With so much in flux about the financial markets and the health of the global economy, it can be a challenge to know how to best position yourself as an investor. It doesn’t really help to know that there are tens of thousands of available stocks to choose from, each of which can be used in a number of different ways. Add in the possibilities that come with equity options, and the possibilities are literally endless about how you can use market conditions at any given time to put your money to work for you.

I usually think of that abundance of possibility as a positive thing – but it’s also one of the things that can make things harder for average investors. Where do you start? What approach works best for today’s market conditions? There is so much information out there that it seems like unless you are a full-time investor or student of the market, you’ll never be able to make sense of it all.

The longer I’ve studied and been involved with the markets, the more I’ve found myself gravitating to trying to keep things simple, while at the same time emphasizing an active approach to the investments I make. An active approach means paying attention to broad market conditions, and being willing to work with and manage trades on individual stocks rather than following passive strategies like index funds. In this context, keeping things simple means, at least in part, that instead of actively trying to track the entire market, I usually focus on a pretty select basket of stocks that I find myself coming back to on a pretty regular basis. They’re the stocks that make up the watchlist I like to review each day, and while I occasionally add to or take away from the list, the fact that a lot of the stocks in that list have been there for a long time means that I’ve been tracking data and activity in those stocks – and the company’s underlying business – for a fairly long time.

Westrock Company (WRK) is a good example of the kind of stock I’m referring to. This is a company that I’ve followed for a couple of years. It occupies an interesting niche in the Materials sector, providing paper and packaging solutions for consumer and corrugated packaging markets. That doesn’t sound very glamorous – but it means that the cardboard boxes, paperboard, and merchandising display materials you see on products you use every day, or in the grocery and department store are, in many cases coming from this company. Despite a generally solid fundamental profile, the stock price suffered over the last couple of years before it finally began to rebound in late 2019. COVID-19 and the economic pressures that have come from it have certainly played their role in the stock’s price performance; they drove the stock to visit lows in the mid-to-low $20 range on two occasions since March. WRK finally started picking up some bullish momentum in August and formed a nice short-term trend until a couple of weeks ago when it hit its most recent peak at nearly $42 per share. It has dropped back a little over -11% from that point, which could be setting up a nice new opportunity to buy on a classic pullback within a bullish trend. I also think the fact, while that their bottom line has been impacted by the economic slowdown caused by COVID-19, their last couple of recent earnings report suggests that they’re holding up remarkably well. That is a strong mark in their favor that translates to a very attractive value proposition.

Fundamental and Value Profile

WestRock Company, incorporated on March 6, 2015, is a multinational provider of paper and packaging solutions for consumer and corrugated packaging markets. The Company also develops real estate in the Charleston, South Carolina region. The Company’s segments include Corrugated Packaging, Consumer Packaging, and Land and Development. The Corrugated Packaging segment consists of its containerboard mill and corrugated packaging operations, as well as its recycling operations. The Consumer Packaging segment consists of consumer mills, folding carton, beverage, merchandising displays, and partition operations. The Land and Development segment is engaged in the development and sale of real estate primarily in Charleston, South Carolina. WRK has a current market cap of $9.7 billion.

Earnings and Sales Growth: Over the past year, earnings declined -31.5%, while sales were -9.67% lower. In the last quarter, earnings improved by 13.43%, while sales dropped about -4.75%. WRK operates with a very narrow, but stable margin profile, which isn’t especially unusual for stocks in this industry; over the last twelve months, Net Income was 4.37% of Revenues, and 4.21% in the last quarter.

Free Cash Flow: WRK’s Free Cash Flow is healthy, at $1.03 billion, and which translates to an attractive Free Cash Flow Yield of 13.37%. This number improved over the last quarter, from $919.2 million.

Debt to Equity: WRK has a debt/equity ratio of .84, which is generally conservative but has increased since November 2018 from just .49. It is worth noting this number was .91 in the quarter prior. The company doesn’t have great liquidity, with cash and liquid assets of about $291.5 billion versus $9.8 billion in long-term debt. It should also be noted that the largest portion of their long-term debt is tied to the November 2018 acquisition of KapStone Paper & Packaging. WRK’s operating profile suggests that servicing their debt should not be a problem.

Dividend: WRK pays an annual dividend of $.80 per share, which at its current price translates to a dividend yield of about 2.69%. Management cut the dividend in the last quarter from about $1.80 per share annually to help preserve cash; however I think it is worth noting the company did not eliminate its dividend, which many other stocks have done in the last few months in response to pandemic-related pressures.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, Fair Value target around $47.54 per share. That means that the stock is compellingly undervalued, with about 53% upside from its current price. It is also worth noting that in the last quarter, my Fair Value target for this stock was around $41 – nearly -14% below where it is now.

Technical Profile

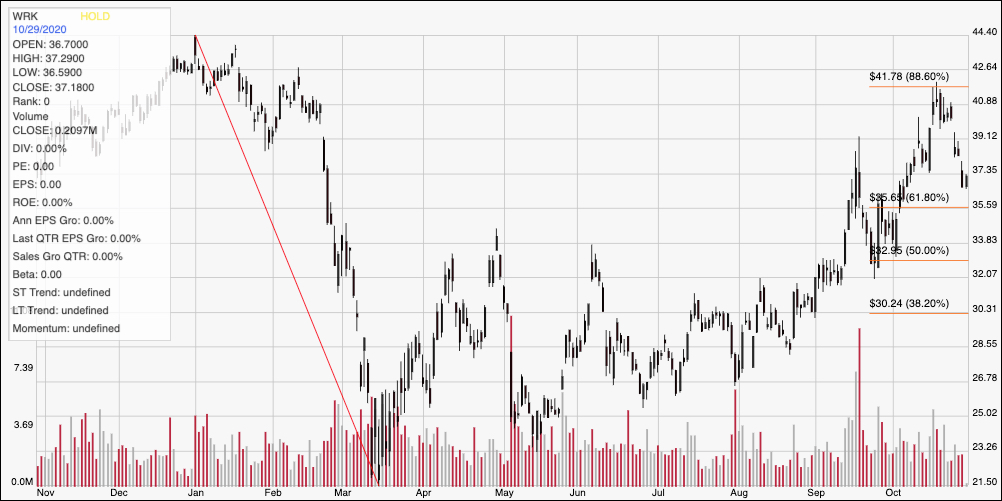

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line marks the stock’s downward trend from January to March; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The rallied strongly from its bottom at around $21.50 to touch the 50% retracement line in late April; from that point, the stock plunged rapidly back a low at around $23 in mid-May before rebounding again to retest the 50% retracement line around $33 in June. After consolidating a little below the 38.2% retracement line, the stock broke above that level in starting a new upward trend August that saw it rally nearly to $42 where the 88.6% retracement line sits. The stock has dropped back from that point and is nearing support at around $35.50, inline with the 61.8% retracement line. A pivot off of support anywhere between the stock’s current price and $35.50 has room back to about $42 before finding immediate resistance, while a drop below $35.50 could see the stock drop to about $33 before finding next support.

Near-term Keys: WRK has a solid fundamental profile and a compelling value proposition that I think makes this a stock smart, long-term investors shouldn’t ignore; the stock’s upward trend since August should also help provide a springboard for the stock to rebound nicely once it finds support to stabilize the stock’s most recent bearish momentum. Keep in mind, this is a long-term view, and includes the reality that in the near-term, the stock could continue to be somewhat volatile. Buying this stock should be seen as a bet on the company’s long-term growth prospects looking beyond 2020 and into 2021. If you prefer to work with short-term trading strategies, you could use a pivot off of current support around $35.50 as a signal to think about buying the stock or working with call options, with an eye on $42 as a useful bullish target. A drop below $35.50, on the other hand could be an interesting signal to think about shorting the stock or buying put options, using next support around $33 as a useful target on a bearish trade.