Moving closer and closer to Christmas means that most people’s focus is on end-of-the-year celebrations and time with family. I think that’s true this year, even though for many of us 2020 has meant maintaining distance from family members and loved ones; for me and my family, that has also impacted our normal, end-of-the-year massive gathering at Grandma’s house. Hopefully we can find new, creative ways to let extended family members know that we are thinking about them even if we can’t be around them.

For investors, the end of the year also means evaluating current positions, deciding whether to rebalance portfolios for tax purposes, and starting to think about what you’ll do to keep your money working for you. With vaccines being deployed around the world, with more coming up in the next few weeks and months, enthusiasm that the end of the pandemic is finally coming seems to be increasing. It gave the market enough of a boost to push all three of the major indices to a new all-time highs last week. The start of this week is starting to look like the “buy the rumor, sell the news” effect in place after a second stimulus package was approved by Congress, while news in the U.K. about a new COVID strain is providing an additional undercurrent of near-term anxiety.

One pocket of the economy that really took a big hit is big-box department stores. While other specialty retailers have found ways to adjust, absorb the negative impact that initial shutdowns imposed and emerge hopefully better equipped for the future, department stores like Kohl’s Corporation (KSS) were already struggling to adjust to shifting consumer preferences towards online shopping and reliance on private labels and brands before the pandemic began. KSS borrowed heavily to bolster its cash and liquid assets early during the pandemic, which enabled the company to absorb much of the blow they took from an extended shutdown period. The real question, I think is whether the isolation exhaustion consumers – especially those in the more affluent demographics that KSS tends to emphasize – have been experiencing lead to an increase in shopping activities as we move into a new year? If the company can see meaningful, improving trends in store traffic and in other aspects of its own long-term transformation strategy, which puts a big emphasis on a partnership with Amazon to handle local returns and on its own digital commerce platform, the company may have already survived the worst the pandemic has to offer. After sitting at lows not seen in this century between $20 and $23 through most of the summer, the stock started to rally in a big way in November, peaking this month at around $40 and currently sitting just a little below that level. Do the company’s fundamentals justify the increase, and is it possible there could be more value ahead? Let’s try to find out.

Fundamental and Value Profile

Kohl’s Corporation (Kohl’s) is an operator of department stores. The Company operates approximately 1,154 Kohl’s department stores, a Website (www.Kohls.com), approximately 12 FILA outlets, and approximately three Off-Aisle clearance centers. The Company’s stores and Website sell moderately-priced private label and national brand apparel, footwear, accessories, beauty and home products. The Company’s Website includes merchandise that is available in its stores, as well as merchandise that is available only online. The Company’s merchandise mix includes both national brands and private brands that are available only at Kohl’s. The Company’s private brands include Apt. 9, Croft & Barrow, Jumping Beans, SO and Sonoma Goods for Life. The Company’s exclusive brands include Food Network, Jennifer Lopez, Marc Anthony, Rock & Republic and Simply Vera Vera Wang. KSS’s current market cap is $6.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings and sales both declined, with earnings -98.6% lower, whiles sales dropped nearly -14%. In the last quarter, earnings increased 104%, while sales also increased, by almost 17%. The company’s margin profile has historically been narrow, but started to show signs of deterioration pre-pandemic that has only become more severe earlier this year. It looks like it may be starting to improve, however for the time being this does represent a risk element of which to be cautious. In the last twelve months Net Income was -1.45% of Revenues, but increased to -0.3% in the last quarter. The fact that Net Income is still negative is a concern; if this measurement doesn’t improve the company’s broader balance sheet, which has held up pretty well this year will start to be impacted.

Free Cash Flow: KSS’s free cash flow is generally healthy, at $1.2 billion. That makes an increased from about $735 million at the beginning of the year, and is a positive counterpoint to the Net Income picture I just painted. That also translates to a Free Cash Flow Yield of 15.53%, which admittedly is impressive given their narrowing Net Income; but it should also be noted that in 2019 free cash flow was markedly higher, at about $1.7 billion.

Debt to Equity: KSS has a debt/equity ratio of .8. Cash and liquid assets increased by almost triple their level at the end of 2019, to a little more than $1.9 billion in the last quarter, while debt increased from $400 million in the middle of 2018 to $2.45 billion in the most recent quarter. Earlier this year, debt had increased to more than $6 billion, which means that in the last couple of quarters management has paid down more than $3.5 billion in long-term debt. I think that their ability to pay down down while increasing liquidity is a big reason management announced they will resume dividend distributions in the first quarter of 2021, which is something that I take as a strong positive sign.

Dividend: KSS suspended its dividend after the first quarter of the year to preserve cash during the pandemic, but as noted above is due to resume dividend payments in the first quarter of next year.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $45 per share. That suggests that even with the stock’s increase since November, the stock remains undervalued, with about 17% upside from its current price. This metric also increased from $40 earlier this year.

Technical Profile

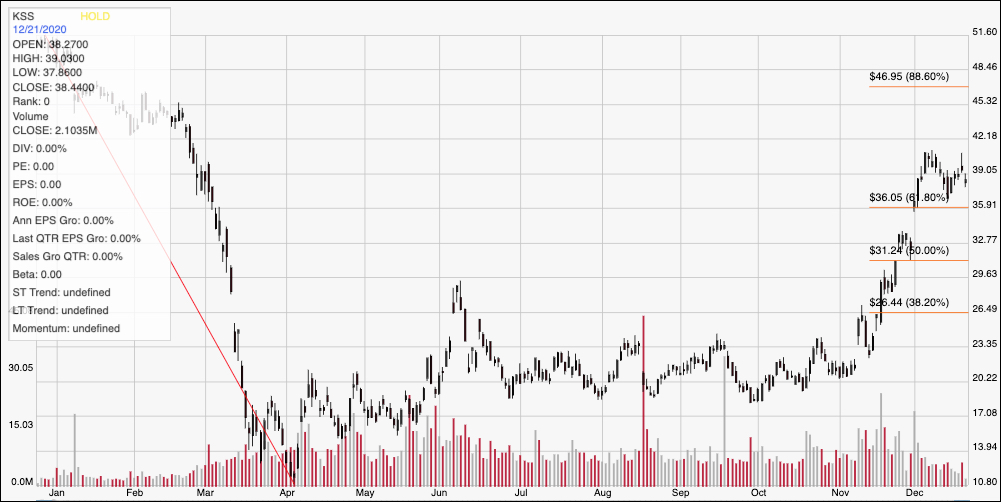

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last year of price movement for KSS. The red diagonal line traces the stock’s downward trend from a January high at about $51.50 to its low around $11 in April. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. Through most of the summer and into the fall from June to November, the stock held in a range between support at around $20 and resistance at about $23 per share. The stock broke out of that range at the beginning of November and saw a lot of momentum into the beginning of December, pushing the stock to a peak at almost $41 early in the month. The stock is nearing immediate support in the $36 to $37 range, where the 61.8% retracement line rests. A break off immediate resistance at $41 should have upside to about the $46 to $47 mark where the 88.6% retracement line sits, while a drop below $36 has downside to between $31 and $30 based on previous pivot activity as well as the 50% retracement line.

Near-term Keys: KSS’s upward surge in the last month and a half makes it tempting fodder for a short-term bullish trade with a value proposition that suggests there could still be some good long-term upside as well. I’m impressed by the company’s improving fundamentals, but I do believe that consumer trends towards online commerce and big-box retailers with much more favorable economies of scale – trends which the pandemic has only emphasized – are not useful for traditional department store chains like KSS. The company’s continued negative Net Income could just be a reflection of pandemic-driven pressures that may ease in 2021, but for the time being I think they are enough of a concern to warrant a wait-and-see approach when it comes to considering KSS as a long-term investment opportunity. That means that the best probabilities lie in short-term trading strategies. If the stock can rebound off of support anywhere between its current price and $36 could offer an interesting signal to consider buying the stock or working with call options, using $41 as a good first-hit profit target, and $46 beyond that if bullish momentum accelerates. A drop below $36 should be taken as a sign to consider shorting the stock or buying put options, using a range between $31 and $30 per share as a good bearish profit target.