Post-election, a lot of the focus for the markets has, not surprisingly shifted back to COVID and the pandemic that just won’t stop. Concern is increasing that the colder months of the year will make things even worse, and that a health care system that is already being strained as infections and hospitalizations are pushing capacity nearly to its limits. In the last couple of weeks, reports from a couple of major pharmaceutical companies including Pflizer Inc. (PFE) showed that late-stage clinical trials for their respective vaccine candidates were more than 90% effective. PFE has also announced that they are seeking federal emergency use authorization for their candidate, which could start making the vaccine available to front-line health care workers and at-risk patients before the end of the year.

That is positive news that has given the markets a bit of a lift, and it is something that pushed the stock to a new peak at around $42 when the news was first announced. Their mRNA vaccine is at the front of a crowded pack of candidates that will be pushing for regulatory approval and wide distribution by the end of the first quarter of 2021, or possibly in the second quarter. The potential for those that are first to market is vast and would seem to be growing more every week – but COVID isn’t the entire story when it comes to PFE.

PFE announced earlier this year that they would be spinning the UpJohn segment of their organization into a separate company. This is a declining business that has been dragging down their overall results for some time now. The spinoff is expected to be completed this quarter and should free up PFE’s capital structure from the burden that business has imposed. As one of the leading pharmaceutical companies in the industry, PFE boasts a broad portfolio with eight separate drug brands that each account for more than $1 billion in annual sales, but none that contribute more than 11% of total revenue. They also have a large development pipeline, especially in oncology drugs that most analysts see strong long-term growth that should offset the effect of increased competition in existing brands as patent protections expire and biosimilar and generic drugs start to take up market share.

PFE is a stock that, despite the media attention on COVID candidates, has mostly held in a range between $35 and $38 since August. This is a company with a generally strong balance sheet, although the pandemic has prompted the company to invest heavily in its vaccine candidate, which has had an impact on some of its other important fundamental metrics. From a value standpoint, does the stock’s price represent a good bargain at this current level – and would it be a smart company to buy in anticipation of its COVID vaccine? Let’s dive in to the numbers.

Fundamental and Value Profile

Pfizer Inc. (Pfizer) is a research-based global biopharmaceutical company. The Company is engaged in the discovery, development and manufacture of healthcare products. Its global portfolio includes medicines and vaccines, as well as consumer healthcare products. The Company manages its commercial operations through two business segments: Pfizer Innovative Health (IH) and Pfizer Essential Health (EH). IH focuses on developing and commercializing medicines and vaccines, as well as products for consumer healthcare. IH therapeutic areas include internal medicine, vaccines, oncology, inflammation and immunology, rare diseases and consumer healthcare. EH includes legacy brands, branded generics, generic sterile injectable products, biosimilars and infusion systems. EH also includes a research and development (R&D) organization, as well as its contract manufacturing business. Its brands include Prevnar 13, Xeljanz, Eliquis, Lipitor, Celebrex, Pristiq and Viagra. PFE has a current market cap of $203.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased by -4%, while revenues declined -4.33%. In the last quarter, earnings slipped nearly -7.69% lower while sales increased about 2.8%. The company’s margin profile is healthy; over the last twelve months, Net Income as a percentage of Revenues was 17.85%, and strengthened a bit, to 18.09% in the last quarter.

Free Cash Flow: PFE’s free cash flow is healthy at $10.4 billion over the last twelve months. That does mark a decline from $12.7 billion in the last quarter and a little over $13 billion in mid-2019. The current number translates to a Free Cash Flow Yield of 5.2%.

Debt to Equity: PFE’s debt to equity is .76, which is generally considered a conservative number. The company’s balance sheet indicates operating profits should be adequate to service their debt; cash and liquid assets were about $21.9 billion in the last quarter versus almost $19 billion at the beginning 2019, while long-term debt was $49.7 billion in the last quarter versus $29 billion in June of 2018. I’m not sure this is a major red flag, given that the company has been directing a major portion of its focus to COVID-19; but it is worth noting that the real profit opportunity in the drug isn’t in the initial implementation and distribution, even though the company has stated its intention to be able to distribute 100 million doses in the U.S. by March 2021 and 1 billion doses by the end of 2021. The truth is that the first wave of vaccine distribution will likely be done at a loss for the company in the interest of the greater public good to address the health crisis. Profitability is assumed to come by the ongoing need for a renewed vaccine, in similar fashion to the yearly flu or pneumonia shot that doctors generally recommend for just about everybody.

Dividend: PFE’s annual divided is $1.52 per share, which translates to a yield of about 4.4% at the stock’s current price. It is also noteworthy that the dividend increased at the beginning of the year from $1.52 per share, which is a useful indication of management’s confidence in their approach.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $30 per share. That means that PFE is currently overvalued by about -18%, with its bargain price actually down at around $24 per share. It is also worth noting that my price target for PFE has decreased measurably since earlier this year, from a little over $36.50.

Technical Profile

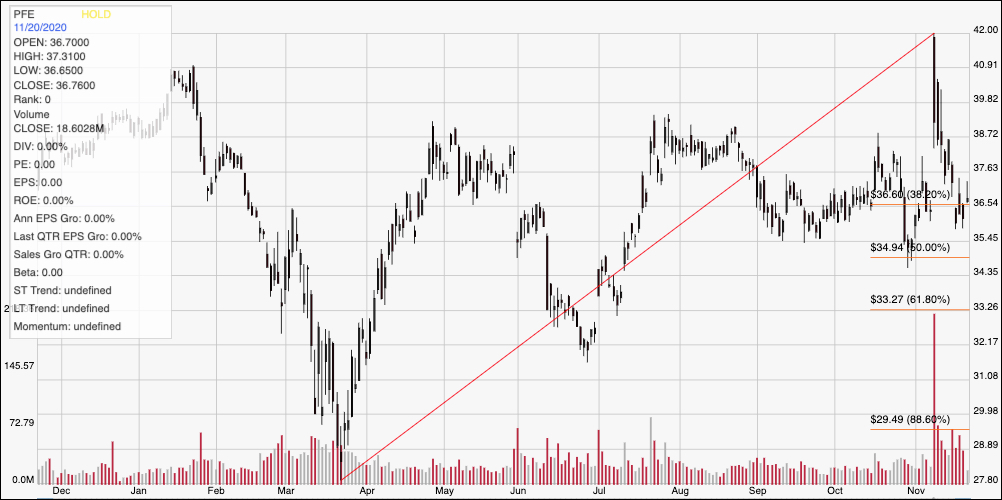

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s upward trend from a bear market low at around $28 per share to its peak about a week ago around $42. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After rising to a short-term peak at the end of April around $39, the stock dropped back, finding a new lower pivot in late June at around $31.50. The stock rallied back to a high at around $39 before beginning to consolidate between support at around $35.50 and resistance in the $38 to $39 range, with last week’s single, short-term peak at around around $42 sitting as a visible outlier. The stock is currently about halfway between those two ranges, and could be finding a new, higher support level at the 38.2% retracement line around $36.50. A push above $39 should give the stock room to test highs in the $41 to $42 range, while a drop below $35.50 could see the stock slide back to between $33 and $32 in the area of the 61.8% retracement line.

Near-term Keys: If you work off of the basis of the stock’s valuation metrics, it’s hard to make a case for the stock right now as a good bargain – even with the expectation that fast-track, emergency regulatory approval for PFE’s COVID vaccine will be given before the end of the year. For now, the best bet if you want to work with this stock is to look for short-term trading opportunities dictated by the path and pace of price momentum. If the stock pushes above $39, you could consider buying the stock or working with call options, using a bullish target price between $41 and $42. If the stock reverses and drops below $35.50, consider shorting the stock or buying put options, using $33 to $32 as a useful bearish profit target.