Pandemic conditions have put a lot of pressure on sectors across the economy, but at the same time there have been pockets of the economy that have performed remarkably well. Most of the attention throughout the year has naturally been focused on sectors tied to the health crisis, or to the shift to work-from-home models.

As we’ve moved further into the year, however, another segment that has received not much more than passing commentary and attention is the Homebuilding industry. I think that’s because Homebuilding is a good example of an industry that is sensitive to economic cycles. The truth is that the pandemic isn’t over, and that means that broad economic pressure that includes still-high unemployment isn’t going away either. So to see reports that indicate that housing has been booming, especially in the last few months, is a bit surprising.

This is a trend that makes homebuilders worth paying attention to, because despite some of the concerns I just mentioned, there are also some interesting tailwinds. Consider that remote workforce trends have allowed a large number of good-paying, highly skilled jobs to simply shift from in-office work to work-from-home, saving rates have generally increased throughout the year, and interest rates remain at historical lows. The Fed has stated pretty clearly its intention to keep to keep monetary policy accommodative for as long as the pandemic keeps other pressures high.

Low interest rates, and generally healthy incomes among the rising Millennial generation are factors that should be good things for stocks like Lennar Corp (LEN), one of the largest homebuilders in the U.S. The stock has performed impressively after reaching its bear market low at around $25 in March, sitting more than three times above that low price as of this writing. Does that big move mean any future increase in the stock’s price is simply speculative in nature, or is there are a fundamental basis that might suggest the stock could still offer an interesting value? Let’s find out.

Fundamental and Value Profile

Lennar Corporation is a provider of real estate related financial services, commercial real estate, investment management and finance company. The Company is a homebuilder that operates in various states. Its segments include Homebuilding East, Homebuilding Central, Homebuilding West, Lennar Financial Services and Lennar Multifamily. It is a developer of multifamily rental properties. Its Homebuilding operations include the construction and sale of single-family attached and detached homes, as well as the purchase, development and sale of residential land. It operates primarily under the Lennar brand name. The Lennar Financial Services segment includes mortgage financing, title insurance and closing services for both buyers of its homes and others.The Lennar Multifamily segment focuses on developing a portfolio of institutional multifamily rental properties in the United States markets. LEN has a market cap of $23.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings for LEN increased by about 33.33%, while sales were flat, but still positive by 0.23%. In the last quarter, earnings grew 41.33% while revenue growth was a little over 11%. LEN’s operating profile is healthy, with Net Income as a percentage of Revenues running at 9.97% over the last year, and strengthening to 11.35% in the last quarter.

Free Cash Flow: LEN’s free cash flow is very strong, at almost $4 billion over the last twelve months. In mid 2019, free cash flow was about $1.1 billion, and came in at $2.3 billion at the beginning of 2020, so this number has strengthened throughout the past year. Its current level translates to an attractive Free Cash Flow Yield of 16.86%.

Debt to Equity: LEN has a debt/equity ratio of .42. This is a relatively low number that reflects a conservative approach to leverage. The company’s balance sheet indicates liquidity is adequate; the last quarter showed almost $2 billion in cash and liquid assets against $7.1 billion in long-term debt. This is a number that, like Free Cash Flow, has improved measurably throughout the course of the year, as cash was $798.65 million at the beginning of the year.

Dividend: LEN’s dividend is $1.00 per year, which translates to an annual dividend yield of just 1.31%. That is an extremely conservative dividend, as it represents a dividend payout of less than 25% of earnings; but it is also a marked increase from the end of 2019, when the dividend was just $.16 per year. In 2020, LEN increased the dividend twice to reach its current level, and that fact alone is remarkable this year.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $98 per share, which means that LEN is nicely undervalued, with about 28% upside from its current price.

Technical Profile

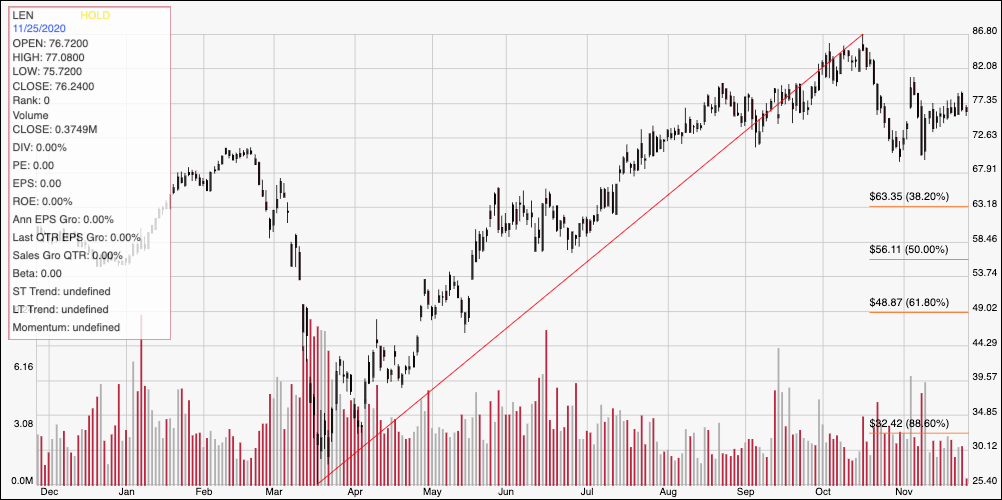

Here’s a look at LEN’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the stock’s price movement over the past year. The red diagonal line traces the stock’s upward trend from its March, bear market low to its peak in October at around $87; it also informs the Fibonacci retracement lines shown on the right side of the chart. Since hitting that high, the stock has dropped back a bit, finding near-term support at around $72 before starting a new push higher that now has the stock a little below $77. Immediate resistance is around $78 based on a pivot high early this week, with support back at around $72. A push above $78 should find new resistance at around $81 based on a pivot high at the beginning of November, with additional upside between $85 and the stock’s peak a little below $86 if bullish momentum persists. A drop below $72 could see the stock drop to around $66 before finding new support, with $63.50 possible beyond that, where the 38.2% retracement line rests if bearish momentum accelerates.

Near-term Keys: LEN’s valuation metrics are very interesting, and the fact not only that the company has weathered the COVID-driven storm, but managed to improve just about every useful fundamental metric this year only strengthens the value argument despite the stock’s increase in price throughout the year. The homebuilding trend could face headwinds if economic pressure gets stronger this winter as the pandemic persists and if vaccine approval and deliveries don’t materialize as quickly as most hope right now; but I think low interest rates could continue to keep demand for new homes high throughout 2021. If you prefer to work with short-term trading strategies, use a break above $78 as a signal to buy the stock or to work with call options, using $81 to $85 as useful bullish targets depending on the state of bullish momentum. A drop below $72 would be a strong signal to consider shorting the stock or buying put options, with a useful bearish target price at $66.