Black Friday means that the market’s attention, along with most consumers is squarely focused on the retail segment. It is interesting to observe the way that retailers have adjusted their Black Friday operations around the limitations and uncertainty attached to the coronavirus pandemic. Those measures have not surprisingly pushed some of the conversation back in the direction back towards vaccine and speculation about what “back to normal” will look like.

This month has been marked by optimism from late stage trial results from a couple of the earliest candidates that suggest front line workers, health care and medical professionals and those most at risk could start being vaccinated by the beginning of 2021, or possibly even before the end of this year if emergency use authorization comes through as anticipated. There are a lot of other companies that are also in their own late stage trials that aren’t getting talked about as much. One is British pharma giant GlaxoSmithKline PLC (GSK), who is working with French partner Sanofi on their own vaccine. The partnership has an agreement with the U.S. government that calls for delivery (upon accelerated, expected FDA approval under the government’s Operation Warp Speed) of 100 million doses, with a long-term option for up to 500 million doses.

For GSK, the agreement is interesting, and certainly helps to call attention to their efforts to help combat the spread of the virus on a global basis; but the truth is that the deal will probably have a limited benefit to the company’s bottom line. GSK’s statement makes it clear the company is not expecting to profit from any COVID-19 vaccine as long as the pandemic persists; in fact, any short-term profit they may realize is planned to be invested in further coronavirus-related research and long-term pandemic preparedness.

From my perspective as a value-oriented investor, the announcement is most useful simply because it gave me a reason to take a deeper look into GSK’s fundamental and value profile. This is a company with a broad, global product portfolio, with a number of over-the-counter brands that you and I are likely to recognize during a typical run through the grocery store. That means that, pandemic aside, the company is already well-positioned to benefit in the broadest sense from increased public awareness about health in general. In fact, the numbers reported by management during the pandemic have been encouraging; while it isn’t surprising that recessionary global conditions have led to declines in revenues, other important measurements, including Free Cash Flow and Net Income, have improved, pointing to a management team that is putting a lot of attention on managing costs and maximizing operations. The stock price has generally underperformed after surging initially from a bear market low in March to about $43 in April. Most recently it tested those bear market lows around $33 before rebounding a bit. That might actually be setting up an interesting opportunity to think about a company with a healthy balance sheet and a nice value proposition.

Fundamental and Value Profile

GlaxoSmithKline PLC is a global healthcare company. The Company operates through two segments: Pharmaceuticals and Vaccines. The Company focuses on its research across six areas: Respiratory diseases, human immunodeficiency virus (HIV)/infectious diseases, Vaccines, Immuno-inflammation, Oncology and Rare diseases. The Company makes a range of prescription medicines and vaccines products. The Pharmaceuticals business discovers, develops and commercializes medicines to treat a range of acute and chronic diseases. The Vaccines business provides vaccines for people of all ages from babies and adolescents to adults and older people. It has a portfolio of medicines in respiratory and HIV. Its Pharmaceuticals business includes Respiratory, HIV, Specialty products, and Classic and Established products. Its Vaccines business has a portfolio of over 40 pediatric, adolescent, adult, older people and travel vaccines. GSK has a current market cap of $104 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined by a little more than -3%, while sales slid about -3.5% lower. In the last quarter, earnings increased about 91.5%while Revenues improved almost 18%. GSK’s Net Income versus Revenue, is healthy, with some signs of pressure; over the last twelve months, Net Income was 18.56% of Revenues and weakened in the last quarter to 14.39%.

Free Cash Flow: GSK’s Free Cash Flow remains healthy, at a little more than $9 billion. This does mark a decline from the last quarter, when Free Cash Flow was $$10.77 billion, and translates to a Free Cash Flow Yield of 9.67%.

Debt to Equity: GSK has a debt/equity ratio of 1.13, which is generally high, but also not unusual for companies in the Pharmaceutical industry.. Their balance sheet shows a little over $6.9 billion in cash and liquid assets against $30.1 billion in long-term debt. Servicing their debt is not a concern.

Dividend: GSK pays an annual dividend of $2.50 per share, which at its current price translates to an impressive yield of 5.45%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $62 per share. That means that GSK is significantly undervalued, with about 67% upside from its current price.

Technical Profile

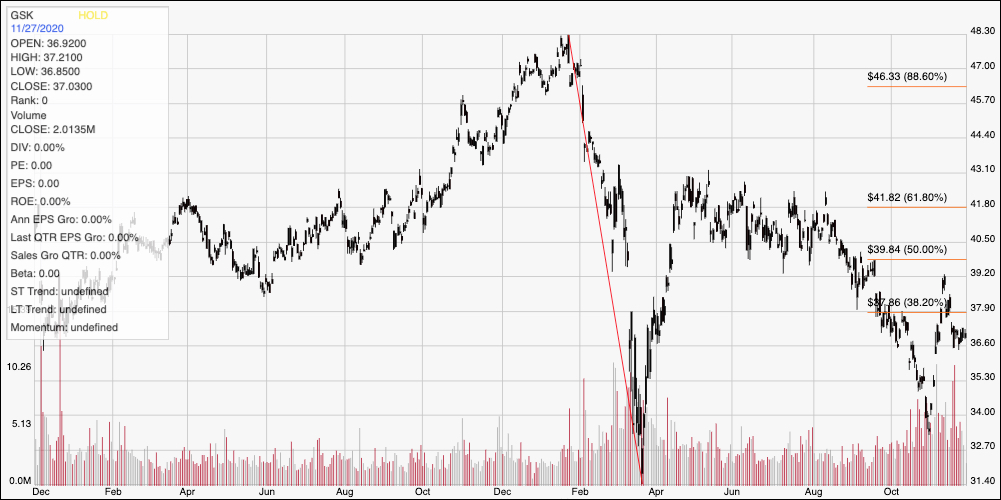

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line defines the stock’s downward trend from a January high at around $48 to is bear market low around $31.50 in March. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After rallying to about $43 by mid-April, the stock began to drift mostly sideways, following a gradual downward trend that has seen the stock establish a narrow trading range that was broken in August when the stock fell through support around $39 to retest those March lows at the beginning of November at around $33. The stock temporarily pushed above the 38.2% retracement line at around $38 and touched $39 before dropping back again and is now about $1 below the 38.2% retracement line. I’m putting actual resistance at the 50% retracement line at about $40, since the stock would need to break that level to build sustainable bullish momentum that would reverse the current downward trend. Support is at around $36.50 based on the stock’s stabilization in the last week or so. If it falls below that point, GSK could fall back to around $33 or possibly as low as the bear market in the $31.50 range.

Near-term Keys: GSK’s balance sheet strength is giving the company the resources it needs to keep pushing forward even while other pressures are in place on Revenue, Net Income and Free Cash Flow. The fact that the stock is trading at a significant discount is also a very positive sign that could make the stock one to watch and to take seriously as a useful, long-term value opportunity. If you prefer to work with short-term trading strategies, you could use a break above $40 as a signal to buy the stock or work with call options, using $43 as a useful bullish profit target. If the stock falls below $36.50, you could also consider shorting the stock or buying put options, using $33 as a useful bearish profit target.