One of the sectors that has really faded after initially pushing strongly off of its March, bear market lows is Financials. When you think about the Finance sector, you probably think first of banks – especially the biggest names in consumer, commercial and investment banking. That makes a certain kind of sense, especially in light of current news, where speculation about a second wave of stimulus – in any form – seems to be one of the TRVmary drivers of market volatility right now. Any kind of package will inevitably be funneled through the banking system, which means those biggest names will continue to be at the forefront of the market’s attention.

One of the segments of this sector that I think is interesting – and that doesn’t get as much attention is the Insurance industry. Companies that provide insurance products – life insurance, property and casualty, auto, health, and so on – certainly are sensitive to economic cycles, since the average consumer is unlikely to take out new insurance policies if they are already being forced to tighten their belts as much as possible to get by. On the commercial side, one of the TRVmary risks for property and casualty carriers is catastrophic disaster risk. While these types of claims rose in 2017 and 2018, they declined in 2019, which provided a useful headwind for many of the largest companies in the industry.

Traveler’s Companies Inc. (TRV) is an interesting example. This is a large-cap company whose largest business segment is Business and International Insurance, where is provides commercial and property and casualty insurance products and services. Reports in 2020 show that COVID-19 claims have been manageable for the company; but 2020 has also marked an interesting year on the catastrophe front in other areas. An interesting news item last month about hurricanes I noticed observed that the National Hurricane Center (NHC) had run through the entire alphabet of hurricane and tropical storm names and had begun using Greek lettersA – the first time since 2005 that has happened. Does that mean that TRV will see claims rise this year? Maybe – if it does, that could present a risk to a company with a strong balance sheet and an interesting value proposition – if it doesn’t, TRV might be a stock to consider using as a good long-term investing opportunity.

Fundamental and Value Profile

The Travelers Companies, Inc. is a holding company. The Company’s segments include Business and International Insurance; Bond & Specialty Insurance, and Personal Insurance. Through its subsidiaries, it provides commercial and personal property and casualty insurance products and services. The Business and International Insurance segment offers property and casualty insurance and insurance related services to its clients, in the United States and in Canada, as well as in the United Kingdom, the Republic of Ireland, Brazil and throughout other parts of the world. The Bond & Specialty Insurance segment provides surety, fidelity, management liability, professional liability, and other property and casualty coverages and related risk management services to a range of TRVmarily domestic customers, utilizing various degrees of financially-based underwriting approaches. The Personal Insurance segment writes a range of property and casualty insurance covering individuals’ personal risks. TRV has a current market cap of $29.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by about -110% while sales were about -5.5% lower. In the last quarter, earnings dropped -107.5%, while revenues were -6.4% lower. The company’s margin profile is narrow, with signs that 2020 has led to a deterioration of profitability; over the last twelve months, Net Income was 5.83% of revenues, but turned negative to -0.54% in the last quarter.

Free Cash Flow: TRV has healthy free cash flow of a little over $5.6 billion over the last twelve months. This number has increased from the beginning of the year at around $5.1 billion. At the stock’s current price, this also translates to a very interesting Free Cash Flow Yield of 19.64%.

Debt to Equity: the company’s debt to equity ratio is .26, which is very low and reflects a conservative approach to debt. TRV’s balance sheet shows $6.7 billion cash and liquid assets (versus $4.5 billion in the quarter prior) and $7 billion in long-term debt.

Dividend: TRV pays an annual dividend of $3.40 per share, which translates to an annual yield of 2.99% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $149.50 per share. That means that TRV is nicely undervalued right now, with about 28% upside from its current price.

Technical Profile

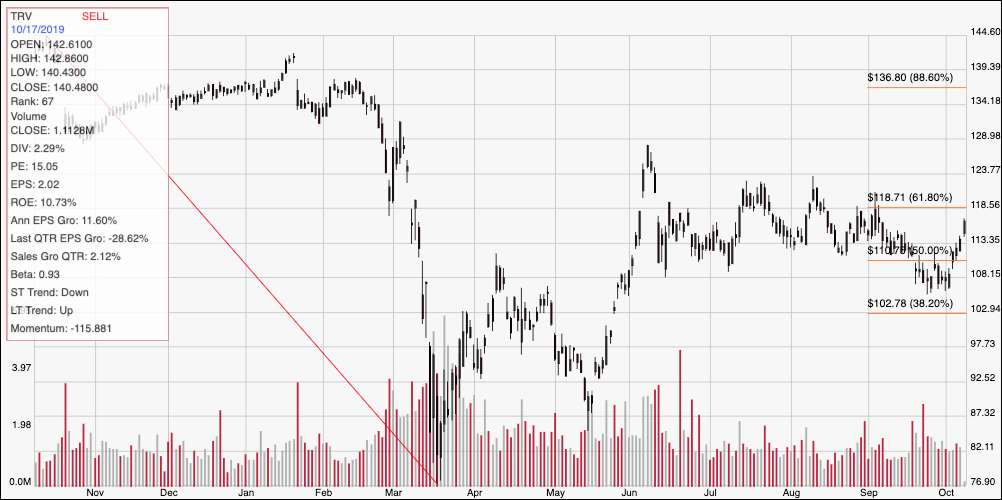

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s downward slide from its pre-pandemic high at around $145 to its March low at close to $77 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that low, the stock rebounded quickly, hitting a June peak at around $129 before dropping back into a consolidation range that weakened in September. The stock found support a little above the 38.2% retracement line, and around $105 and has been rallying from that point; it is now just a little below the 61.8% retracement line, which marks immediate resistance at around $119. Immediate support should be around $113. A drop below $113 could see the stock fall to somewhere between $103 and $105 before finding new support, which a break above $119 should give the stock momentum to test its June high around $129.

Near-term Keys: TRV has some interesting fundamental metrics working in its favor right now, including a solid balance sheet and increasing Free Cash Flow. The stock’s deteriorating Net Income is a concern, especially when cast against the shadow of a potential increase in catastrophic claims that could continue to pressure this measurement. TRV’s value proposition is tempting, but I would prefer to wait to see if Net Income can rebound in the quarters ahead before taking a long-term opportunity in this stock seriously. That means the best opportunities to work with this stock lie in short-term trades. A break above $119 would be a good signal to buy the stock or work with call options, using the June peak at around $129 as a near-term profit target on a bullish trade. A drop below $113, however could be a strong signal to think about shorting the stock or working with put options, with an eye on next support in the $103 to $105 level as a useful target on a bearish trade.