For the last few years, one of the worst underperformers in the market has been General Electric Company (GE). While the stock has seen a sizable month in the last month, and more than doubled from its March, bear market low as of this writing, it remains in an extremely extended downward trend that began in mid 2016 from a peak at around $32. It appears to have finally found its bottom this year and could be building a new upward trend. If you’re thinking about using one of the largest industrial companies in the world as a new potential investment, though it’s smart not only to look at the stock’s current fundamentals, but also to consider what has brought the stock to this point.

Prior to 2019, most of the pressure on GE’s stock price came from the perception that the company had become old and stale, with its fingers in too many pies to be productive. The CEO at that time, Jeffrey Immelt made a number of acquisitions that proved unwise, leading to major drawdowns of the company’s cash from large increases of debt to fund those acquisitions; the result was the CEO brought in to replace him, John Flannery was forced to implement drastic measures to make the company leaner and more focused on it core businesses, and even to commit the “cardinal sin” of slashing its dividend. That gave GE’s board as well as shareholders, to demonize because his actions didn’t bear immediate fruit, and simply prompted the stock to fall more and more out of favor the more apparent it became that turning around one of the world’s biggest companies was, in fact a herculean task. Less than a year after hiring Flannery, he was replaced in 2018 by Larry Culp to shepherd the company from that point.

2019 didn’t get better; as the company was divesting non-productive businesses and selling other productive units that it could maximize cash from like BioPharma, its Aviation business, which it identified as one of its most important core businesses, took the brunt of the grounding of Boeing’s 737 MAX (the LEAP-1B engine, which produced through a GE joint venture, is the exclusive engine for the MAX) that was, of course, followed in 2020 by the catastrophic decline in air travel demand due to COVID-19. The company’s next largest segment is HealthCare, which has offset some of those pressures, but the company’s other segments, Power, Renewable Energy and Capital all have felt the effects of the pandemic-induced slowdown. Since Aviation represents more than 1/3 of the toned-down company’s total business volume, 2021 is generally expected to see revenue growth as vaccine deployment aids industrial demand, but a true return to pre-pandemic levels of demand is likely to take three years or more owning to the likelihood that business travel demand is unlikely to rebound quickly.

All told, this is a company that found itself caught in the middle of a multi-year transformation plan at exactly the worst time in 2020. Even so, the company’s fundamentals show a very strong balance sheet and generally stable Free Cash Flow in 2020. Lost in the wave of COVID-related headlines is the fact that the 737 MAX was cleared yesterday to return to service; it may take some time for demand to pick up again, but having that aircraft grounded for nearly two years meant no demand whatsoever, so a return to service should generally be taken as a long-term positive for the Aviation segment. Is it enough to make the stock a useful value as well?

Fundamental and Value Profile

General Electric Company is a global digital industrial company. The Company’s products and services range from aircraft engines, power generation, and oil and gas production equipment to medical imaging, financing and industrial products. Its segments include Power, which includes products and services related to energy production; Renewable Energy, which offers renewable power sources; Oil & Gas, including liquefied natural gas and pipelines; Aviation, which includes commercial and military aircraft engines, and integrated digital components, among others; Healthcare, which provides healthcare technologies in medical imaging, digital solutions, patient monitoring and diagnostics, and drug discovery, among others; Transportation, which is a supplier to the railroad, mining, marine, stationary power and drilling industries; Energy Connections & Lighting, which includes Energy Connections and Lighting businesses, and Capital, which is a financial services division. GE’s current market cap is $99.6 billion.

Earnings and Sales Growth: Over the last twelve months, earnings dropped more than -60%, while sales declined almost -17%. In the last quarter, however, earnings grew by 140% while sales were almost 9.5% higher. GE’s margin profile has historically been narrow, and 2020 has not helped matters; Net Income over the last twelve months was 4.5% of Revenues, but deteriorated in the last quarter to -5.89%.

Free Cash Flow: GE’s free cash flow for the trailing twelve month period was a little more than $5 billion. This number has declined over the course of 2020, from about $6.6 billion at the beginning of the year, and from around $7.8 billion in 2018 for broader historical context. That is a continuing concern that bears watching – but I also believe that it has held up better than many expected in 2020 given the pressures described above.

Debt to Equity: GE has a debt/equity ratio of 2.1, which indicates the company carries a high degree of leverage, but does not automatically signal their inability to service their debt. Their balance sheet indicates GE has more than $86 billion in cash and liquid assets versus $73 billion in long-term debt. Servicing its debt is clearly not a problem, but a reversal and improvement of Net Income on both a yearly and quarterly basis, along with an improvement in Free Cash Flow would be strong signs that profitability is improving while preserving financial flexibility.

Dividend: GE pays an annual dividend of just $.04 per share, which translates to a yield of 0.35% at the stock’s current price. The company has slashed the dividend multiple times over the course of the last two years; an increase in the dividend is not anticipated in the near-term, but if/when it is increased, it should be taken as a sign of increasing fundamental strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $14 per share. That suggests the stock is undervalued by about 21%.

Technical Profile

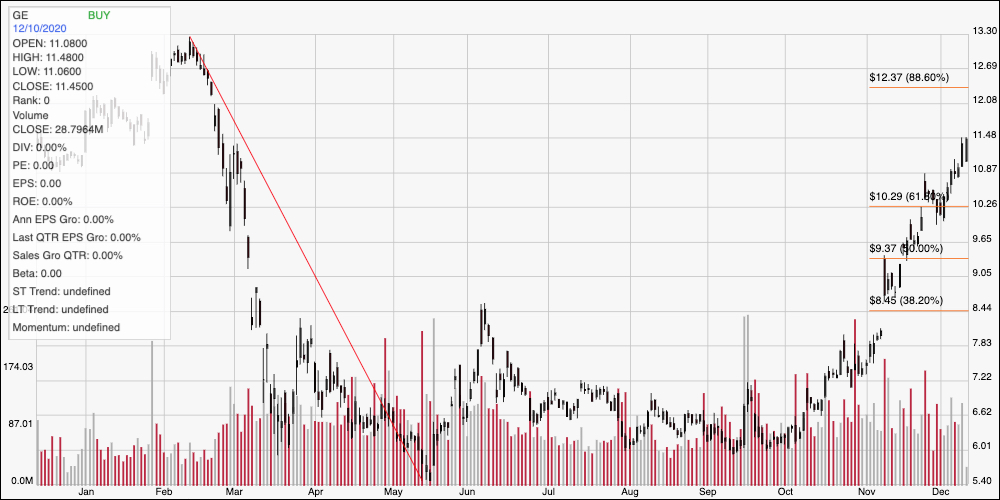

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s downward plunge from a little above $13 in February of this year to GE’s bear market bottom at about $5.50. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock lifted off of that bottom in early October, and has staged a significant, short-term upward trend from that point, rising from about $6 to its current price a little above $11 per share. It could be finding resistance at around $11.50 based on pivot activity from the beginning of the year, with additional resistance expected at the 88.6% retracement line a little above $12, which could give the stock enough momentum to test its 52-week high above $13. Immediate support is at around $10.25, where the 61.8% retracement line sits. A drop below that line should see the stock fall to about $8.50 where the 38.2% retracement line lies.

Near-term Keys: The stock’s overall trend right now is clearly bullish, and the stock is offering an interesting value proposition. Its strong balance sheet could make a long-term bet pretty tempting, but the broad market is generally taking a “show-me” view of GE right now, and is something that I think means the stock shows little long-term upside past its 52-week for the time being. I think that puts the highest probabilities for GE in short-term trades; you could take a push above $12 as a bullish signal to consider buying the stock or working with call options, using $13.30 as a very quick-hit profit target. A drop below $10.25 should act as a strong bearish signal to think about shorting the stock or working with put options with an eye on the 38.2% retracement line at around $8.50 offering a useful exit target on a bearish trade.