The Consumer Discretionary sector cuts a wide swath across the economic landscape of the United States. It’s easy to think about the sector as the place you’ll find retail stocks, but the truth is that there are a lot of other businesses within the sector that are much more than just the department stores and restaurant chains that you might normally think about.

Within the sector, there is an industry called Specialty Retail, and this industry is the category where you’ll often find retail businesses and stores that each have a unique, specific focus; the interesting thing about the industry is the wide range of business types you’ll find. Think Best Buy (BBY), Home Depot (HD), and Tailored Brands (TLRD), to name just a few, and you start to get an idea about the diversity of business types the industry covers.

Penske Automotive Group Inc (PAG) is a company in the Specialty Retail industry that you’ve probably heard of, but wouldn’t naturally think of as a retail stock. It isn’t all that unusual to see a Penske moving truck moving along any of America’s highways, so this is a stock with immediate name-brand recognition and a large international footprint in their specific niche. After dropping with the rest of the market to bear market lows around $20, this stock reclaimed its pre-pandemic high by October, and since then touched a new yearly high at nearly $63 in mid-November before dropping back a bit to its current level around $56.

Against the backdrop of its intermediate upward trend since March, this is a stock that could be setting up for a new bullish opportunity. It also carries a value proposition that, taken alone, might tempt you to think about taking a position in a stock that includes a high dividend yield to boot. I believe that part of the stock’s bullish momentum since October came from news that management was reinstating its quarterly dividend, which it had suspended in the first quarter of the year to preserve cash, at pre-suspension levels. That is a good sign that management is confident not only about having weathered the storm that has been 2020, but is also well-positioned for the future. Let’s dive in to the numbers to see if this is a stock that you should consider as a useful opportunity for yourself.

Fundamental and Value Profile

Penske Automotive Group, Inc. is an international transportation services company. The Company operates automotive and commercial truck dealerships principally in the United States, Canada and Western Europe, and distributes commercial vehicles, diesel engines, gas engines, power systems, and related parts and services principally in Australia and New Zealand. The Company’s segments include Retail Automotive, consisting of its retail automotive dealership operations; Retail Commercial Truck, consisting of its retail commercial truck dealership operations in the United States and Canada; Other, consisting of its commercial vehicle and power systems distribution operations and other non-automotive consolidated operations, and Non-Automotive Investments, consisting of its equity method investments in non-automotive operations. The Company holds interests in Penske Truck Leasing Co., L.P. (PTL), a provider of transportation services and supply chain management. PAG’s current market cap is $4.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased 102%, while Revenue was flat, but positive at 0.07%. In the last quarter, earnings increased by 412.5% while sales were 63.5% higher. The company operates with a narrow margin profile, which is pretty normal for auto retailers; Net Income was 2.17% of Revenues over the last twelve months, but increased to 4.13% in the most recent quarter.

Free Cash Flow: PAG’s free cash flow is healthy, at more than $567.6 million. That translates to a Free Cash Flow Yield of 12.51%, which is useful; it should be noted that since mid-year, Free Cash Flow dropped from $841 million but remains higher over the beginning of 2020 when it was $442.5 million.

Debt to Equity: PAG has a debt/equity ratio of .72. This is a generally conservative number that typically suggests debt management shouldn’t be a problem; however the balance sheet shows that PAG’s cash and liquid assets were only $92.7 million in the last quarter versus $2.26 billion of long-term debt. Given the company’s healthy Free Cash Flow and improving Net Income, servicing their debt shouldn’t be a problem, however liquidity could be a concern, especially since cash declined from $431.9 million at the beginning of 2020.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $85 per share. That suggests that PAG is undervalued by about 50% at its current price.

Technical Profile

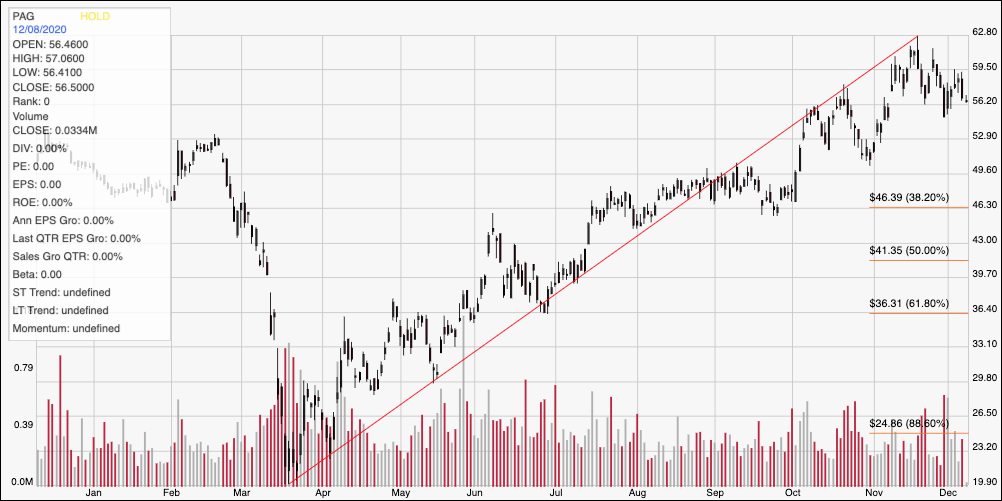

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the past year; the red diagonal line also provides the baseline for the Fibonacci retracement lines on the right side of the chart. The red line follows the stock upward trend from a bear market low at around $20 March of this year to its peak in mid-November at almost $63. This is an extremely extended, intermediate-term bullish trend that appears to be fading back a bit since that peak, with the stock pulling back to recent support at around $56. Against that longer trend, however, that drop does look like a simple, normal retracement of the trend, which means that a bounce off of support at around $56 has about $7 of near-term upside to the stock’s 52-week high at around $63. A drop below $56 could be a signal the trend could retrace further, with next support anywhere between $53 and $50.

Near-term Keys: It is interesting that despite the stock’s strength over the past nine months, the value proposition remains compelling. PAG is a company that has weathered 2020 better than most Specialty Retailers, with some interesting fundamental strengths working in its favor. I would prefer to see the balance sheet showing a stronger balance between debt and liquid assets, but I do also believe that the reinstatement of the company’s dividend is a strong positive that shouldn’t be ignored. If you prefer to work with short-term trading strategies, you could use a bounce off of support at $52 as a signal to consider buying the stock or working with call options, using the stock’s recent peak at around $63 as a near-term exit target. A drop below $56, on the other hand could be an interesting signal to think about shorting the stock or buying put options, with useful exit targets sitting anywhere between $53 and $50 on a bearish trade.