The last week has been impressive to watch. With elections in the U.S. translating to a change in residency at the White House (Trump out, Biden in), while the House and Senate remain split between parties, the market seems to be interpreting the result in a positive light. Some of that, presumably reflects a hope that some of the combativeness and divisiveness that dominated political headlines over the last four years will moderate with a new President in place. More than anything, though I think it boils down to the fact that a split government should mean that major changes in business changes driven by government regulations are unlikely. Since the market abhors change, the hope that “business as usual” will be the norm seems to be providing a big boost.

Today early news about better-than-expected initial results from late-stage COVID vaccine trials is giving the market an even bigger lift, as investors anticipate the chances that approval of a number of promising, leading vaccines could finally stem the spread of the virus. Implementation and distribution remain question marks, and even if a vaccine were approved today, it would take months to get enough of it distributed to make a difference; but hope continues to spring eternal and provide a light at the end of a long tunnel.

One of the sectors that is bouncing in a big way right now on vaccine news is the Energy sector. Stocks in this sector have marked some of the biggest values in the market for most of the year, in my opinion as consumer demand for gasoline cratered in the initial outbreak of the virus on a global scale early in the year and has been slow to recover. That has pushed most of these stocks to multiyear lows, and while some are admittedly just cheap stocks, there are a number as well that represent outsized bargains at current levels.

When considering value, the question becomes whether or not a stock that is now trading at a major discount has the resources it needs to ride through current economic and business turmoil, and still be standing in a favorable position once those concerns eventually fade. That means recognizing the impact current conditions have had, and may continue to have in the near term, and balancing them against the company’s balance sheet. Does the company possess a healthy combination of cash and liquid assets to provide near-term stability relative to its debt? And is their current debt load manageable enough that the company might be able to prudently take on more debt to further extend its financial stability and flexibility? Those are questions that can help to delineate between the stocks that offer the best long-term opportunities at nice prices versus those that are just plain cheap.

HollyFrontier Corporation (HFC) is a case in point. The company’s earnings reports throughout the year have shown significant declines in their operating margins, which isn’t surprising given the collapse in crude prices that began at the beginning of the year resulting from a price war between Russia and Saudi Arabia, and then exacerbated by the vaporization of demand that came from global shutdowns to limit the spread of COVID-19. The stock cratered in the meantime, plunging from a November high at around $59 to a March low below $19 per share. The stock rebounded from that point, pushing to a high in June around $38 before slipping back amid concern about oil demand. The slide back pushed the stock below its March lows to below $17 earlier this month. The stock is one of the biggest gainers today, on the heels of an earnings reports at the end of last week that seems to indicate the company could be turning a corner back to profitability and growth. That could make HFC a hard stock for contrarian and value investors to ignore.

Fundamental and Value Profile

HollyFrontier Corporation is an independent petroleum refiner. The Company produces various light products, such as gasoline, diesel fuel, jet fuel, specialty lubricant products, and specialty and modified asphalt. It segments include Refining and Holly Energy Partners, L.P. (HEP). The Refining segment includes the operations of the Company’s El Dorado, Kansas (the El Dorado Refinery); refinery facilities located in Tulsa, Oklahoma (collectively, the Tulsa Refineries); a refinery in Artesia, New Mexico that is operated in conjunction with crude oil distillation and vacuum distillation and other facilities situated 65 miles away in Lovington, New Mexico (collectively, the Navajo Refinery); refinery located in Cheyenne, Wyoming (the Cheyenne Refinery); a refinery in Woods Cross, Utah (the Woods Cross Refinery), and HollyFrontier Asphalt Company (HFC Asphalt). The HEP segment involves all of the operations of HEP. HEP is a limited partnership, which owns and operates logistic assets. HFC has a current market cap of about $3.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased by about -124%, while revenues declined by -36.3%. in the last quarter, earnings decreased by -64% while sales improved 36.6%. The company’s margin profile has turned sharply negative this year but appears to be turning a useful corner; over the last twelve months, Net Income was-1.25% of Revenues but improved modestly to -0.09%. For perspective, the quarterly Net Income actual numbers are useful. For the quarter ended March 2020, Net Income was -$304.62 million, -$176.88 million in June, and just -$2.4 million in the quarter ending in September. These are improvements that reflect a heavy focus on cost savings that will reap benefits when consumer demand rebounds.

Free Cash Flow: HFC’s free cash flow is mostly healthy, at $215.74 million despite its decline throughout the year from around $1.25 billion at the beginning of the year. The current number translates to a modest, but still useful Free Cash Flow Yield of 7.61%.

Debt to Equity: HFC’s debt to equity is .42, a generally conservative number. The company’s balance sheet indicates liquidity and debt management remains healthy despite the current negative Net Income pattern, with more than $1.5 million in cash and liquid assets in the last quarter versus about $3 billion of long-term debt. It’s worth noting that at the beginning of 2019, HFC reported just $496 million in cash, and $909 at the beginning of 2020, which makes the latest number all the more impressive.

Dividend: HFC’s annual divided is $1.40 per share, which translates to a yield of about 7.97% at the stock’s current price. The dividend was also increased earlier this year from $1.32 per share, which I take as another sign of the company’s ability to manage their bottom line and maintain confidence in the future. It is also an encouraging sign of strength that other stocks in the sector don’t have, as other energy companies are reducing, suspending or eliminating their dividends to conserve cash.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at almost $31 per share. That target is significantly below targets from earlier in the year above $40, but still means the stock is trading at a major discount, with about 42% upside from the stock’s current price.

Technical Profile

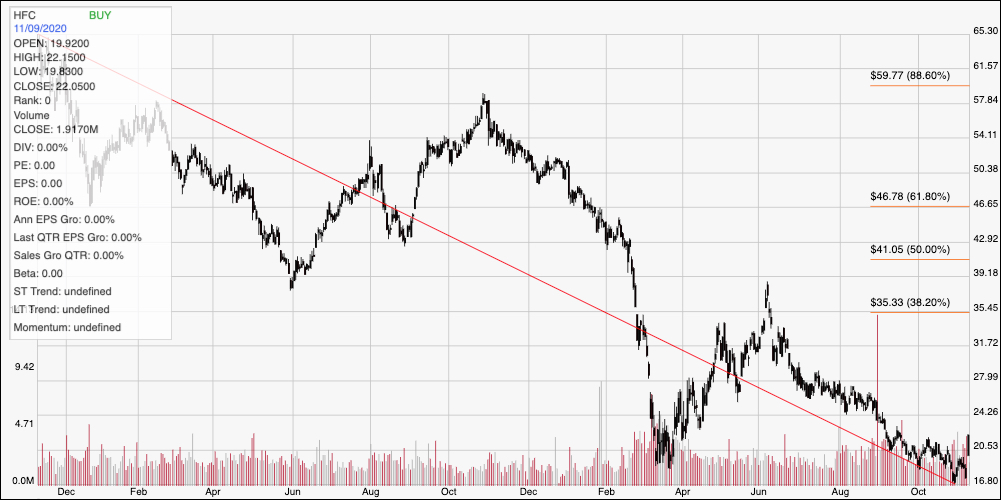

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last two years of price activity. The red line traces the stock’s downward trend from a high at around $65 to a low at around $17 earlier this month. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The downward pattern over the last two years is strongly bearish, but also illustrates the size of the potential long-term opportunity this stock could see at the inevitable point that economic and market conditions shift further back into favor for the Energy sector. Given the stock’s current rally and push above the stock’s top end resistance from October, support should be between $20 and $20.50, with immediate resistance in the neighborhood of $25. A push above $25 should have additional upside to about $31, or possibly even $35 where the 38.2% retracement line rests. A drop below $20 could see the stock retest its multiyear lows around $17.

Near-term Keys: HFC’s value proposition is compelling, and the stock appears to be picking up some useful near-term bullish momentum. Given the relative strength of its balance sheet, a patient investor who doesn’t mind accepting some continued near-term price volatility could be well-positioned for a long-term opportunity in a good company trading at a very nice stock price. Keep in mind, however that momentum in energy stocks remains highly volatile, so this isn’t a bet to make if you’re looking for a “safe haven” kind of investment. If you prefer to work with short-term trading strategies, you could use the stock’s current push higher as an indication to buy the stock or work with call options, using a near-term target at around $25 as a quick-hit exit point. If the price drops back below $20, consider shorting the stock or buying put options, using $17 as useful bearish profit targets.