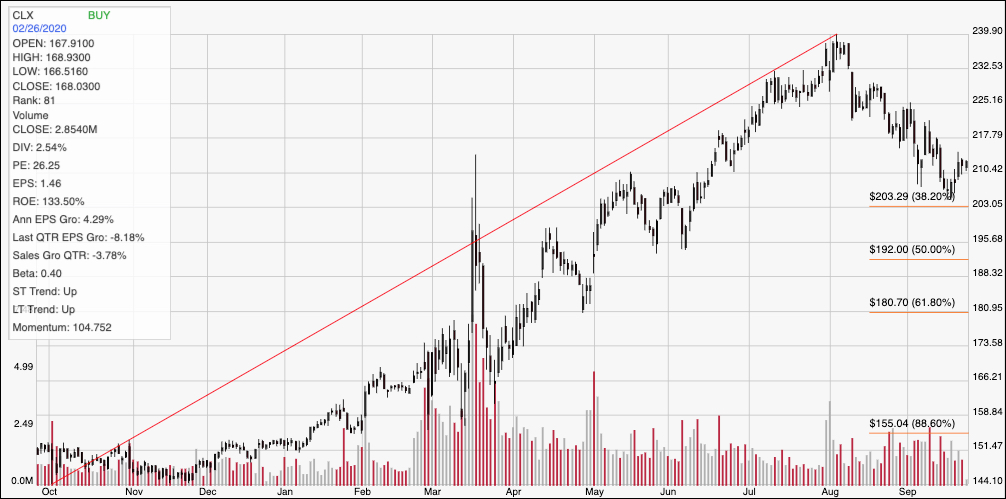

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above outlines the stock’s movement over the past year. The red diagonal line marks the stock’s upward trend over the period; it also provides the baseline for the Fibonacci retracement line shown on the right side of the chart. It’s pretty easy to see the stock’s increase since November 2019 from a low at around $153 per share, with the stock pushing to a new 52-week high in early August at nearly $240. Since then, the stock has dropped back, finding support at the 38.2% Fibonacci retracement line around $203 per share and bouncing higher from that point. Immediate resistance is around $218. Given the fundamental strength outlined above, the stock’s drop since August appears to be an attractive pullback within the longer upward trend; that means that a push above resistance at $218 is probably a good indication not only that the stock will retest those August highs, but also that the upward trend will simply redraw its slope, making a long-term continuation more sustainable. A drop below support at $203, however could see the stock drop to next support between $195 and $192 where the 50% retracement line sits.

Near-term Keys: Look for a push above $218 per share before taking any kind of short-term bullish trade seriously; as previously mentioned, the stock could be setting up for another strong push higher, but it needs to break that resistance first. If it does, look for near-term upside to at least $225, with the stock’s August high around $240 possible if bullish momentum keeps building that could be a nice opportunity to buy the stock or to work with call options. If the stock drops below $203 per share, there could be a very attractive opportunity to short the stock or to start buying put options, using $195 as a useful target on a bearish trade. If you have the capital to support the position, CLX is also offering an interesting value-based opportunity at a time that I think makes this stock a smart option if you’re looking for a good combination of defensive positioning with value.