I hope everybody had a wonderful Thanksgiving holiday! I’ve written a lot in this space about my belief in defensive sectors and industries for more than a year now. The market is showing a lot of bullish momentum right now, but I think the initial relief that I attribute mostly to decreasing political uncertainty is going to be a short-term thing; even enthusiasm from good news on the vaccine front seems likely to get blunted by the harsh reality of near-term, ongoing health concerns. That means that an increasingly overvalued broad market seems more and more primed for a retracement and pullback, which means that defensive names are still a good place to be.

If you’ve been following me in this space at all, or participating in my weekly options trading webinar, you already know that CVS is a good, old friend that I’ve followed for quite some time. Since my last review on this stock, the company has released a new earnings report, which shows some deterioration in Net Income and Free Cash Flow that I believe is mostly a reflection of this year’s health crisis-driven pressures. The short-term result is that my long-term target price has dropped a bit from above $100 to around $90, but that is still well above the stock’s current price.

I also believe that CVS and other pharmacy companies will take on an increasingly important role in the coming months. An increasing number of pharmaceutical companies are publishing late-stage trial results of their COVID vaccines which are reflecting a high level of efficacy and safety. That has prompted these companies to submit applications for emergency use approval that is being considered this week by the government’s regulatory bodies. Widely expected approval – note that the first domino fell today as the UK formally approved the Pfizer/BioNTech vaccine this morning – means these vaccines could start being delivered to first responders, medical professionals, and front line workers before the end of the year. It also means that broader distribution could begin in the first quarter of 2021. Yesterday, Treasury Secretary Mnuchin went before Congress to address a number of issues. Dismissing the political rhetoric that usually takes up most of these sessions, my ears perked up when the Secretary specifically mentioned CVS and Walgreens (WBA) as places the public at large would be able to get vaccinated once they are made available. How much of a financial benefit that truly translates to remains to be seen, of course, but it’s hard to argue that the expected increase in foot traffic at CVS stores won’t act as a useful headwind as 2021 gets rolling. All told, I can’t find a good reason not to take CVS seriously. The company is uniquely positioned for the current environment, not only in the pharmacy space but also with what I think is a big competitive advantage from its 2018 merger with insurer Aetna. If this stock isn’t already on your radar, it really should be.

Fundamental and Value Profile

CVS Health Corporation, together with its subsidiaries, is an integrated pharmacy healthcare company. The Company provides pharmacy care for the senior community through Omnicare, Inc. (Omnicare) and Omnicare’s long-term care (LTC) operations, which include distribution of pharmaceuticals, related pharmacy consulting and other ancillary services to chronic care facilities and other care settings. It operates through three segments: Pharmacy Services, Retail/LTC and Corporate. The Pharmacy Services Segment provides a range of pharmacy benefit management (PBM) solutions to its clients. As of December 31, 2016, the Retail/LTC Segment included 9,709 retail locations (of which 7,980 were its stores that operated a pharmacy and 1,674 were its pharmacies located within Target Corporation (Target) stores), its online retail pharmacy Websites, CVS.com, Navarro.com and Onofre.com.br, 38 onsite pharmacy stores, its long-term care pharmacy operations and its retail healthcare clinics. CVS has a market cap of $81 billion. Aetna Inc. is a diversified healthcare benefits company. The Company operates through three segments: Health Care, Group Insurance and Large Case Pensions. It offers a range of traditional, voluntary and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, medical management capabilities, Medicaid healthcare management services, Medicare Advantage and Medicare Supplement plans, workers’ compensation administrative services and health information technology (HIT) products and services. The Health Care segment consists of medical, pharmacy benefit management services, dental, behavioral health and vision plans offered on both an Insured basis and an employer-funded basis, and emerging businesses products and services. The Group Insurance segment includes group life insurance and group disability products. Its products are offered on an Insured basis. CVS has a market cap of $88.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased by about -10%, while Revenues rose by about 3.5%. Earnings dropped in the last quarter by -37% while sales were 2.6% higher, respectively. The company’s margin profile is very narrow, and is showing some indications of weakness; over the last twelve months Net Income was 2.99% of Revenues, and 1.83 in the last quarter. This is a concern, but given the tailwinds I already mentioned heading into 2021, I think it is also likely to be a temporary question.

Free Cash Flow: CVS’s free cash flow is healthy, at about $12.6 billion. That does mark a decline from $13.6 billion in the quarter prior; however the current number still translates to a healthy Free Cash Flow Yield of about 14.2%.

Debt to Equity: CVS has a debt/equity ratio of .89. That is a conservative number that has dropped from 1 over the last two quarters. In the last quarter Cash and liquid assets were $12.08 billion – a little below the $12.7 billion the company reported at the beginning of 2020 – versus $61.5 billion in long-term debt. The vast majority of that debt comes from the acquisition of health insurer Aetna, however the fact that long-term debt has dropped from about $65 billion since the beginning of the year is a good reflection of the company’s success so far (with plenty of work still to go) in transitioning these disparate organizations into a larger, productive company.

Dividend: CVS pays an annual dividend of $2.00 per share, and which translates to an annual yield that of about 2.95% at the stock’s current price. It is also noteworthy that, while dividend increases have been suspended, management has maintained the dividend at current levels.

Value Proposition: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at about $90 per share. While that is lower than my fair value target in the last quarter, which was around $103, it still means the stock is nicely undervalued, with about 32% upside from its current price.

Technical Profile

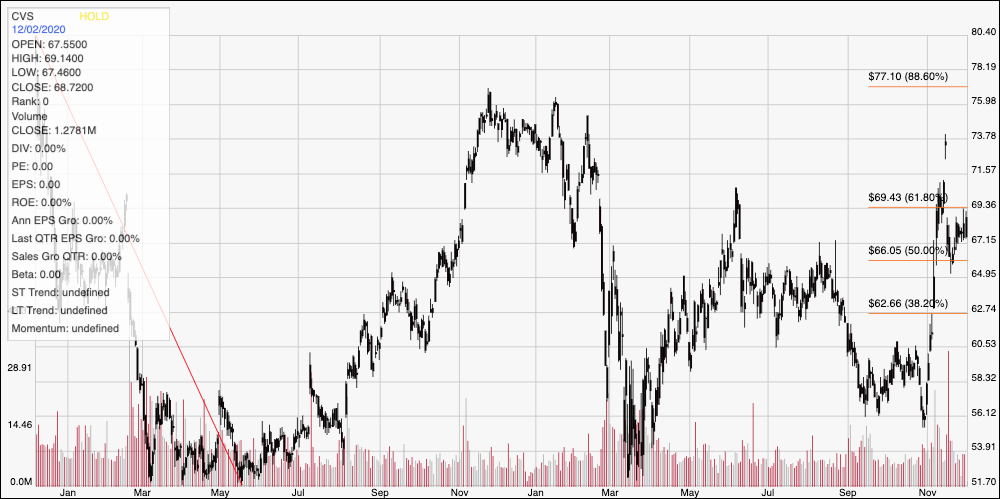

Here’s a look at CVS’ latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line marks the stock’s downward trend from November 2019 to March of this year. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. Throughout July, the stock hovered in a range between the 38.2% and 50% retracement lines before breaking above resistance at around $64.53 at the beginning of August. From that point, the stock set a consolidation range between $62 and $65, but broke below that level at the beginning of September. Over the last month, the stock has picked up significant bullish momentum following its latest earnings report, breaking out of a consolidation range between $56 and $60 to drive to a peak above $70 before dropping back to a new, higher pivot support point at $66. The stock is now about halfway between that support and expected resistance at $70. A drop below $66 could see the stock drop to somewhere between $62 and $60 before finding next support, while a push above $70 could see the stock test its pre-pandemic highs in the $78 price range.

Near-term Keys: If you prefer to work with short-term trading strategies, the best opportunity on the bullish side would come from break above resistance at $70; that would be a good signal to buy the stock or work with call options with an eye on $78 as an exit point. A bearish signal would come from a drop below $66; in that case you could consider shorting the stock or buying put options, using $62 as a good bearish profit target. Despite the fact that my analysis has lowered my long-term target price, the stock’s value proposition remains very attractive, and from a long-term perspective, I think continues to offer one of the best value opportunities in the stock market right now.