Developing a system of analysis that provides the right balance of fundamental strength, attractive value, and useful price patterns is something that takes a fair amount of time, study and experimentation. Even if you copy somebody else’s system, you won’t know if it really works for you the way you want it to until you give it a try yourself to see how it plays out. Along the way, you end up discarding some pieces of the puzzle and picking up others.

My approach to value-based investing is something that I developed for myself over a period of a lot of years. It represents the result of a lot of experience, both good and bad. One of the big questions that I had to answer for myself fairly early in the process was simple: out of the thousands of stocks that are available to choose from, how do I start narrowing my analysis into stocks that are the most likely to fit the requirements I have? That is where my reliance on dividends came into play. Early on, I knew that I wanted to use fundamental strength as one of the foundational corners of my system. Looking at different search and filtering tools that were available to me, I had a lot of fundamental metrics that I could make use of; but I realized pretty quickly that one of the most straightforward metrics was whether or not a company makes regular dividend payments.

Dividends are one of two ways that a company’s management can “return value” back to shareholders. The other method is through stock buybacks. Buyback programs are pretty popular among analysts, because they reduce the total number of shares outstanding of a given stock, which theoretically should translate to a higher stock price as earnings continue to grow. The assumption, however is that earnings will continue to grow – something that this year has proven can be harder at times to do than at others. Even if earnings continue to grow, share appreciation from buybacks is something that isn’t usually seen right away. It takes time and usually blends into the overall context of broad activity.

I like dividends, because they provide shareholders with a passive income source that is often very competitive with the yields that can be found in other instruments like Treasury bonds. With Treasury yields likely to remain near historical lows for the foreseeable future, that also means that dividend yields are even more attractive than normal. From a qualitative standpoint, they also reflect management’s confidence in their ability to keep the business running profitably, since dividends usually represent a long-term management commitment. Dividends have to approved by a company’s board of directors, and the fact that they represent a cost on a company’s balance sheet is a big reason the large majority of publicly traded stocks do NOT pay dividends at all. That’s how dividends became a big theme of my system; I estimate that only a little over half of the companies on the three major U.S. exchanges pay any kind of dividend at all, while only about a third pay a consistent quarterly dividend. That makes dividends a useful way to immediately shorten the universe of stocks I pay attention to companies that implicitly should have stronger fundamental profiles than most others.

That’s a long way to explain why Standard Motor Products Inc. (SMP) is the stock I’m highlighting today. But SMP is an interesting case in the current market environment. This is a company in the Auto Components sub-industry. Auto companies, by and large have been affected all year long by COVID pressures that have dramatically reduced miles driven by Americans, and that means less demand for replacements of all types of components – tires, engine parts, sensors, and so on. That pressure is a reason that a number of companies in the industry that did pay a dividend have temporarily suspended their payouts, or eliminated them altogether. SMP was among that group early in the year, but in their latest earnings statement reinstated the dividend. It’s too late to jump on board the first of those reinstated payouts – the ex-dividend date was November 13 – but the move puts this small-cap company ahead of a lot of bigger brethren in reasserting their confidence in their management approach and their future prospects. Does that also make the stock a useful value? Let’s find out.

Fundamental and Value Profile

Standard Motor Products, Inc. is an independent manufacturer and distributor of replacement parts for motor vehicles in the automotive aftermarket industry with a complementary focus on heavy duty, industrial equipment and the original equipment service market. The Company’s segments include Engine Management Segment and Temperature Control Segment. The Engine Management Segment manufactures and remanufactures ignition and emission parts, ignition wires, battery cables, fuel system parts and sensors for vehicle systems. The Temperature Control Segment manufactures and remanufactures air conditioning compressors, air conditioning and heating parts, engine cooling system parts, power window accessories and windshield washer system parts. The Company sells its products primarily to warehouse distributors, large retail chains, original equipment manufacturers and original equipment service part operations in the United States, Canada, Latin America and Europe. SMP has a current market cap of about $1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings have grown about 56%, while revenues increased a little over 11.5%. In the last quarter, earnings improved by almost 206%, while revenues grew a little over 38.5%. The company’s margin profile is solid, and is showing signs of strengthening; over the last twelve months, Net Income was 5.5% of Revenues, and increased to 8.33% in the last quarter.

Free Cash Flow: SMP’s free cash flow is healthy, at about $95.4 million over the last year. It has also increased from about $77.92 million in the last quarter, and $53.34 million at the beginning of the year. Those numbers might not sound impressive by themselves, especially compared to the totals you’ll from much larger companies in the market; but remember that this is a small-cap stock with a total market cap of just about $1 billion. That provides a better context to view these numbers in; when you think about Free Cash Flow on that basis, it translates to a useful Free Cash Flow Yield of 9%.

Debt/Equity: The company’s Debt/Equity ratio is 0, implying there is very little long-term debt. In fact, SMP’s balance sheet only shows about $100,000 in total long-term debt versus $16.76 million in cash and liquid assets in the last quarter (up from $13.27 million in the last quarter). The company’s healthy operating profile, along with a solid cash position means that the company has good liquidity and should have no problems servicing the debt they have.

Dividend: SMP’s annual divided is $1.00 per share and translates to a yield of about 2.1% at the stock’s current price. The dividend also appears safe, running less than a third of SMP’s earnings per share.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $60 per share. That means the stock is nicely undervalued, offering about 27% upside to that fair value target price.

Technical Profile

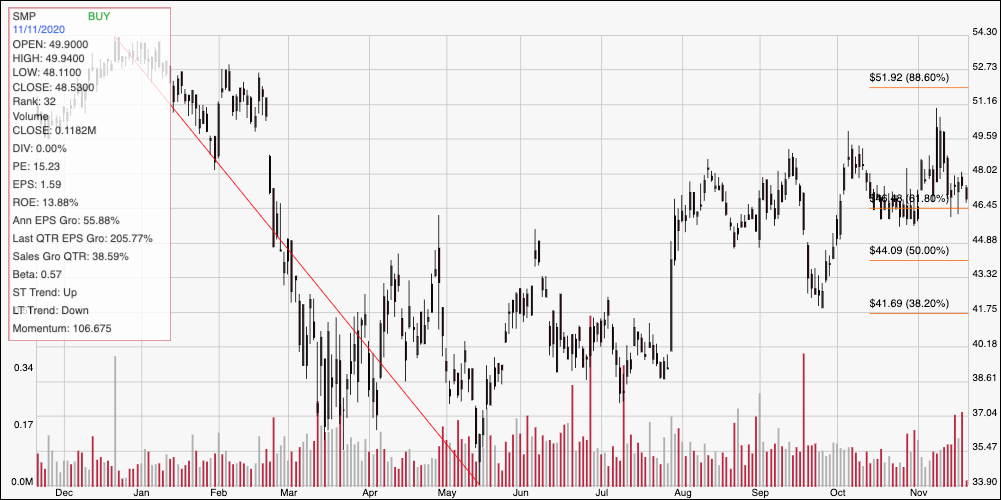

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last year of price activity for SMP. The red diagonal line traces the stock’s downward trend from a late 2019 high at around $54 to its March, bear market low at around $34. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has rebounded nicely from that low point, reaching its most recent peak at about $50 earlier this month before dropping back a bit in the last week or so to its current price. Immediate support is at around $46.50, inline with the 61.8% retracement line, while immediate resistance is at around $50 using that last peak. A push above $50 should find next resistance at around $52, where the 88.6% retracement line sits, with the stock’s 52-week high not far off from that point if bullish momentum picks up. A drop below $46.50 has downside to about $44 where the 50% retracement line waits, with additional room down to the 38.2% retracement line at around $41.50 if bearish momentum accelerates.

Near-term Keys: SMP’s fundamentals are very solid, and in fact have improved throughout the year – which is remarkable considering broad conditions that have plagued their industry throughout the year. Even with the stock’s upward trend, it also continues to offer an interesting value proposition at its current price. If you prefer to focus on short-term opportunities, you could look for a bounce off of support at around $46.50 as an interesting opportunity to buy the stock or work with call options, with an eye on $50 as a useful, near-term profit target. If the stock drops below $46.50, consider shorting the stock or buying put options, using $44 as a practical exit target on a bearish trade.