The Consumer Discretionary sector includes stocks that cover a wide variety of the Retail industry. Because there are so many retail companies that offer different products to consumers, it’s hard to pinpoint any kind of specific niche. In the sporting goods niche, there were significant challenges even before COVID-19 became a global pandemic. Declining revenues in traditional brick-and-mortar stores, in part coming from a big shift into online-driven sales and a brands like Nike, Adidas and others pivoting away from those stores to deliver directly to consumer through their own methods. Those changes forced a number of established names to declare bankruptcy and go out of business. It’s been a common theme for a lot of retail businesses, who have been forced to close stores and scramble to build omnichannel revenue streams.

In the sporting goods segment, all of that turmoil – not to mention the significant pressures from the pandemic and self-isolation mandates this year have really left just one established name standing: Dick’s Sporting Goods (DKS). While they’ve been forced to close selected locations to cut costs, they’ve also been proactive about taking advantage of bankruptcies and the difficulties of their competitors, bidding at bankruptcy auctions for businesses they wanted to add to their corporate portfolio and acquiring locations throughout the U.S. from others. They’ve also worked hard to develop their own online channel, and responded to the shift of major suppliers to sell directly to consumers by adding their own private labels. They’ve also taken an active role on social issues, including the removal of assault rifles from 850 of their stores well before larger competitors like Walmart decided to do the same. Earlier this year, the company also signaled a shift away from the declining hunting business by announcing plans to remove hunting products – including rifles from 440 stores in 2021.

The pandemic has, not surprisingly put pressure on DKS’ business just as it has most of the retail world, but analysts like to point out that if there is a retail segment that has been well-positioned to take advantage of pandemic conditions – and that will still be well-positioned in the next year for what I believe will be a long-term, enhanced focus on health, wellness and physical activities. I also believe a natural effect of deployment of vaccines, and what should translate to an increasing level of social activity will include a push to engage in more outdoor recreation, for which DKS is also perfectly positioned.

Despite having to weather the same storm every other retailer has this year, DKS has come out at the end of this year in a stronger financial position, with minimal to non-existent long-term debt, healthy liquidity, and improving free cash flow. After suspending their dividend in April in response to the pandemic, management reinstated the dividend just one quarter later, signaling the strength in their management focus and their long-term strategy. Those strengths gave the market justification to push the stock to a new 52-week high at around $63 in mid-October; from that point the stock has dropped back by about $11 per share to a current level around $52. Has the stock moved too far to be useful as a long-term, value choice? I don’t think so.

Fundamental and Value Profile

Dick’s Sporting Goods, Inc. is an omni-channel sporting goods retailer offering an assortment of sports equipment, apparel, footwear and accessories in its specialty retail stores primarily in the eastern United States. The Company also owns and operates Golf Galaxy, Field & Stream and other specialty concept stores, and Dick’s Team Sports HQ, an all-in-one youth sports digital platform offering free league management services, mobile applications for scheduling, communications and live scorekeeping, custom uniforms and FanWear and access to donations and sponsorships. The Company offers its products through a content-rich e-commerce platform that is integrated with its store network and provides customers with the convenience and expertise of a 24-hour storefront. It offers products to its customers through its retail stores and online. The Company offers hardlines, which include items, such as sporting goods equipment, fitness equipment, golf equipment, and hunting and fishing gear. DKS’s current market cap is $4.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased 286.5%, while sales improved by nearly 23%. In the last quarter, earnings declined -37.4%, while sales dropped by a little over -11%. Like most retailers, DKS’s margin profile is narrow, but unlike many retailers this year, it appears to be strengthening; over the last twelve months Net Income was about 4.2% of Revenues, declining to 7.35% in the last quarter. Given the difficulties most specialty retailers have faced this year, the improvement is remarkable.

Free Cash Flow: DKS’ free cash flow is robust, at about $1.3 billion over the last twelve months. That translates to a Free Cash Flow yield of 27.9%. It should be noted that Free Cash Flow increased from the beginning of the year, and pre-pandemic when it was around $187 million.

Debt to Equity: DKS has a debt/equity ratio of 0.19. This is a very low number that also represents a massive drop over the last two quarters, when it was just 1.09. Their balance sheet shows $0 in long-term debt versus $1.06 billion in cash and liquid assets. That means that what debt they have is primarily short-term in nature, with plenty of cash to provide liquidity and an improving margin profile to take care of short-term liquidity needs.

Dividend: As previously mentioned, DKS suspended its dividend payout in March of this year, but reinstated it in June at $1.25 per share. That translates to an annualized yield of 2.4% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target for DKS at around $77 per share. That means that at the stock’s current price, it is significantly undervalued, with about 48% upside from its current price. It is also worth noting that earlier this year, my fair value target for this stock was just $43 per share.

Technical Profile

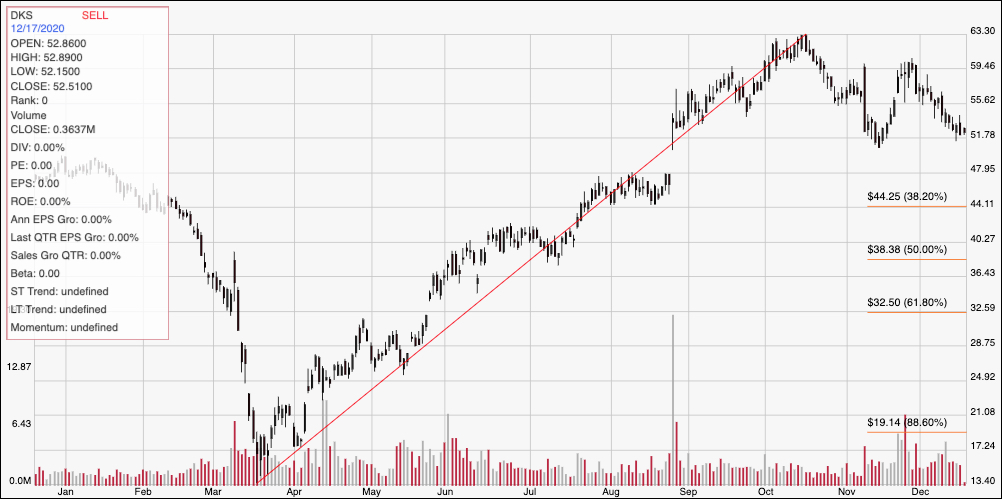

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of market activity for DKS. The red diagonal line traces the stock’s upward trend from a bear market low in March at around $13.50 to its October peak above $63. The stock dropped back in early November to a low a little below $52 before rebounding at the end of the month, but has faded back again in the last few weeks and is again nearing that expected support level around $52. Immediate resistance is at around $56, with next support at around $59.50, and then $63 if bullish momentum picks up again. If the stock drops below $52, it should find next support at around $48 based on pivot activity at the beginning of this year; but an acceleration of bearish momentum could push it down to the 38.2% retracement line at around $44.

Near-term Keys: DKS is one of the most interesting speciality retail stocks on my long-term watchlist. The company has countered significant pressure from online retailers and direct sales from companies like Nike, Under Armour and so on by taking advantage of selected opportunities to buy assets and properties from failing brick-and-mortar competitors, and using them, along with currently open stores to provide a way to differentiate from its larger, online-focused competitors (including suppliers pushing harder to focus on direct sales). Despite the stock’s impressive upward trend, it is still offers a compelling value, which is also a very different dynamic to observe. If you prefer to focus on short-term trading strategies, you could use a bounce off of support anywhere between the stock’s current price and $52 as a signal to buy the stock or work with call options, using $56 to $59.50 as useful short-term bullish targets. If the stock drops below $52, take it as a signal to consider shorting the stock or buying put options, with next support around $48 offering a first useful profit target and $44 if bearish momentum increases.